- Home

- News & articles

- Thought Leadership

- TRI Claims 2020 : How collaboration has improved the M&A insurance claims process

TRI Claims 2020

How collaboration has improved the M&A insurance claims process

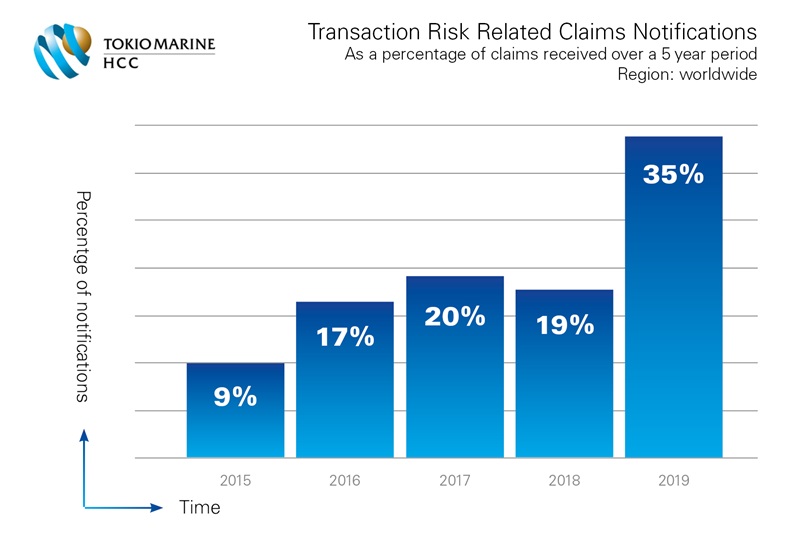

At Tokio Marine HCC (TMHCC), we have definitely seen an increase in the number of W&I claims notifications, especially within the last three years. With currently over 100 active W&I claims on our books and having paid up to seven figure sums to five clients in those three years, we can safely say the product is maturing.

W&I has greatly improved over the past few years, and, increasingly, so has its claims process. This could be due to its rapid growth and clients’ willingness to claim against this insurance product. In addition, the experience gained by both insureds and insurers has also helped claims processes improve in the past few years.

The path to greater understanding

It used to be common to see a “scatter gun” approach to the presentation of W&I claims. As a result, many of the earliest W&I notifications included overlapping warranty breach allegations and double-counted calculations of quantum. The process to narrow it down to the relevant warranty breach and to calculate the actual loss took time. The resulting delays were often blamed by many on the W&I process itself.

Nowadays, however, W&I claims have become more focused and the product is responding more quickly. This is due to greater familiarity with the W&I product and more involvement of claims brokers. In addition, loss calculations are based on a better understanding of W&I cover and the most appropriate measure of damages for warranty breaches.

Collaboration, information and transparency are key

As awareness grows around the advantages of using W&I, on the claims side, a more effective co-operation between insureds and insurers is also growing. Deal parties have started to appreciate that W&I compares favourably to more “traditional” methods of managing warranty breaches: insurers provide impartiality in the claims process, they are not involved in the deal and are professional claims handlers.

However, on the flip side, being removed from the deal process means that insurers require additional (and sometimes extensive) information to evaluate claims. It is especially important (for financial statement claims) to provide extra information around technical accounting issues such as the way income has been booked or the preparation of management accounts.

This can be time-consuming and, for this reason, TMHCC has developed a more collaborative and efficient approach: our accountants, retained by us, assist with extracting the requested information as early on in the claims process as possible. Our claims experience has shown that this approach aids the assessment of claims and speeds the progress of negotiations.

It is increasingly understood that quantification of loss is often the most contentious point in W&I claims. For example, it is difficult for insurers to calculate loss without knowing how the original purchase price was calculated. For the best results from the W&I product, transparency on this matter is essential. However, some insureds may need to maintain the confidentiality of the valuation methodology for commercial reasons. So, we have found ways around this: for example, on-site document inspections by our accountants or dedicated sessions where both accounting teams (ours and the insured’s) discuss key points. We have found that most difficulties can usually be overcome when all sides take a commercial and pragmatic approach.

Our value in the claims process

In conclusion, it is not always straightforward and there are likely to be issues, but increased dialogue and greater understanding is making the W&I claims process smoother, more agile and reliable for the M&A community.

At TMHCC, we have been writing W&I insurance for over 10 years and have one of the most experienced underwriting teams in the W&I market. Our extensive underwriting experience has meant that we have also developed market leading W&I claims expertise.

Our W&I claims leader is a solicitor qualified in England & Wales (with over 10 years in private practice) who is assisted by a stable team of experienced claims handlers in Barcelona and the US. Our claims teams are multinational, able to handle claims from most jurisdictions.

As the W&I product develops and matures, TMHCC prides itself on bringing value to the process and on our ability to support our clients in a pragmatic way.