- Home

- News and articles

- Thought Leadership

- Trade Credit UK Retail Sector Report 2024

Trade Credit UK Retail Sector Report 2024

Summary

- Conditions in the sector are challenging with insolvencies already above pre-Covid levels and rising, within the overall UK corporate insolvency number hitting a 30-year high in 2023, a trend likely to continue throughout 2024.

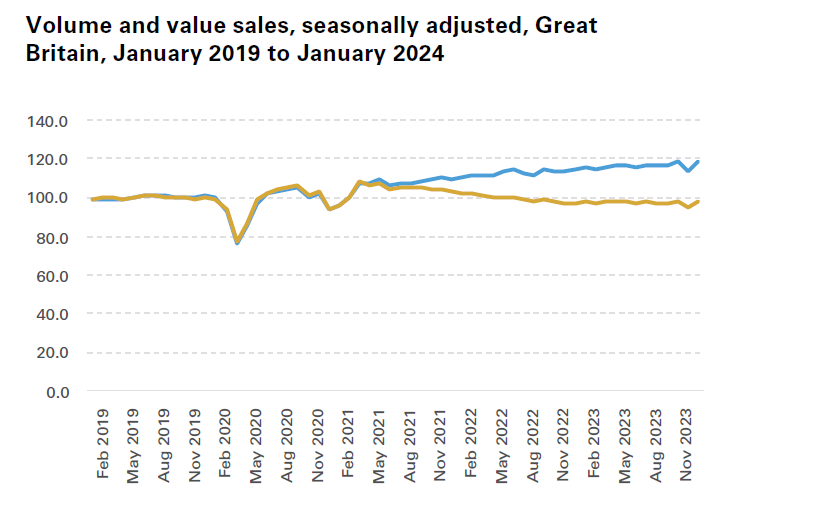

- There has been an increasing divergence in volume versus spend. While pay in the sector increased throughout 2023, retail sales in the UK fell in volume terms as households struggled to manage the cost-of-living crisis. However, due to persistent inflation, the amount consumers spent increased (albeit by an anaemic rate), creating an artificial rise in value terms.

- This was spread equally across the sector. As of December 2023, sales in non-food were down 3.9%, clothing by 1.5% while household goods and food stores saw a 3% drop in year-on-year terms.

- Retailers cut costs, reduced debt where possible and curtailed spending in 2023, focussing largely on maintenance, warehouse and store automation and strengthening their online channels.

- Despite the bad news, there are some green shoots in 2024. Retail sales volumes are estimated to have rebounded by 3.4% in January 2024, following December’s 2023 record fall. This was the largest monthly rise since April 2021 and saw volumes return to November 2023 levels.

- Sales volumes in all subsectors -except clothing stores - increased over the month, with food stores contributing most to the increase.

- Despite the rebound in January, the 2024 outlook is clouded by the UK’s dip into recession, high interest rates, ongoing labour shortages and low consumer confidence

To view a pdf version, click here.

Key Trends in 2023

Retail is just one of many sectors that faces a challenging 2024. The ongoing cost of living crisis has resulted in lower consumer spending while the rise in interest rates has made renewing or taking out new debt increasingly costly. The consequences can be seen in many problematic developments across the industry.

Sales Figures

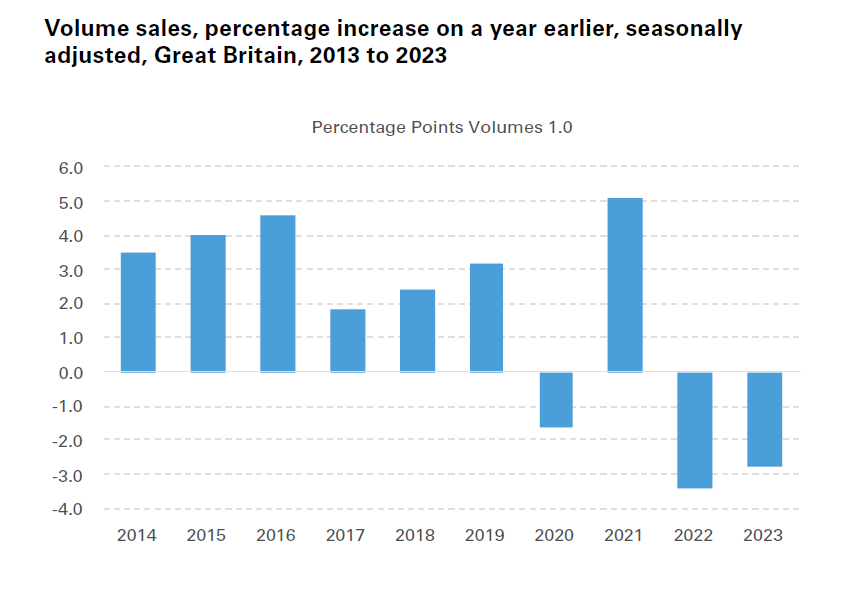

Retail sales in the UK continued to trend downwards over the year. Over the 12 months, sales in volume terms (the quantity bought), dropped by 2.8% compared to 2022, their lowest value since 2018. This fall was reflected in all the main sectors, highlighting the impact of high inflation and the cost-of-living pressures across the board.

Worryingly, this trend can also be seen in online sales. December 2023 saw a 2.1% decline over the month in terms of volume, an acceleration of the 1.1% decline seen in November. And on a quarterly basis, the picture was even more bleak with a 3.5% volume decline and in value terms, while December 2023 saw a 1.7% decline on the previous month. As a share of overall retail sales, on average, consumers made 27.1% of their retail purchases online, slightly up the preceding 12 month average of 26.5% and significantly higher than pre-pandemic levels (19.7% in February 2020).

Source: ONS

On a more positive note, inflation has started to move in the right direction. The ONS’ Consumer Price Index (CPI) peaked at a 41-year high of 11.1% in October 2022 but has since then fallen dramatically – albeit the year ended above the Bank of England’s (BoE) 2% inflation target. After dropping back into single-digit territory in April 2023 (for the first time since August 2022) it has remained on a downward trend, coming in at 4% in December 2023.

Retailers curtailed spending over the year and limited non-essential capital expenditure to protect their cash positions. Investment was largely reserved for maintenance, warehouse and store automation and the strengthening of online channels while spending on new stores was limited. The focus for retailers was very much on cashflow, liquidity and profitability. Rating agency Fitch reported that profitability in the sector had stabilised throughout 2023. However, this has not yet translated into a positive impact on business failures and, unfortunately, smaller companies in particular still struggle to absorb the higher cost base.

Christmas 2023

The festive season is a key trading period for retailers, but increasing competition and the cost-of-living crisis led to a mixed trading period across the sector. Some succeeded in encouraging consumers to spend despite the ongoing pressure on household finances, however many reported disappointing results, as they relied increasingly upon heavy, promotional discounting.

Tesco was firmly in the winning enclosure, raising its profit forecasts again after record sales over the Christmas period with sales up 6.8% in the six weeks to 6 January. Likewise, Sainsbury’s posted a 7.4% increase in sales, claiming to have won market share in the process. On the back of a strong performance in food and womenswear, Marks & Spencer reported better-than-expected trading over Christmas, with like-for-like sales up 8.1% in the 13 weeks to 30 December. The German discounters also had a Merry Christmas with Aldi reporting an 8% uplift in sales (its best ever festive period) and Lidl boasting a 12% lift in the four weeks to Christmas Eve, with over 4.5 million more customers through its doors.

Fashion retailer Next provided more cheer as it raised profit forecasts following better-than-expected sales in the run-up to Christmas. Full-price sales increased by 5.7% in the nine weeks to 30 December, with both stores and online sales ahead of expectations. B&M announced a special dividend after reporting another strong Christmas trading period with revenue up 5% in the 13 weeks to 23 December.

In contrast, JD Sports reported lower-than-expected like-for-like sales growth of 1.8% in the 22 weeks to the end of December and as a result, cut its full-year forecasts. Online specialists such as Asos, N Brown and Very Group, all reported falling sales. Across the sector, many retailers experienced softer demand and the need for higher promotional activity than anticipated, reflecting more cautious consumer spending.

2024 Outlook

January has reported a rebound in retail sales volumes, up 3.4% following a disappointing fall of 3.3% in December. Sales volumes across all subsectors were up – apart from clothing stores – with supermarkets delivering the most growth. While this data indicates a recovery from December, there is still a clear divergence between volumes bought and amount spent. With a 3.9% rise in sales values, against a 3.4% rise in sales volumes, it is clear that consumers continue to pay more for less

Source ONS

Despite the positive start to the year, the immediate outlook for the sector is clouded by many factors that weighed on performance in 2023. Consumers are rather pessimistic about the twelve months ahead, reflected in their lack of willingness to spend, especially as inflation still remains above long-term averages and interest rates remain elevated. The latter also weighs on credit risk as taking out new or rolling over existing debt continues to be very expensive and a further rise in business failures is likely.

The sector’s recent cost-cutting exercises are at odds with the need to respond to consumer demand and invest significantly in the ESG and AI fields. Although the UK Government has recently watered down some of its carbon-neutral goals, this appears to be at odds with general trends. Meeting the ESG expectations of consumers will become increasingly important going forward and in this light, retailers will have to pay more attention to labour rights, child labour-free supply chains, the community impact of their operations and the environmental costs of sourcing and transportation. Resale markets are increasingly accepted with major players like M&S, John Lewis, Selfridges and Zara already involved.

Besides investment in ESG-related fields (such as identifying and sourcing from sustainable suppliers), retailers will also have to spend more on solutions that optimise the use of customer data. Improving stock management as well as producing more accurate sales forecasts with the help of predictive analytics, will play an important role in future profitability. Furthermore, augmented reality and AI-powered personalisation will enable brands to boost their return on marketing spend. However, upfront investment costs are considerable.

Ominously, macroeconomic headwinds look significant throughout 2024, clouding the outlook for the sector. Unfortunately, British consumers are rather pessimistic about the coming twelve months with consumer confidence indicators all signalling a difficult year ahead. Geopolitical tensions such as the escalating Israel-Gaza conflict and deteriorating economic data are keeping consumer confidence in check.

Consumers are likely to continue to curtail their spending in 2024 and retailers will have to fight harder for every sale, whilst dealing with a further rise in credit risk throughout the year. Interest rates make debt very expensive and that, coupled with weak growth, pessimistic consumers and the repayment of Covid support measures, has already led to a rise in business failures.

Insolvencies in the sector continue to increase and are already above pre-Covid levels. While this is an incredibly challenging environment, at TMHCC we continue to work closely with our sectoral policyholders to support the growth opportunities that 2024 will provide, within a dynamic sector that is core to the UK macroeconomic performance.

By Fiona O’Brien, Senior Risk Underwriter – Credit

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.