Tuesday 09 December 2025

- Thought Leadership

UK Construction Sector Report: December 2025

Summary

- 2025 was another disappointing year for the construction sector.

- Input price inflation has moderated over the past quarters but nonetheless, building costs are predicted to increase by 15% until the end of this decade.

- Output growth over the summer months has been lacklustre, not boding well for the cold weather period in Q4 2025 and Q1 2026.

- UK construction has shed around 10% of its workforce (equivalent to 250k jobs) since Covid and the number of job vacancies is also falling but pay rises remain above UK- average.

- Business confidence has

remained in contraction

territory for ten consecutive

months, the longest stretch

since the global financial crisis.

- Regulatory bottlenecks such

as Gateway 2 requirements,

delayed building starts,

higher national insurance

contributions, skill shortages,

reduced contractor availability

and stretched

government

finances all weigh

on the sector’s

outlook.

- Insolvency figures

remained on a downward

trend in January to August

2025 but credit risk levels

remain elevated as even large

construction sector companies

issue more profit warnings

with harmful knock-on

effects on the wider

supply chain.

To view a pdf version, click here.

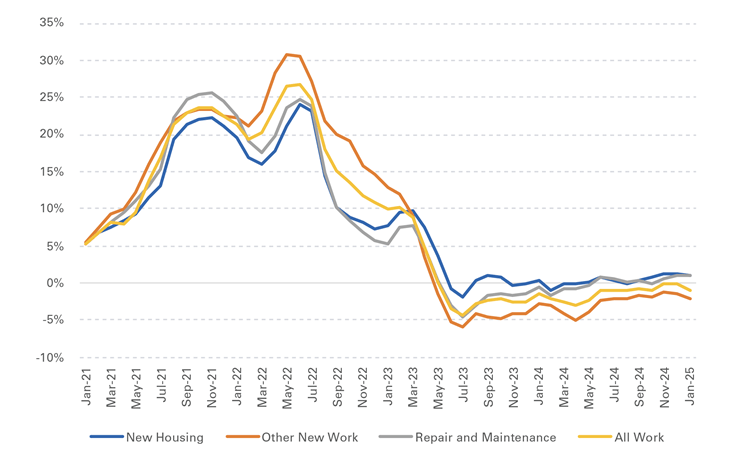

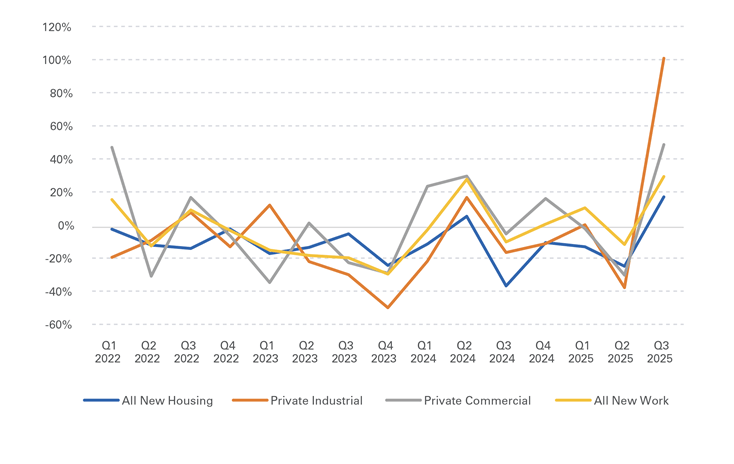

Inflation

Positively, inflationary pressures in the sector have come down over the past years, thereby providing support for UK construction companies (which predominantly operate on fixedprice contracts). According to data from the Office for National Statistics (ONS), construction material prices have moved lower since mid-2023, in line with general consumer price index developments. In June 2022, the “all work” construction price inflation had peaked by 26.8% year on year (y/y), the highest growth rate in 40 years. The “repair and maintenance” (24.7%) and the “new housing” sub-indices (24.0%) also saw immense increases with “other new work” inflation coming in at an even higher 30.5% y/y in mid-2022.

Since then, construction material price inflation has quickly dropped back to more sustainable levels. Since March 2023, it has been in the single-digit range again before falling into deflation territory in June 2023. Unfortunately, the ONS has suspended the publication of several sectoral producer price indices in spring 2025 (citing quality concerns) and launched an internal investigation. Hence latest available data is for January 2025: it shows that the “all work” sub-index was still decreasing by 0.9% y/y while “repair and maintenance” as well as “new housing” reported 1.0% increases. Positively, latest Purchasing Managers’ Index data (which provides a more up-to-date view) supports this assessment: in October 2025, the input price subcomponent had dropped to a 12-month low1 .

Worryingly, while material price inflation has moderated in recent years, construction companies’ operating costs are still under pressure because of rising wages (see Labour Market chapter below). In addition, in absolute terms, the early 2025 “all work” construction price index reading of 151.8 points compares very unfavourably with the 2020-value of 110.6 points, highlighting a persistent rise in building costs since Covid2 .

UK Construction Materials Price Indices (y/y change)

Source: ONS

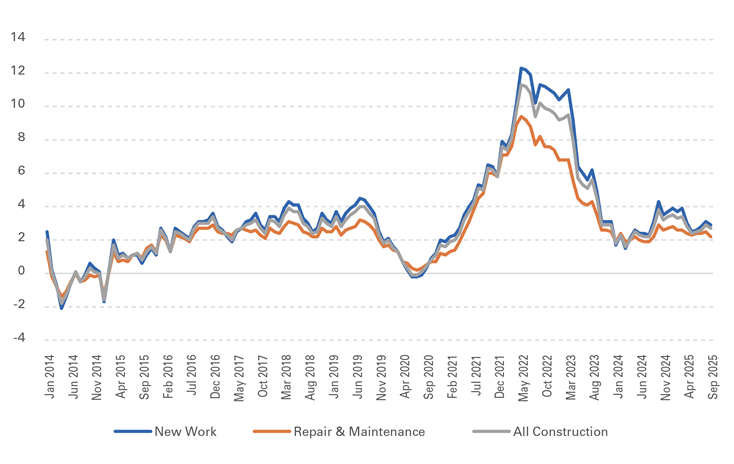

Meanwhile, output price inflation (prices charged by construction companies) has also eased since 2022-23 but still remains positive3. ONS data shows that output price inflation in the sector peaked in mid-2022: in June, inflation for new construction work stood at a very high 12.1%. Repair and maintenance inflation came in at 7.9% y/y, leading to average construction sector output inflation of 10.7%.

UK Construction Sector Output Price Inflation (y/y change in %)

Source: ONS

Output price inflation in the British construction sector had dropped to 1.6% y/y in March 2024, the lowest reading since late 2020. This was then followed by a short-lived increase (rising to above 3% y/y in October 2024-March 2025) before moderating again in Q2 2025. Latest available data for September 2025 shows construction sector output price inflation standing at 2.7% y/y, thereby exceeding input price inflation. Positively, this is supporting profit margins following several years of material price inflation severely outstripping output price inflation.

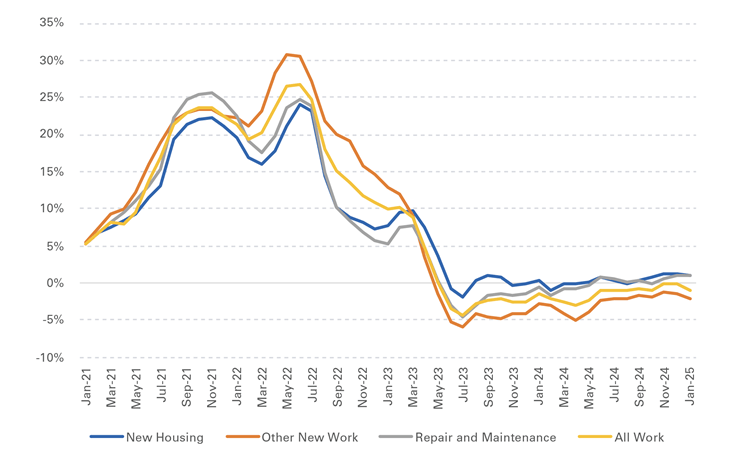

Output

Problematically, UK construction output disappointed in 2024 and ONS data shows that 2025-performance to date was lacklustre too. Last year, sectoral output expanded by 0.7%, only marginally up from the 0.6% recorded in 2023 but still far below pre-pandemic averages⁴. 2024-growth was solely driven by repair and maintenance which expanded by 8.6%. At the same time, new work fell in both, new housing (-5.1%) and private commercial new work (-3.1%).

UK Construction Sector Output (seasonally adjusted three-month moving average, y/y change in %)

Source: ONS

A closer look at the 2025-data shows that things have changed and that new work has become the growth driver. Since the start of the year, repair and maintenance growth (measured in seasonally adjusted moving three-month averages) has remained in a 0.0% to 1.3% y/y corridor, far below the corresponding new work readings (which stood between 1.3% and 3.5% in January to September 2025). On balance, output growth in the construction sector had picked up in spring, reaching 2.2% y/y in the three months to April 2025, the best reading since February 2023. However, since then, performance has slowed down and sectoral output growth moderated again, dropping to 1.5% y/y in the July-September period.

Generally, construction remains a mixed bag: 5 out of the 13 sub-sectors reported contractions in September 2025 with public housing R&M (down by 9.1% y/y in the three months to September) and public new housing (minus 16.3% y/y) seeing the biggest contractions again. On the other side of the spectrum are private industrial new work (+20.7% y/y) and public other new work (up by 22.5% y/y). Problematically, the relatively poor performance in mid-2025 does not bode well for the upcoming winter months: historically, the weather-dependent sector performs much stronger in the summer months before entering a quieter period during the winter period.

Labour Market

Problematically, the UK labour market is gradually running out of steam as job vacancies are falling and unemployment is rising. After having dropped to a multi-year low of 3.6% in mid-2022, the unemployment rate has remained on an upward trend for quite some time now. In the three months to September, it came in at 5.0%, up from 4.3% a year ago and on the worst reading since early 2021 (when Covid distorted the comparison)⁵.

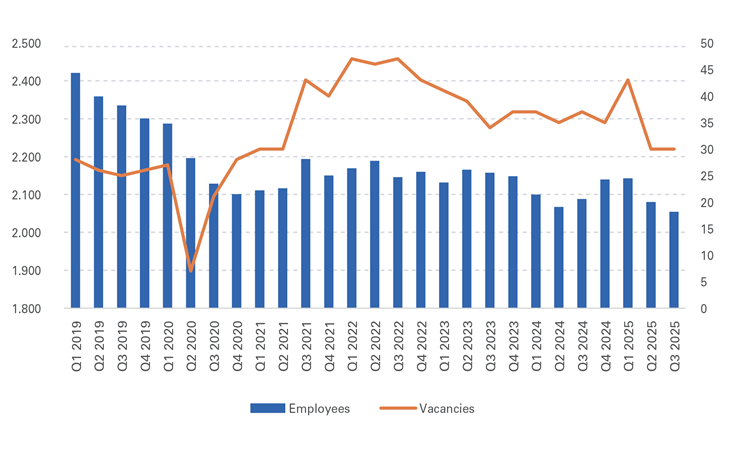

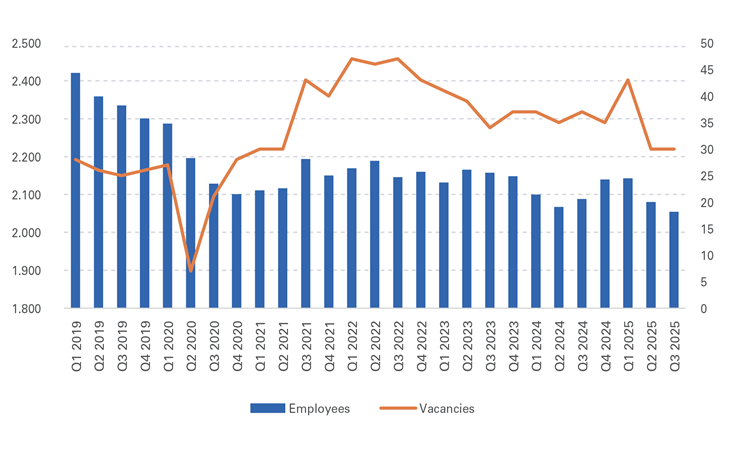

Number of Employees and Vacant Positions (in thousands) in UK Construction

Source: ONS

At the same time, job vacancies in the UK have moved lower over the past three years. The number of open positions in the country has fallen from an all-time of 1.3m in March-May 2022 to 723,000 in August-October 2025, below the pre-pandemic reading of 811,000 in late 20196.

The UK construction sector mirrors this generally negative trend: employment has been falling and open positions have become more and more scarce. ONS data shows that sectoral employment (accounting for around 6% of total UK employment) has dropped from 2,088m workers in Q3 2024 (and 2,158m in Q3 2023) to 2,054m in July-September 2025. Since the start of the Covid pandemic, the sector has shed more than 10% of its workforce, equivalent to around 250k employees. This is against the national trend which has actually seen an increase in employment over the past years: from 33.1m in Q4 2019 to now 34.2m.

Furthermore, job vacancies in the construction sector have also moved lower, coming in at 30k in Q3 2025, the lowest reading since the lockdown-years and also far below the readings of around 45k in 2022⁷. Vacancy ratios are more or less in line with the national average: while there are 1.9 vacant positions per 100 jobs in the construction sector, the UK average stands at 2.3. However, vacancy ratios have come down significantly from their 2022 peaks: back then, the corresponding readings stood at 3.3 (construction sector) and 4.1 (UK average), respectively.

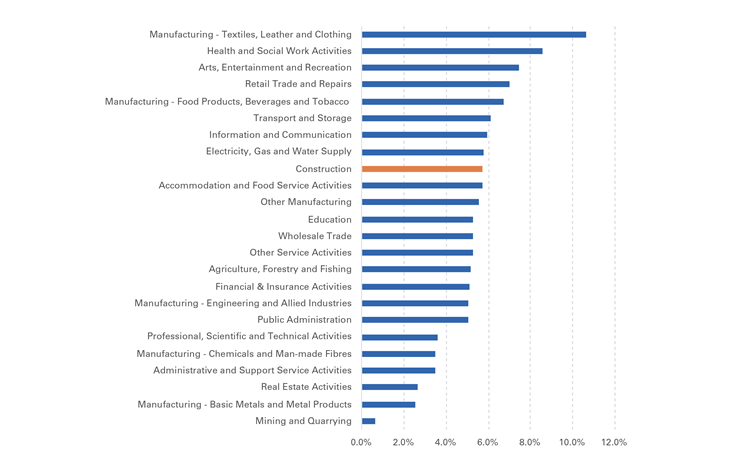

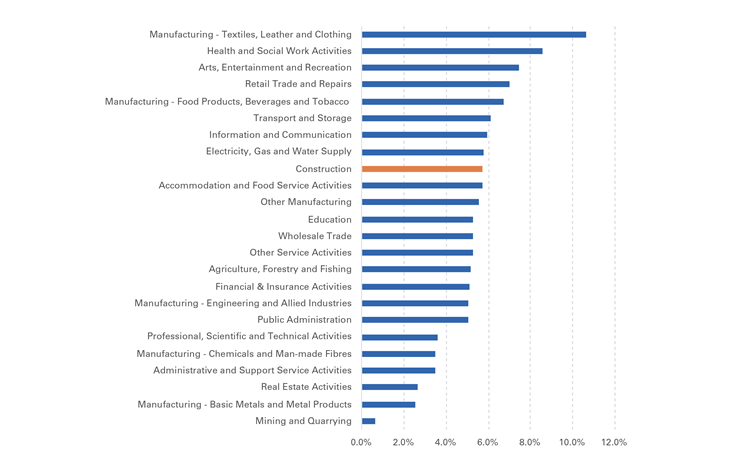

Furthermore, wages continue to increase, thereby adding pressure on operating costs and reducing companies’ profitability. In the twelve months to September 2025, weekly earnings growth in the construction sector (including bonuses and arrears) averaged 5.7%, the 16th highest increase out of the 24 sectors covered by the ONS⁸.

Average Weekly Earnings (including bonuses and arrears) Growth between October 2024 and September 2025 by Sector

Source: ONS

UK construction, like all sectors of the UK economy currently has to digest higher national insurance contributions, a measure that came into effect in April 2025. The simultaneous government-mandated increase of the country’s minimum wage (up by 7% from 2024) is unlikely to have impacted on the sector directly (as salaries tend to be higher) but it has nonetheless the potential to push up pay bands and distort salary bands indirectly. Further tax and national insurance increases as well as another minimum wage rise in spring 20269 cannot be ruled out. As a result, operating costs are likely to rise further in the year ahead as the government will have to plug fiscal holes over the next months and quarters.

Outlook

Problematically, the outlook for UK construction has darkened over the year as macroeconomic conditions have not improved, high frequency data has softened and confidence indicators have fallen. Credit risk continues to be a source of concern with UK construction already accounting for an above-average share of all insolvencies in the country.

Macroeconomics

Worryingly, the UK’s growth outlook remains clouded, despite several interest rate cuts and a fall in global economic policy uncertainty over the summer months. According to the latest set of IMF forecasts, released in October 2025, real GDP in the UK is set to grow by 1.3% in 2025, followed by a similar rate of expansion in 2026.

Although the 2025-projection is up from the April World Economic Forecast, the 2026 figure has not been revised downwards since spring. While the UK will outperform euro zone growth once again, the growth figure remains far below medium and long-term averages10.

Consumer Price Index (including owner occupiers’ housing costs), y/y change in %

Source: ONS

Equally problematically for policy makers in the UK, lacklustre growth is once more coupled with elevated inflationary pressures11. Consumer prices including owner occupiers’ housing costs (CPIH) have been rising for several months now, increasing from 2.6% in September 2024 to 4.1% one year later. The current reading is the highest since October 2023 and inflation is more than twice as high as the Bank of England’s (BoE) 2% target. With inflation forecasted to remain above target until mid-2027 (albeit gradually decreasing over time), the BoE’s room for further interest rate cuts remains limited, despite the adverse growth backdrop12. Markets are expecting a single rate cut (by 25 basis points) in 2026 which will mean that the period of monetary loosening is effectively coming to an end.

Monthly Average Interest Rate (in %) on Loans to UK Private Non-Financial Corporations

Source: Bank of England

This development is noteworthy as despite the interest cuts in 2024-25, the average rate British non-financial corporations have to pay on new loans remains high. Since peaking at 7.26% in May 2024, floating interest rates on new loans have come down to 5.53% in September 2025. However, this is still severely above the 2009-22 average of around 2%-3%13. At the same time, lending terms have tightened, thereby complicating companies’ (and households’) access to credit.

Confidence Indicators

As macroeconomic headwinds are still sizable, sectoral confidence indicators are deteriorating, highlighting the widespread pessimism in UK construction. Latest Purchasing Managers’ Index (PMI) data for October shows another drop to 44.1 points, far below the neutral 50-points line that divides expansion in sectoral activity from contraction14. This is the tenth consecutive month in which the PMI has remained below the growth threshold, the longest period of contraction since the global financial crisis in 2008-09. It is also a stark difference to last year’s confidence readings: before the Autumn Budget in October 2024, construction sector PMI had stood at a very high 57.2 points.

Problematically, the rate of decline in total industry activity was the steepest since mid-2020 and all three sub-sectors remained in contraction territory: Commercial activity (46.3 points) outperformed residential work (43.6 points) and civil engineering (35.4 points) and many survey respondents mentioned sluggish market conditions, fewer tender opportunities and delays in new works, leading to disappointing new order inflow. Positively, PMI data also shows that input cost inflation has fallen to the lowest reading in a year and the business activity sub-component leaves room for a bit of optimism: while 20% of survey participants expect construction sector output to fall over the next twelve months, 34% forecast an expansion.

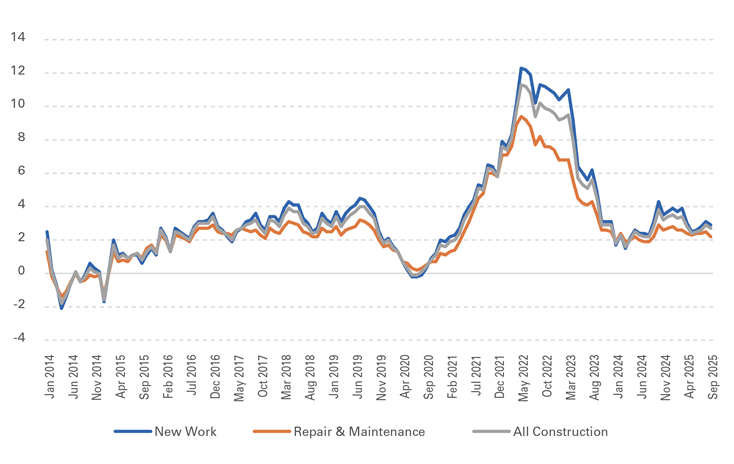

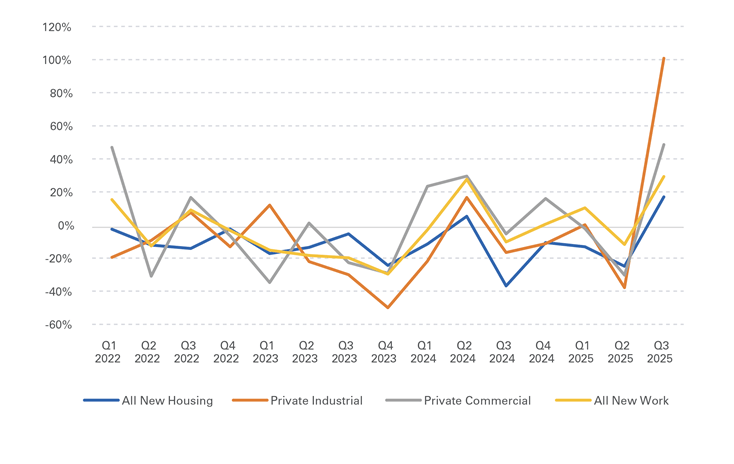

Meanwhile, data from the ONS shows that new order inflow has started to pick up, pointing towards increased building activity in 202615. “All new work” expanded by almost 30% y/y in Q3 2025, the fastest rate of expansion since late 2021. “Private commercial” (up by 48.6% y/y) and “private industrial” (+100.8% y/y) saw even more rapid new order inflow but data tends to be volatile so it is too early to be overly optimistic. Positively, after a period of contraction between Q2 2022 and Q3 2024 (when new order inflow was negative in y/y terms in seven out of nine quarters), new orders have been rising in three out of the past four quarters now.

Seasonally Adjusted New Orders for Construction ( y/y change in volume terms)

Source: ONS

Meanwhile, building statistics from the ONS also show that the government is far away from meeting its self-imposed target of building 300k new homes per year. In 2024, 185k houses were completed, down from 195k in 2023. Data for Q1 2025, the latest available data point, does not bode well for 2025-26: according to the ONS, around 39k new homes were finished in January-March, the lowest Q1 figure since 2014. Negatively in this light, the latest projections from the Construction Products Association, released in October, forecast total construction sector output to come in at 1.1% in 2025 and 2.8% in 2026. This is down from 1.9% and 3.7% growth in the previous set of forecasts, published in July 20216.

Politics and Regulatory Environment

The Labour government, in office since mid-2024 has vowed to increase construction sector output to 1.5m new homes in this five-year parliamentary term and has earmarked sizable investment in public infrastructure projects in last year’s Autumn Budget. At the same time, it has promised to hire 300 new planning officers and to remove red tape by revamping planning laws (which are a major bottleneck). His Majesty’s Government has also reintroduced mandatory housing targets, focussing on the least affordable regions of the UK. Local governments will be hit with hefty fines if targets are missed.

Furthermore, in its 10-Year Infrastructure Strategy, published in June 2025, the government has committed to investing GBP725bn in public infrastructure over the next decade17. Water companies will have to quadruple investment in new water infrastructure over the next five years (including nine new reservoirs) while at the same time, road and railway infrastructure will also see investment. Energy generation and distribution are set to become construction sector growth drivers too. Furthermore, schools, hospitals and net zero projects will also see sizable funding, according to the strategy paper.

Sadly, to date, reform progress has been slow though, thereby holding back building activity. As government finances are stretched, large scale infrastructure investment (such as the10- Year Infrastructure Strategy) during this parliamentary term is at risk of being cut. The administration is also severely behind its housebuilding target and red tape continues to undermine activity. The Building Safety Act and Gateway 2 (both reforms coming out of the Grenfell Tower Fire in 2017 which killed 72 people) add another layer of administrative burden, costing developers time and money.

Meanwhile, ESG topics and decarbonisation targets will also impact on construction companies going forward. Generally, net zero policies have become less popular over the past years and on an international stage, the topic has been put on the backburner since the election of Donald Trump as US president. In the UK, the government has watered down targets for in the troubled automotive industry, giving car makers more time to transition from internal combustion engine cars to electric vehicles18. That said, no changes to the goalposts for the UK construction sector have been announced yet. With the sector accounting for around a quarter of the UK’s carbon footprint, emissions will need to be cut by 76% by 2035 (and reduced to zero by 2050). At the moment, the country is behind schedule and achieving these aggressive targets will require sizable investment and seismic changes to operating models. That said, it will also provide opportunities for companies embracing change.

Credit Risk

Positively, the number of business failures in the construction sector has fallen in 2024. After three consecutive increases in 2021-23, last year saw an 8.1% drop in England and Wales (which accounts for around 94% of all company insolvencies in the UK). Overall, 4,032 construction companies went under in 2024, down from 4,388 in 2023 but still far above the pre-Covid reading of 3,217 in 2019.

Construction Company Insolvencies in England and Wales

Source: Insolvency Service

Encouragingly, this positive trend continued in the first eight months of 2025. Data from the government’s Insolvency Service shows that in January to August, 2,707 construction companies became insolvent, down by 3.8% y/y. The construction sector also performs better than the national trend which has seen a stagnation in business failures in England and Wales in a y/y comparison (from 16,359 to 16,363 failures)19.

However, UK construction continues to display an above-average insolvency risk. While the sector accounts for around 6%-7% of gross value added in the country, it is responsible for almost 17% of all insolvencies (4,032 out of 23,879 in 2024). This is due to small profit margins, usually around 2%-4%, and the inability to pass on unexpected cost increases to customers due to fixedprice contracts20.

Also worryingly, anecdotal evidence shows that payment patterns in the sector are deteriorating again. While things improved during the Covid pandemic, especially bigger companies are now holding on to cash longer again, thereby adversely impacting on working capital requirements in their supply chain. A recent publication from Begbies Traynor, a business recovery consultancy shows that the number of UK construction companies in financial distress has risen by 70% y/y in Q3 202521. According to the report, almost 104k construction companies in the UK are experiencing significant financial stress, more than in any other sector in the economy. Even more concerningly, 7,361 construction companies are seeing critical levels of financial distress.

This concerning development is backed up by consultancy’s EY-Parthenon latest UK Profit Warnings Report22. According to the publication, 14 UK stock-listed construction and material firms issued profit warnings in Q1-Q3 2025, almost three times the level recorded in the whole of 2024. Companies often cited residential market weakness, commercial uncertainty, budget constraints and delays caused by new safety regulations as the reasons for lower-than-expected profits23. Worryingly, the EY publication indicates that even large construction sector companies (which tend to have bigger buffers and higher resilience) are under increasing financial stress, thereby potentially causing issues for smaller contractors in their supply chain.

Furthermore, the rising number of employee ownership trusts in the sector is also a source of concern, given the high amount of EOT failures in recent quarters (often caused by too-high committed contributions to previous owners). It remains to be seen whether EOTs are a suitable model for the very volatile construction sector.

Taking all factors into account, the 2026 credit risk outlook remains challenging. Although interest rates might come down further a little bit next year, sectoral insolvency risk must be monitored closely. With turnover expansion over the past years largely been driven by inflation, rather than organic growth, the high degree of uncertainty could easily derail the already weak recovery. Especially large contractors have already pushed big projects into the next financial year in order to await more clarity on domestic legislation and government policy targets. At the same time, skill shortages and limited contractor capacity, a consequence of the elevated number of business failures, are also causing problems and delays.

Related links:

[1] https://www.pmi.spglobal.com/Public/Home/PressRelease/2efd8f9aa44a4bc98efadb8db66d9350

[2] https://www.gov.uk/government/statistics/building-materials-and-components-statistics-october-2025

[3] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/interimconstructionoutputpriceindices

[4] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/outputintheconstructionindustry

[5] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/e

[6] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/j

[7] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyin

[8] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

[9] https://www.gov.uk/government/news/national-living-wage-estimate-update

[10] https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

[11] https://www.ons.gov.uk/economy/inflationandpriceindices

[12] https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2025/november/monetary-poli

[13] https://www.bankofengland.co.uk/statistics/visual-summaries/effective-interest-rates

[14] https://www.pmi.spglobal.com/Public/Home/PressRelease/2efd8f9aa44a4bc98efadb8db66d9350

[15] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/newordersintheconstruc

[16] https://www.theconstructionindex.co.uk/news/view/forecasts-downgraded-on-back-of-poor-summer

[17] https://www.gov.uk/government/publications/uk-infrastructure-a-10-year-strategy

[18] https://www.bbc.com/news/articles/cj3xe7ppmn2o

[19] https://www.gov.uk/government/statistics/company-insolvencies-september-2025

[20] https://www.linkedin.com/pulse/profitability-shrinking-margins-uks-construction-tpr7c/

[21] https://www.constructionnews.co.uk/financial/70-rise-in-construction-firms-in-critical-financial-dis

[22] https://www.ey.com/en_uk/services/strategy-transactions/profit-warnings

[23] https://bcis.co.uk/insight/key-takeaways-from-the-latest-profit-warnings-report/