Friday 12 December 2025

- Thought Leadership

UK Metals Sector Report: December 2025

By Tom Bryant

Summary

- The UK metals sector continues to struggle: global overcapacity (which is still increasing quickly), low demand, high energy costs and rising trade barriers all create headwinds for the already ailing industry.

- Steel production in the UK remains on a steep downward trend; the government had to de-facto nationalise two of the remaining six producers in 2025 to avoid insolvencies and large-scale layoffs.

- Trade barriers are rising for UK steel exporters: the US has introduced a 25% tariff on UK steel and the EU will launch its Carbon Border Adjustment Mechanism on 1 January 2026 (which also comes with lower tariff free quotas and higher tariffs).

- Domestic metal consumption remains under pressure: manufacturing output continues to disappoint and UK car production is forecasted to fall by another 15% in 2025.

- UK industrial electricity costs remain high in an international and historic comparison; government support is on its way but its effect remains to be seen.

- The macroeconomic outlook is better than in most other European markets but still bleak; high interest rates and tight lending conditions, coupled with higher national insurance contributions and rising wages all weigh on credit risk levels in the sector.

To view a pdf version, click here.

Key trends in 2024-25

Operating conditions in the UK metals sector remained problematic in 2024-25 as both,

supply and demand struggled amidst micro- and macroeconomic challenges.

Metal Producers

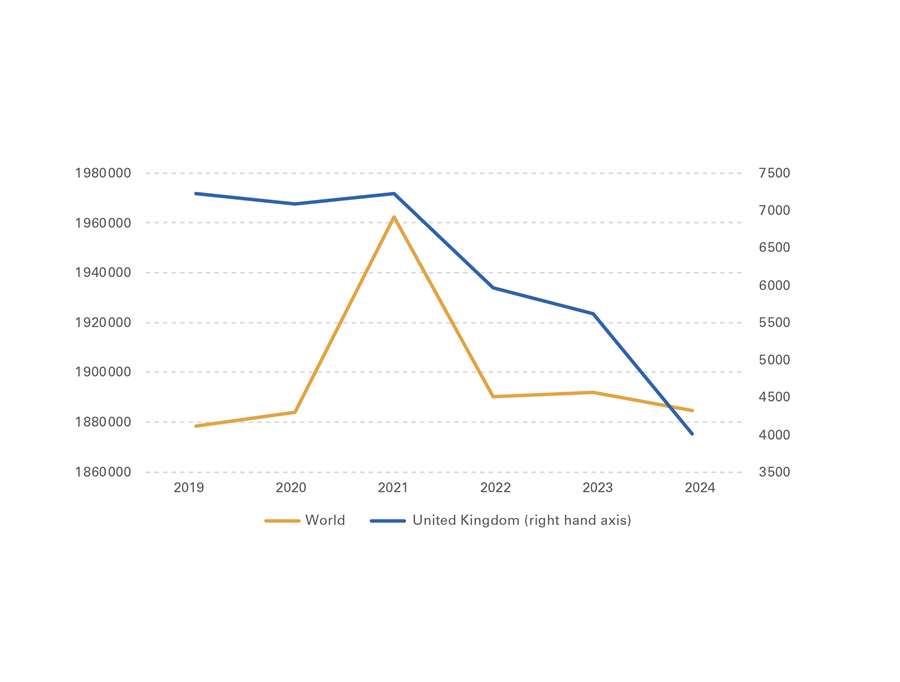

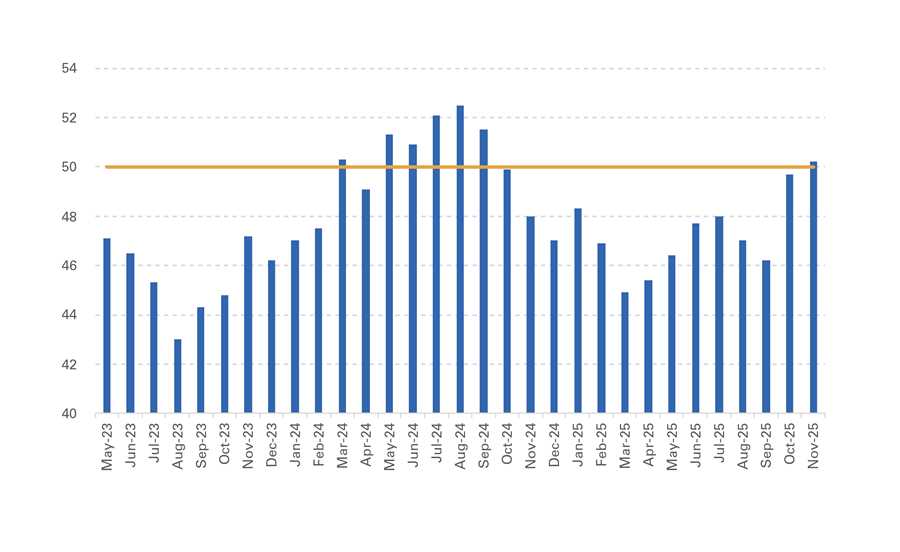

As Tata Steel closed its blast furnace in Port Talbot in September 2024, crude steel production in the UK fell for the third consecutive

year in 2024. According to data from the World Steel Association, output contracted by a sizable 29% in 2024 (to below 4m tonnes), on

top of 17% and 6% drops in 2022 and 2023, respectively1. The country’s importance for global steel production has diminished further

with the UK now being the 36th largest steel producer (between Sweden and Slovakia), down from 26th in 2023. For 2025, another

output drop seems inevitable, given the permanent closure of the Port Talbot facility and the emergency nationalisation of British Steel in

April2and Liberty Steel in August 20253.

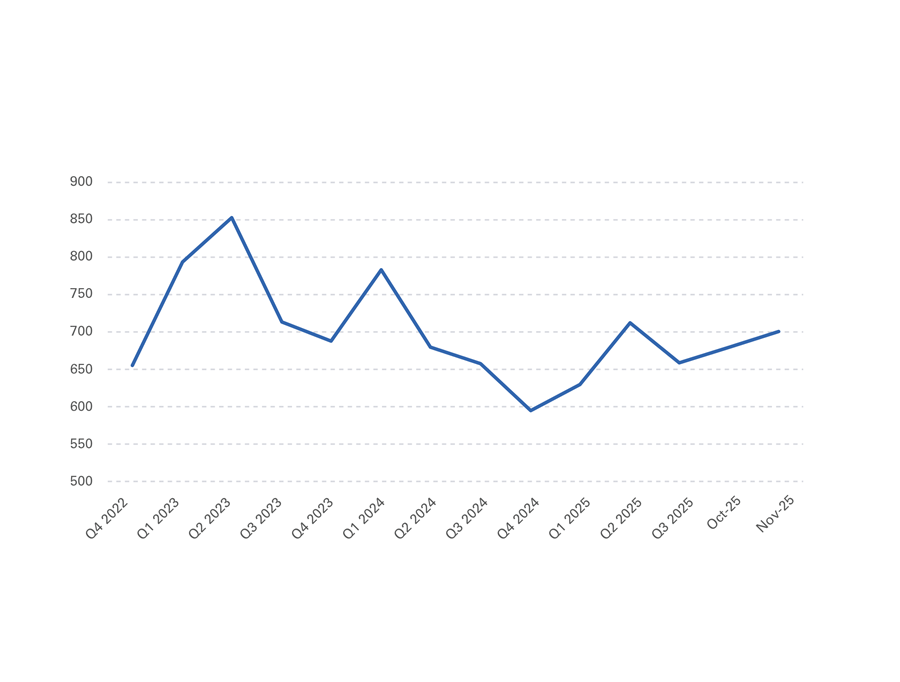

Crude Steel Production (in thousand tonnes)

Source: World Steel Association

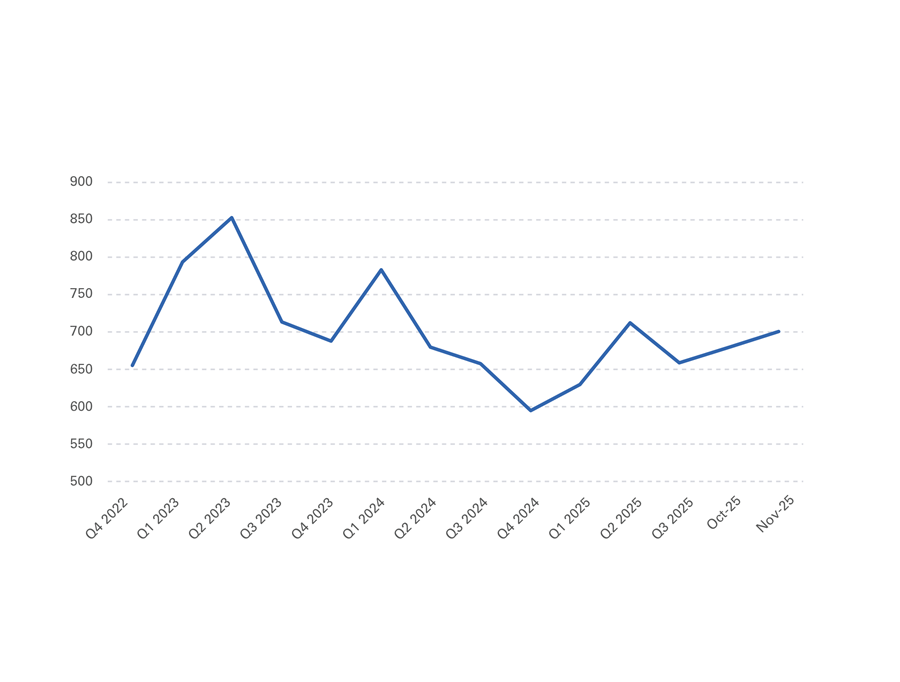

In Q4 2024, steel prices had hit the lowest reading since late 2020. Positively for steel producers, prices increased somewhat

throughout 2025, coming in at USD700 per metric tonne in November. However, much of the upward movement is likely to be driven by

frontloading steel purchases ahead of the Carbon Border Adjustment Mechanism (CBAM) introduction in the EU on 1 January 2026.4

Steel Prices in Europe (in USD per metric tonne

Source: www.focus-economics.com

Despite the generally improving trend, prices are still down

against 2023 readings though and with global oversupply in

the steel sector still increasing, downward pressures on steel

prices are likely to be persistent. According to EUROFER, the

European Steel Association, overcapacity exceeded 560m tonnes

in 2023, four times the EU’s annual steel output. The OECD’s

Steel Outlook 2025 expects excess capacity to rise to 721 million

metric tonnes in 2027 with China, the Middle East and Southeast

Asia all still reporting immense capacity increases (of which 74%

are CO2-intensive blast furnaces). In this light, China’s policies are

an immense source of concern for European steel producers (and

politicians): Beijing is still subsidising steel production at ten times

the OECD average and as a result Chinese steel exports have

doubled since 2020, reaching 118m tonnes in 2024.

However, because of incoming policy changes, domestic users

of steel and metals should count on higher end-user prices: the

upcoming CBAM introduction in 2026 (EU) and 2027 (UK) will

provide upward pressure on imports from countries that do not

have emission trading schemes in place. Market watchers expect

increases in 2026 to range betweenGBP80-GBP200 per metric

tonne5.

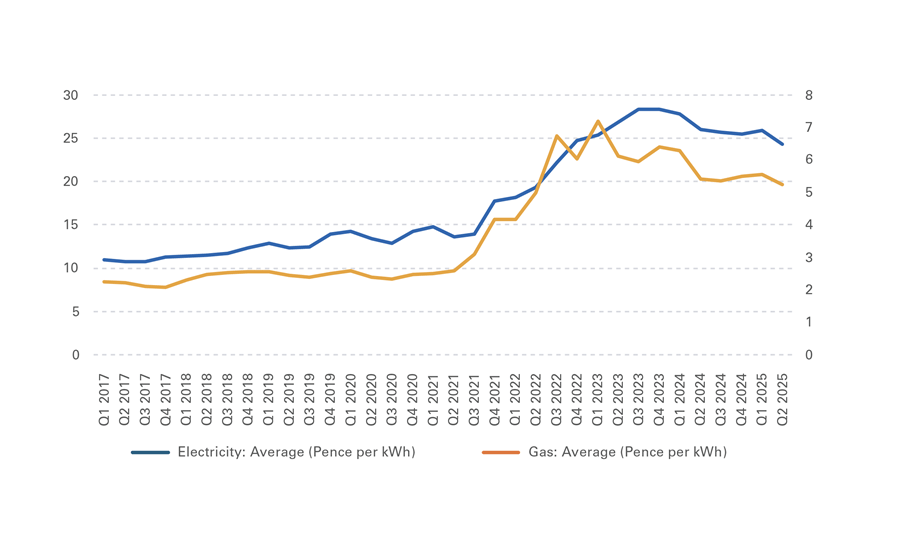

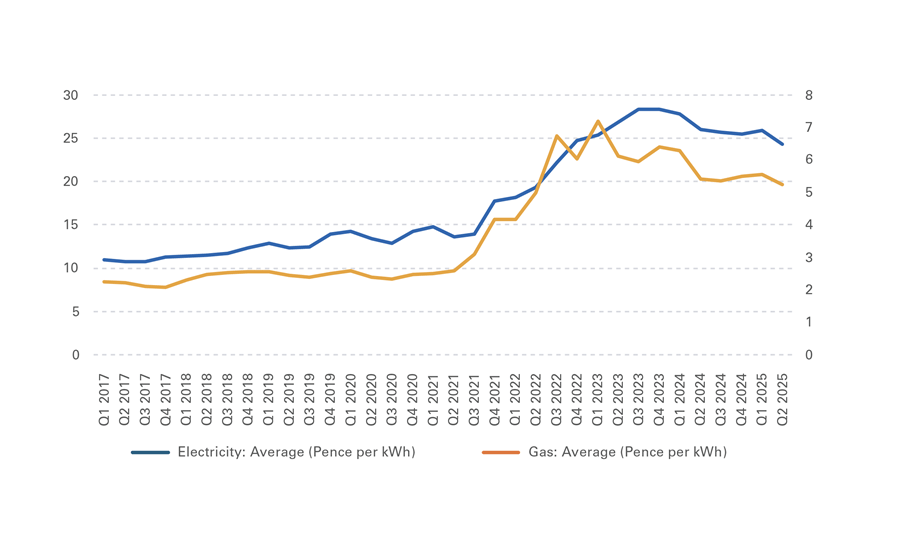

Furthermore, with energy costs accounting for 20%-40% of total

steel production costs, the price shock following the outbreak

of the Russia-Ukraine war in 2022 had a negative effect on

companies’ cost base, a development that is still felt across the

industry. This is especially problematic for the UK which has the

highest industrial electricity costs in the G7.

Electricity and Gas Prices (including Climate Change Levy) for UK Non-Domestic Consumers

Source: ONS

Positively in this light, energy prices continued to moderate

somewhat in 2024-25, a trend that had already started in

2023. Unfortunately, despite the moderation, prices are still

far above their pre-war readings. Compared against Q4 2021,

industrial electricity and gas prices are up by 60% and 110%,

respectively6. Positively, in its latest industrial strategy paper, the

UK government has earmarked GPB420m to subsidise energy

costs for several industries, including steel making. Around

500 businesses will see a 90% discount on their electricity

network charges which would reduce the energy bill of qualifying

companies by around 18%.7

In addition, the UK government has also launched a new British

Industrial Competitiveness Scheme with the aim of reducing

electricity costs by up to GBP40 per MWh for over 7,000

electricity intensive companies. This could lead to a 25% price

cut for eligible businesses. The public consultation period has

been launched in November 2025 but it will take until spring 2027

before the scheme will become operational8.

End Users

Unfortunately, UK manufacturing continues to struggle. In a y/y comparison, manufacturing output has been falling in six out of the first

nine months of 2025. Latest available ONS data shows a sizable 1.7% y/y contraction in the three months to September 20259, the

biggest drop since April 2024.

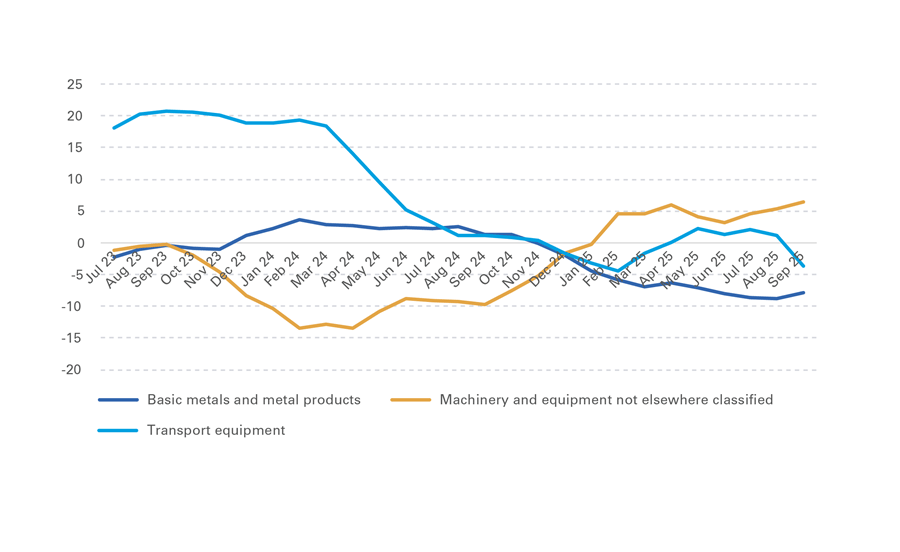

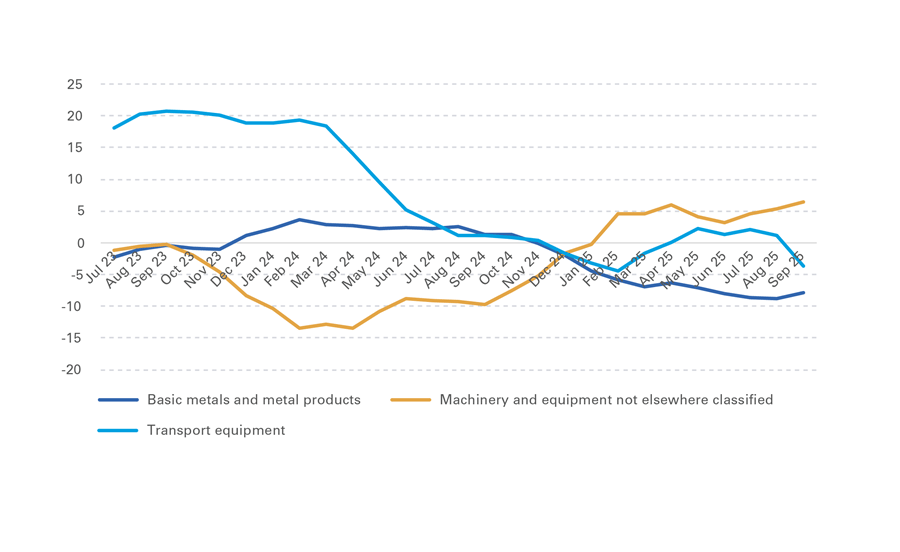

UK Industrial Production (three-month moving average, y/y change in %)

Source: ONS

Looking at the metals-related sub-sectors in more detail, the

situation does not improve much although there are certain

industries that continue to report growing output. Overall, seven

out of thirteen manufacturing sub-sectors shrunk in September10.

Production in the “basic metals and metal products” sector

has been falling for eleven months in a row now with the rate

of contraction standing above 5.0% y/y since February 2025.

“Transport equipment” is following a disappointing pattern too;

the latest available data point for September shows a 3.7%

y/y drop. In January to September 2025, this sub-sector has

contracted in four out of nine months. Meanwhile, “machinery”

output has recovered: after having fallen in H2 2023 and 2024,

the sector has returned to growth in early 2025, reporting a sound

6.5% y/y expansion in the three months to September 2025.

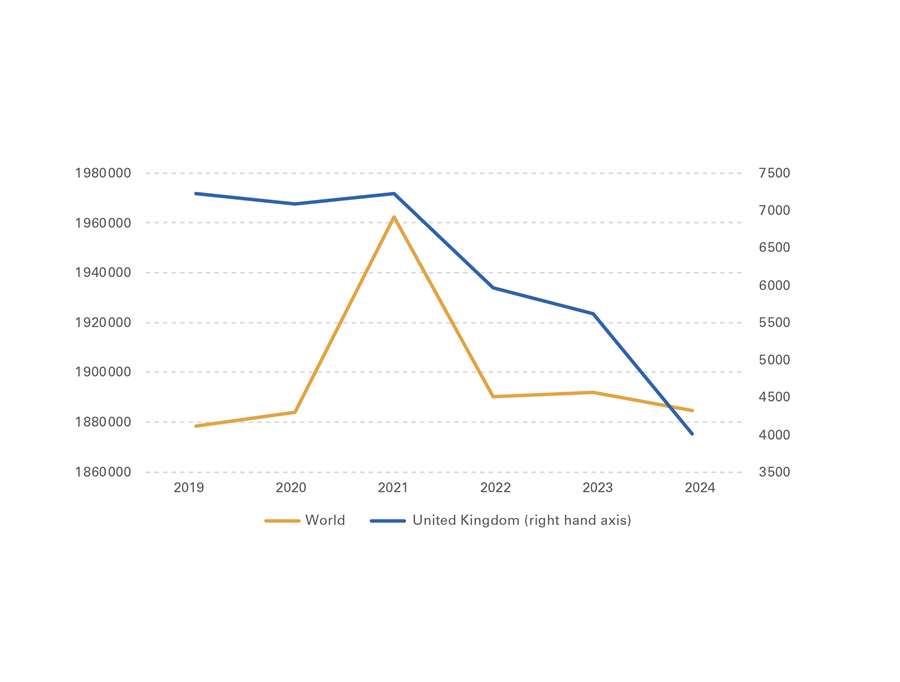

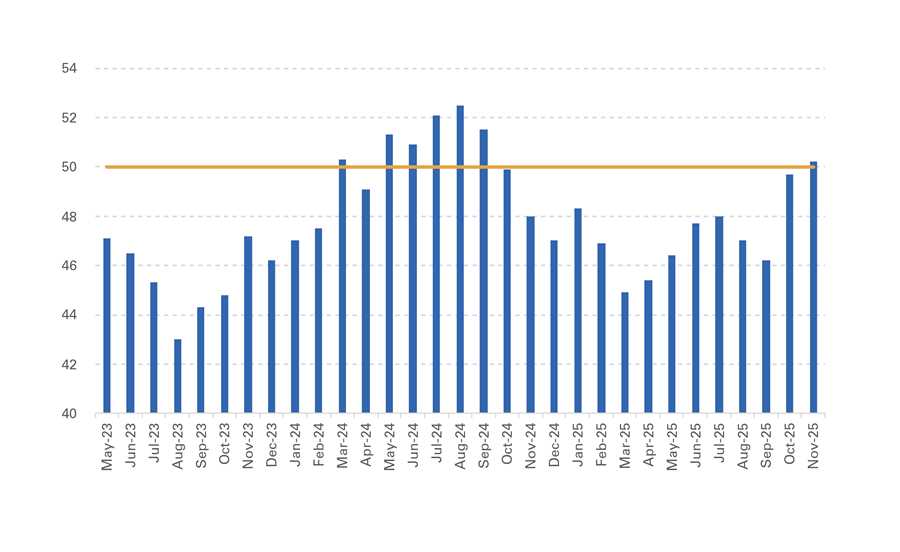

Sadly, Purchasing Managers’ Index (PMI) data for the UK

construction and manufacturing sectors point towards persistent

headwinds. In the construction sector, an important customer of

metal products, the PMI remained below the neutral 50-points

line (which divides expansion in sectoral activity from contraction)

in October, coming in at 46.2 points. This was the tenth

consecutive month of below 50-points readings, the longest

stretch of contraction since the global financial crisis in 2008-09.

Also worryingly, new order inflow continues to fall too, indicating

more problems for the sector in the next months11.

UK Manufacturing Purchasing Managers Index%)

Source: S&P Global, range: 0 (pessimism) to 100 (optimism), neutral reading: 50 points

In the manufacturing sector, the PMI has quickly fallen from its 26-month high in August 2024 (52.5 points) to 44.9 points in March

2025 before recovering over the summer months. After another period of weakness, the UK manufacturing sector PMI has moved

into growth territory again towards the end of the year: reaching 50.2 points in November, the Index is now standing above the neutral

50-points line for the first time in fourteen months . Positively, domestic new order inflow expanded but export orders continue to fall,

albeit by a smaller pace than in mid-2025.

2026 Outlook

The sectoral outlook for 2026 is mixed. The nationalisation of British Steel’s Scunthorpe

steel plant in April and the government intervention at Liberty Steel’s Yorkshire facilities

in August 2025 highlight the ongoing problems steel-making in the UK is facing: high

energy costs, the need to reduce the industry’s high carbon footprint, intense international

competition and generally low demand for its products pose persistent challenges.

Furthermore, macroeconomic conditions have deteriorated in the first half of 2025 and

although growth forecasts have been revised upwards recently, 2026 will be another

challenging year for the global as well as the UK economy. Positively, the prospect of a

UK-US trade war has subsided, following an agreement between the two governments

in mid-2025; the UK benefits from generally generous US market access, compared with

other economies.

Macroeconomics

Problematically, economic headwinds remain substantial,

highlighted by poor business and consumer confidence

readings and disappointing high frequency data such as retail

sales or industrial production figures. Higher national insurance

contributions and the increased minimum wage (policies that

came into effect in April 2025) also had a negative impact on the

British labour market as well as business performance.

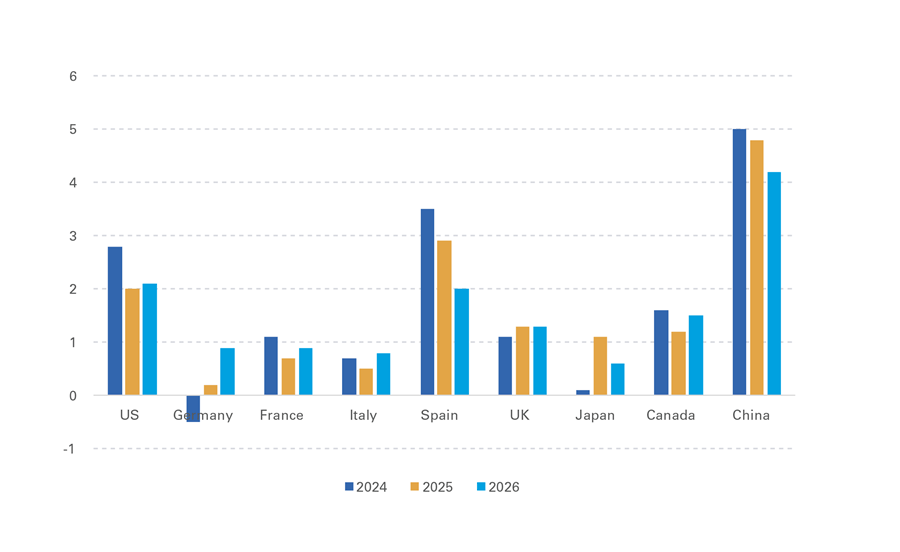

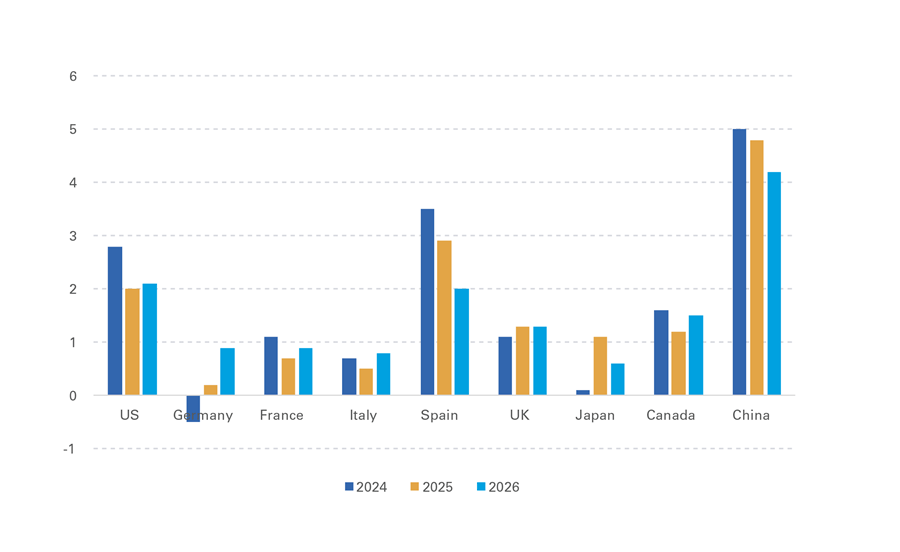

In terms of real GDP growth, the IMF has revised its UK 2025

forecast upwards twice over the past quarters. Having stood

at 1.1% for 2025 and 1.4% for 2026 in the April 2025 World

Economic Outlook (WEO), the Fund has factored in lower geopolitical risk over the summer months. As a result, the

2025-projection was revised upwards (to 1.2%) in the July-

WEO with the October edition seeing another upgrade (to

1.3%). Problematically, the 2026-forecast did not benefit from

an upgrade in July and in the final WEO of the year, the IMF has

actually lowered its UK growth projection to 1.3%.

The UK is one of only a handful of developed markets that will not

report an acceleration in real GDP growth in 2026 but even with

this disappointing growth rate, the UK will outperform most other

major European markets: Italy (+0.8% growth in 2026), France

and Germany (both +0.9%) will all see below-1% growth next

year, according to the latest set of IMF forecasts14.

Real GDP Growth (in %)

Source: IMF, World Economic Outlook October 2025

Political and Regulatory Environment

Positively, the UK government has agreed on trade deals with

several international partners in 2025, thereby improving growth

prospects for the country as well as the metals sector. In May,

a trade deal with India (which had been under negotiation for

several years) has been agreed on. For the UK metals sector, this

is promising as India will lower its tariffs on higher value cars from

100% to 10% while also cutting import duties on aerospace and

electrical devices over the next years15.

Furthermore, the UK and the US governments have also finalised

a trade deal in mid-2025 but unfortunately Washington has

moved goalposts since then. In September (and against previous

expectations), Washington suspended talks about eliminating

tariffs on UK steel exports to the US indefinitely16. That means

that the current rate of 25% will continue to apply (most other

nations face an even higher 50% tariff on steel exports though).

This comes at a time when the US is still taking around 9% of all

UK steel exports (in value terms). However, over the past years,

UK steel exports to the US have fallen substantially: from 300,000

tonnes in 2017 to 165,00 tonnes in 202317.

Positively, the trade deal in May also included lower tariffs on UK

car exports to the US. They were reduced from 27.5% to 10%

for the first 100,000 cars exported per year18. This is good news

for the struggling UK automotive and steel sectors but given the

often erratic style of policy making in the US, it remains to be

seen how beneficial the trade deal will ultimately be.

Meanwhile, the EU and the UK completed talks about closer

economic cooperation in May 2025. Most notably for the metals

sector, both sides agreed on linking their respective emissions

trading schemes (which had been disjointed since Brexit)19.

With the EU’s Carbon Border Adjustment Mechanism (CBAM,

effectively acting as a tariff on carbon-heavy imports) coming into

force on 1 January 2026, one year before the UK’s scheme, both

sides are currently negotiating a temporary CBAM exemption for

UK steel makers to safeguard bilateral trade20.

That said, imported steel (which often originates from carbon-

heavy blast furnaces in China or India) might be ending up in the UK instead of the EU from 1 January 2026 on as exporters might

want to avoid the higher costs associated with selling to the EU.

As a consequence, the UK government is currently considering

mirroring EU measures (which include lower tariff-free import

quotas and higher tariffs), likely triggering steel price increases

in Europe of around GBP30-GBP130 per tonne, depending on

carbon-density and country of origin21 in order to shield domestic

steel producers from foreign competition22.

Additionally, the UK government continues to work on its steel

strategy. After having come into office in mid-2024, the Labour

administration had already earmarked GBP2.5bn for the sector,

on top of GBP500m support for Tata Steel’s new electric arc

furnace (EAF) in Port Talbot. The nationalisation of British Steel’s

Scunthorpe plant also created additional costs of GBP235m23,

thereby putting further strains on already stretched public

finances. At the moment, four of the country’s six main steel

companies receive some form of financial support from the

government, highlighting structural profitability issues in the

British steel sector24. Looking ahead, the government is warming

up to the idea of merging all remaining six UK steel companies

into one to improve their economic viability before finding a

private-sector owner for the newly-created business25.

Furthermore, maintaining a certain degree of strategic

independence from the China-dominated global steel market and

making production greener (via EAF or investing in hydrogen-

based steel making) are likely to remain key priorities for the

UK government going forward. Indeed, the UK steel sector

was given high importance in the UK’s Defence Industrial

Strategy, published in September 2025. Investment in defense-

critical industries (such as steel-making), securing domestic

manufacturing capabilities via long-term contracts and a generally

higher focus on homegrown supply chains will support UK steel

producers going forward, especially as the neighbouring EU will

embark on a similar journey26. Problematically in this light, the

steel import share in the UK (with imports often coming from

China) has risen from an already high 55% in 2022 to 70% in

202427, thereby highlighting the country’s reliance on foreign

suppliers.

The Automotive Sector

Also problematically, the domestic automotive sector continues to

struggle. Production has more than halved in the six years to 2024

and is now on the lowest level since 1954. 2024 saw another

11.8% fall in vehicle output, according to data from the Society

of Motor Manufacturers and Traders (SMMT)28. Worryingly, car

production fell even further in January to August 2025: minus

12.2% y/y29.

For the year as a whole, the SMMT expects production figures to

contract by around 15% (to around 755k units). While structural

problems (such as Brexit, high operating costs and the shift to

EV) are the main drivers behind this decline, one-off effects also

contribute to the slowdown. For example, a large-scale cyber-

attack on JLR in September caused a five-week long shut down

in several car plants across the UK as well as severe supply chain

disruptions within the JLR group30.

Business Failures

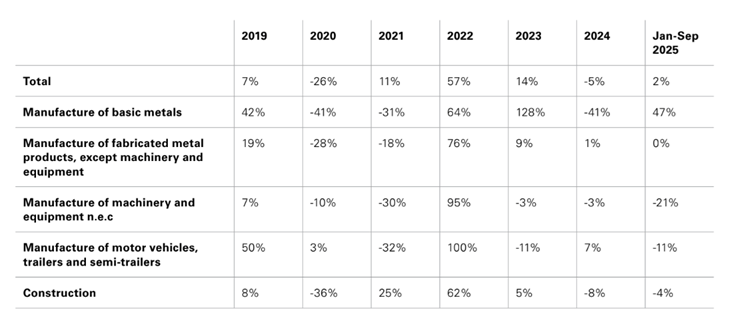

After having peaked on a 30-year high in 2023, business failures in England and Wales have fallen by 5% in 2024, according to data from

the government’s Insolvency Service. That said, despite this improvement, figures are still significantly above the pre-Covid readings:

23,880 business failures in 2024 against 17,170 in 2019. Even more problematically, the encouraging 2024-trend has already come to a

halt again with business failures in January to October 2025 rising by 2.1% y/y again.

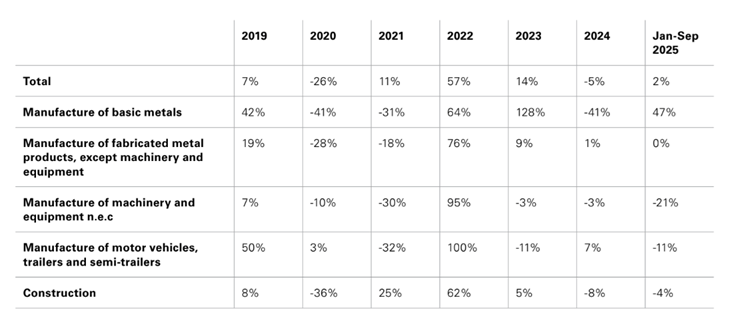

Registered Company Insolvencies in Selected Industries in England and Wales (Y/Y Change in %)

Source: Insolvency Service

In the metals sector, the number of business failures has also

developed favourably in 2024 with most sub-sectors continuing

to see improvements in Q1-Q3 2025. While manufacture of basic

metals saw a high 47% y/y increase, the remaining industries

reported further falls or a stagnation. Car producers (down by

11% y/y) and machinery manufacturers (minus 21%) witnessed

the biggest improvements with construction (a sector with

notoriously high credit risk levels) also seeing a 4% y/y drop in

January to September31.

Also positively, sectoral business failure risk is low in absolute

terms: manufacturing of basic metals (24 failures in 2024),

fabricated metal products (268), machinery and equipment (72)

and the automotive industry (44) account for a very small fraction

of total business failures in England and Wales (23,880). At the

same time, some exposure risks exist via construction (which

saw 4,038 failures last year, the riskiest sector out of all 22

industries covered).

Problematically, the insolvency outlook is relatively gloomy. Weak

macroeconomic growth, tight bank lending conditions, still above-

average interest rates and higher labour costs in the UK (via the

wage and national insurance contributions channels) all have the

potential to increase the number of business failures again. Long-

term business planning is also complicated by the still elevated

level of global economic policy uncertainty, a trend unlikely to

disappear anytime soon.

Related links

1 https://worldsteel.org/data/annual-production-steel-data/?ind=P1_crude_steel_total_pub/CHN/IND

2 https://www.theguardian.com/business/2025/oct/16/cost-of-taking-over-british-steel-rises

3 https://www.theguardian.com/business/2025/aug/21/government-control-liberty-steel-south-yorkshire-sanjeev-gupta

4 https://www.focus-economics.com/commodities/base-metals/steel-europe/

5 https://eurometal.net/all-steels-eu-and-uk-steel-prices-set-to-surge-as-new-tariffs-and-cbam-framework-take-effect/

6 https://www.gov.uk/government/statistical-data-sets/gas-and-electricity-prices-in-the-non-domestic-sector

7 https://www.bbc.com/news/articles/c5ype0gp7lgo

8 https://www.gov.uk/government/news/government-acts-on-top-business-concern-and-cuts-electricity-bills-for-thousands-of-manufacturers-by-up-to-25

9 https://www.ons.gov.uk/economy/economicoutputandproductivity/output/bulletins/indexofproduction/september2025

10 https://commonslibrary.parliament.uk/research-briefings/sn05206/

11 https://www.pmi.spglobal.com/Public/Home/PressRelease/2efd8f9aa44a4bc98efadb8db66d9350

12 https://www.pmi.spglobal.com/Public/Home/PressRelease/a1124de6abed4c30a6a9bcaeb6e67d77

13 https://www.reuters.com/world/uk/uk-government-take-over-liberty-steel-division-after-collapse-2025-08-21/

14 https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

15 https://commonslibrary.parliament.uk/research-briefings/cbp-10258/

16 https://www.bbc.com/news/articles/cj4y2gge7p1o

17 https://www.uksteel.org/steel-news-2025/trump-declares-25-tariffs-on-steel-imports-to-the-us

18 https://www.gov.uk/government/news/landmark-economic-deal-with-united-states-saves-thousands-of-jobs-for-british-car-makers-and-steel-industry

20 https://eurometal.net/eu-and-uk-prepare-temporary-cbam-exemption-deal-to-protect-cross-channel-trade/

21 https://gmk.center/en/news/new-tariffs-and-cbam-will-push-up-steel-prices-in-the-eu-and-the-uk-forecast/

22 https://eurometal.net/all-steels-eu-and-uk-steel-prices-set-to-surge-as-new-tariffs-and-cbam-framework-take-effect/

23 https://www.theguardian.com/business/2025/oct/16/cost-of-taking-over-british-steel-rises

24 https://www.bbc.com/news/articles/c4g35rzlgjvo

25 https://www.bbc.com/news/articles/c4gqe91kp57o

26 https://eurometal.net/uks-new-defense-industrial-strategy-puts-uk-steel-at-core-of-national-security/

27 https://www.uksteel.org/steel-trade

28 https://www.smmt.co.uk/vehicle-production-dips-amid-ev-transformation-and-intense-market-pressure/

29 https://www.smmt.co.uk/vehicle-production-slips-back-in-august/

30 https://www.bbc.com/news/articles/cy9pdld4y81o

31 https://www.gov.uk/government/statistics/company-insolvencies-october-2025