Tuesday 14 October 2025

- Thought Leadership

UK Retail Sector Report : October 2025

Summary

- The UK retail sector is still not performing well: although retail sales have increased modestly during the summer months (in volume terms), they still stand more than 2%

below pre-Covid readings.

- Inflation has crept up over the past quarters, coming in close to 4% in August; this undermines households’ purchasing power and weighs on already subdued consumer

confidence.

- The sectoral outlook remains clouded by lacklustre macroeconomic growth, precarious government finances (which could make the sector a target for further tax increases) and persistently high household savings rates.

- Labour costs have risen substantially, also caused by a higher minimum wage and increased national insurance contributions (which hit UK retail particularly

hard)

- The number of business failures in UK retail has fallen by more than 13% in 2024 with January to July 2025 showing another drop but tight refinancing conditions weigh on

the insolvency outlook.

- Long-term trends such as AI implementation and further automation as well as a change in consumer habits create opportunities for the sector but upfront investment is required to make use of them.

To view a PDF version, click here

Key Trends in 2025

Retail sales increased marginally throughout the summer months but sales volumes still stand more than 2% below pre-Covid readings. At the same time, the sector continues to shed jobs while wage growth remains substantial, also caused by a higher minimum wage and increased national insurance contributions (which both have a disproportionally large impact on the sector).

Retail Sales Figures

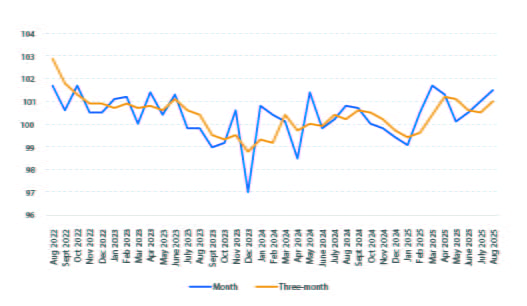

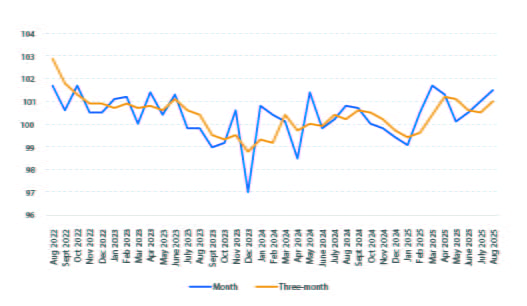

The UK retail sector continues to struggle but as real wage growth has been positive for quite some time, sales volumes have increased marginally over the summer months. According to data from the Office for National Statistics (ONS), retail sales volumes grew by 0.5% month-on-month (m/m) in August, following another 0.5% expansion in July1. Although August marked the third consecutive month of expansion (in m/m terms), sales volumes have not returned to their March 2025 peak yet and they are still 2.1% below the pre-Covid reading from February 2020.

UK Retail Sales Volumes, Seasonally Adjusted (Index 2023: 100)

Source: ONS

Data from the British Retail Consortium (BRC) also shows ongoing problems. Footfall continued to drop in August (-0.4% in year-on-year y/y terms), following a similar contraction in July. While the High Street reported an increase, retail parks (down by 1.1% y/y) suffered in particular2.

In a sectoral comparison, clothing textiles and footwear stores sales (+2.2% in June-August, compared with March-May) outperformed the national average (-0.1%). Department stores saw marginal growth in the three months to August 2025 (+0.1%) according to the ONS but other non-food retailers struggled during the summer, reporting a 3.0% drop in retail volume sales.

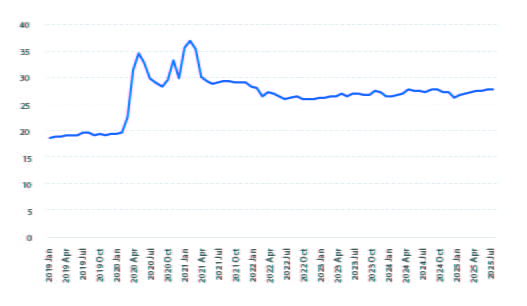

Online Sales

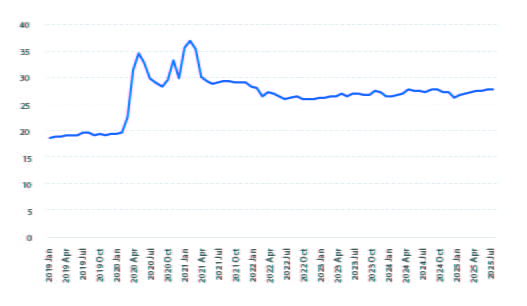

Online sales continue to account for more than a quarter of all UK retail sales. Having increased to levels above 30% during the Covid years in 2020-22, e-commerce had lost some ground to bricks-and-mortar shops again in the immediate aftermath of the pandemic. In August 2025, the share of online retail (in % of total UK retail sales excluding automotive fuel) stood at 27.6%, compared with 27.1% one year earlier3. However, adoption rates vary largely across retail sub-sectors: less than 10% of food shopping was carried out online in August 2025 (9.6%) while at the same time, textile clothing and footwear stores (26.7%) and household goods stores (26.3%) saw a much higher share of e-commerce transactions.

Online Retail Sales UK (Seasonally Adjusted, in % of Total Retailing)

Source: ONS

More detailed data from the ONS reveals that three of the four most important retail sub-sectors reported sales growth last year: nonfood stores (+1.2%), non-store retailing (+3.2) and automotive fuel (+3.8%) saw increases while food stores (down by 1.2%) recorded a decline.

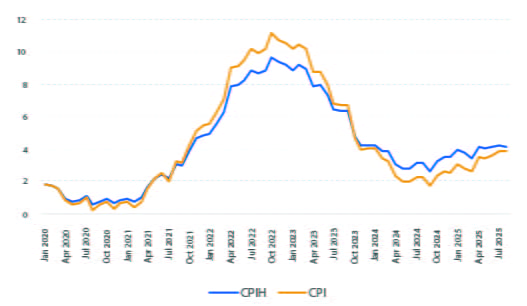

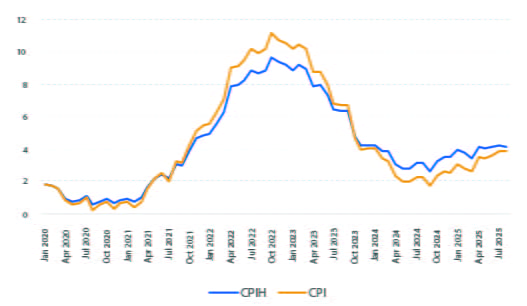

Inflation

Problematically, after having dropped below the Bank of England’s (BoE) inflation target of 2.0% in September 2024 (for the first time in more than three years), consumer prices started to pick up again in late 2024, a trend that still continues at the moment4. Latest available data from the ONS shows that consumer price inflation (CPI) came in at 3.8% in August 2025, the worst reading since early 2024. The CPIH (which includes owner occupiers’ housing costs) reached an even higher 4.1%.

UK Inflation (y/y change in %)

Source: ONS

A more detailed breakdown of the most recent ONS data shows that inflation continues to be service sector driven, albeit to a smaller degree than in previous quarters. Service sector inflation came in at 4.9% in August (down from 5.2% in July and the lowest since mid-2022) while at the same time goods inflation stood at 2.8%, the highest reading since October 2023.

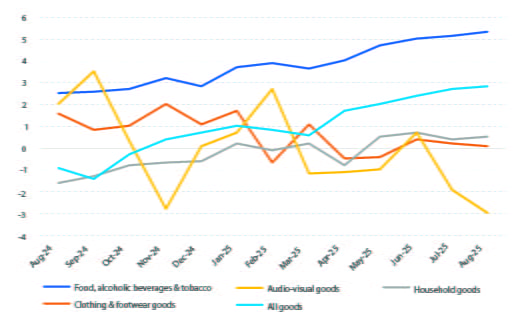

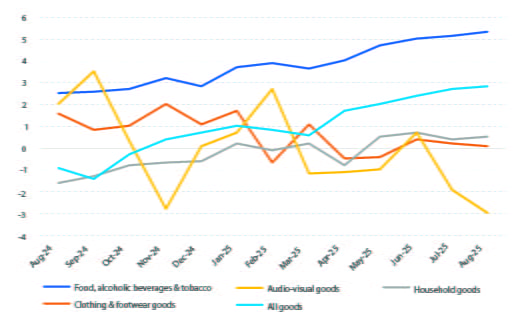

CPIH Detailed Changes (y/y, in %)

Source:ONS

Within the goods sector, food, alcoholic beverages and tobacco still continues to see above-average price increases. Latest available data shows a 5.3% y/y increase in August 2025, more than twice the reading seen twelve months earlier (2.5%). Meanwhile, household goods (0.5% inflation in August 2025) clothing and footwear goods (0.1%) and audio-visual goods (-3.0%) still report little to no inflationary pressures5.

Positively, the BoE expects UK inflation to peak in Q4 2025 before gradually falling again. However, the 2.0% target will not be met before mid-2027, according to the Bank’s latest Monetary Policy Report from August6. As a consequence of the somewhat persistent price pressures (created by minimum wage increases, higher national insurance contributions and changes to regulated water and energy prices), the Bank’s room to manoeuvre remains limited. After having been cut from 5.25% (the highest reading since 2007) in mid-2024 to now 4.00%, markets no longer expect further changes to the BoE’s key policy rate in the final quarter of 2025. For 2026, one additional 25 basis points cut is priced in by market observers but given the stickiness of inflation, this is by no means certain7.

Labour Market

The retail sector remains an important factor for the British economy. In 2024, it employed around 2.87m workers (10% of all jobs in the UK), turned over GBP429bn and created around 9% of gross value added in the UK8. Although 2024-employment stood slightly above the 1977-2023 average of 2.77m, the sector has lost a sizable number of workers last year. Around 170,000 retail sector jobs were shed in 2024, 42% more than in 2023 and the highest reading since 2020 (when Covid caused 200,000 layoffs)9. Problematically, the “retail, wholesale trade and repair of motor vehicles” sector (all grouped together by the ONS with retail being the dominant factor) continued to lose workers in the first half of 2025: between December 2024 and June 2025, employment in the sector dropped by around 200,000

employees10.

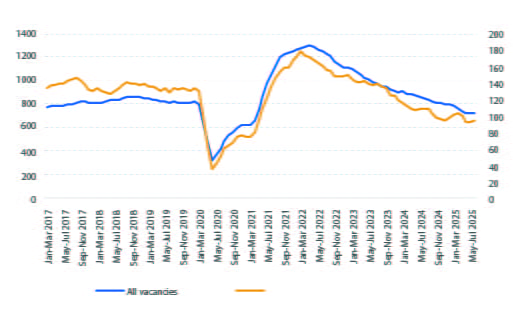

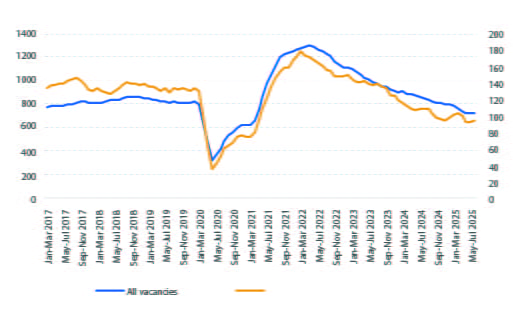

The general slowdown of the sectoral labour market is also visible in the number of open positions11. ONS data for June to August 2025 shows that the number of job vacancies in the wholesale and retail sector had dropped to 94,000, down from a peak of 169,000 in January-March 2022 and the lowest reading since 2011. The vacancy ratio (measuring the number of open positions per 100 employee jobs) in the sector has also come down: from 3.8 in early 2022 to now 2.1, slightly below the national average of 2.3.

Job Vacancies in the UK (in thousands)

Source: ONS

Problematically for the sector’s profitability, labour costs have risen quickly in 2024 and in 2025 year-to-date, despite the general labour market slowdown. Between August 2024 and July 2025, weekly earnings growth (including bonuses and arrears) in the sector averaged 7.3% y/y. This was the third highest expansion rate across the 24 sectors surveyed by the ONS12.

UK Average Weekly Earnings Growth in August 2024- July 2025 (y/y change in %)

Source: ONS

Worryingly, the recent changes to minimum wage and national insurance contributions have also added extra costs to retailers’ wage bills. Research from the Institute for Fiscal Studies (IFS) shows that the retail and wholesale sector will face the second highest cost increase amongst all sector because of the changes (after the hospitality sector). As UK retail employs a high share of people younger than 20 years (around 25% of the sectoral workforce falls under this bracket) and part-time workers, the minimal wage and insurance contribution reforms will lead to a disproportionally sharp cost increase13.

While costs for a worker on the UK median salary will grow by around 4% because of the reforms, labour costs for minimum wage workers older than 21 years will rise by between 7% (fulltimers) and 10% (part-timers). Minimum wage workers that are 16-17 years old will experience the biggest change: according to the IFS analysis, employment costs will rise by around 14%, thereby likely reducing demand for entry level staff and temporary workers, especially during the Golden Quarter (the October to December period which includes Black Friday, Cyber Monday and the Christmas shopping period).

2026 Outlook

Problematically, the factors that weighed on sectoral performance in 2024-25 are unlikely to disappear in the near-term future. The macroeconomic outlook is lacklustre, at best, while at the same time, consumer confidence remains muted and household savings rates are high, thereby reducing shopping budgets. As government finances are in a precarious state, the sector might be targeted by additional tax increases in 2026. Long-term trends (such as ESG and AI implementation) will require sizable investment but also offer business opportunities in the long-run.

Macroeconomics

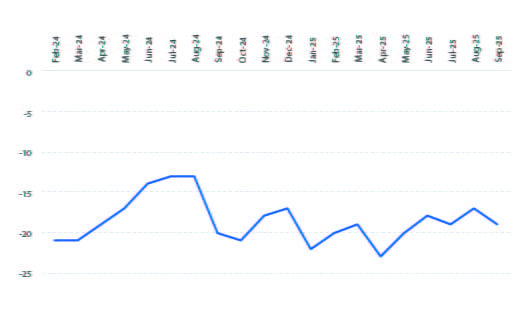

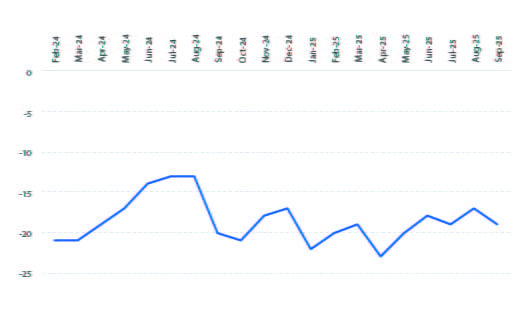

The country’s real GDP growth outlook remains clouded by domestic and external factors. On the domestic front, business investment continues to underperform (a long-term trend) while household consumption is suffering from low consumer confidence. NIQ GfK’s (a consumer intelligence company) Consumer Confidence Index has been moving sidewards for several months now, staying between -17 and -23 points in the twelve months to September 202514. Unfortunately, consumer confidence dipped in September (from -17 to -19 points), despite the BoE interest rate cut in August. All sub-indices (including the major purchase and the personal finances expectation indices) moved lower, indicating widespread pessimism amongst UK households.

UK Consumer Confidence Index

Source: GfK

Also problematically for UK retailers (and despite real wage growth still being positive), ASDA’s Income Tracker showed a fall in middle-income households’ disposable budgets in August 2025, the first reduction in two years15. September recorded another decrease, pointing towards more challenging operating conditions in the sector going into the Golden Quarter16. Coinciding with the relatively gloomy expectations, the households’ savings ratio in the UK is elevated at the moment. According to ONS data, consumers are currently putting more than 10% of their income aside, roughly twice the rate seen in 2017-2019 (the 2020-2022 period is distorted by Covid)17. As households’ precautionary savings are likely to remain high, the retail sector will face ongoing consumption constraints throughout 2026.

On the external front, the ongoing international trade frictions continue to create headwinds for the British economy. Although the UK has signed a comparatively favourable trade agreement with the US in May 2025, the country will still face a 10% blanket tariff when exporting across the Atlantic. For certain product groups such as aluminium, steel and (potentially) pharmaceuticals, tariffs will be even higher though. As a result, in its latest country review in August, the IMF stated that trade tensions will lower UK growth by 0.3% by 202618.

UK Households’ Savings Ratio (in % of income)

Source: ONS

As a consequence of the adverse external and domestic developments, real GDP growth forecasts remain disappointing. For 2026, the IMF expects the British economy to expand by 1.4%, up from 1.2% in 2025. Although higher than in the neighbouring euro zone (0.9% in 2025 and 1.2% next year), the rate of expansion remains lacklustre. Companies should hence not count on sizable support coming from the general macroeconomic picture.

Politics and Supply Chain Risk

Political risk had fallen in 2024 when the victory of the Labour Party ended 14 years of sometimes erratic Conservative rule. Elected with a comfortable parliamentary majority, the new administration embarked on a difficult journey to reduce the sizable fiscal deficit. Unfortunately for the retail sector, the government’s 2024 Autumn Budget included several measures that have created additional costs and thereby reduce profitability.

Firstly, the increase in national insurance contributions (from 13.8% to 15.0% plus a lower threshold) and a higher minimum wage (from GBP11.44 per hour to GBP12.21 in April 2025) has led to higher wage costs at a time when salaries had already risen substantially. According to the British Retail Consortium, these measures will cost the sector GBP5bn alone.

Secondly, the higher plastic packaging tax (coming into force in October 2025) is expected to cost retailers an additional GBP2bn. Thirdly, business rate relief (introduced during the pandemic) will continue to be phased out, albeit by a slower pace than initially communicated. From April 2025 on, relief has dropped to 40% (down from 75%) before being abolished completely in April 2026, one year later than previously announced.

Furthermore, larger retail stores would also suffer from a currently proposed introduction of a higher business rate tax band, applying to shops with a rateable value of over GBP500,000. According to the BRC, around 10% of these shops (400 out of 4000) would be at risk of closure with an additional 1,000 venues having already shut down over the past five years19. Lastly, the government is in the process of drafting legislation that will improve workers’ rights. Proposals include changes to statutory sick pay, reforming redundancy procedures as well as banning so called “zero-hours” contracts. According to the government’s own analysis, the full implementation of the Employment Rights Bill would cost British business around GBP5bn per year with the retail sector (with its high share of small shops and zero-hours contracts) being hit in particular20.

Worryingly, further tax increases over the parliamentary term cannot be ruled out, given the precarious state of government finances. Yields on a 10-year government bond stood at a 17-year high in August 2025 and the overall government debt level is at a very high 100% of GDP22. Government borrowing in the first five months of the 2025/26 fiscal year already stands at GBP83.3bn, more than GBP10bn above the Office for Budget Responsibility’s projections23. As the government might have to plug a GBP20bn funding hole in its finances later this year, the Chancellor of the Exchequer might have to rely on higher taxes to fund the shortfall. VAT increases and changes to income taxes have been ruled out so the government might once more look at the corporate sector as a source of additional revenue in the upcoming Autumn Budget.

While political risk remains elevated, supply chain developments have been favourable over the past 12 months. The World Container Index, produced by maritime research and consulting firm Drewry has fallen from USD3,489 on 3 October 2024 to USD1,669 on 2 October 2025, the lowest reading since January 202424. At the same time, the US Federal Reserve’s Global Supply Chain Pressure Index has been moving lower for the past four months and now stands below its long-term average25. That said, cyber-attacks on retailers’ digital infrastructure continue to be a source of concern. For example, a ransomware attack on department store Marks & Spencer in April 2025 led to customer data being compromised, increased delivery times and also forced the company to take its “Click and Collect” offering offline. It took Marks & Spencer months to resolve the issues completely with expected costs of around GBP300m26.

Credit Risk

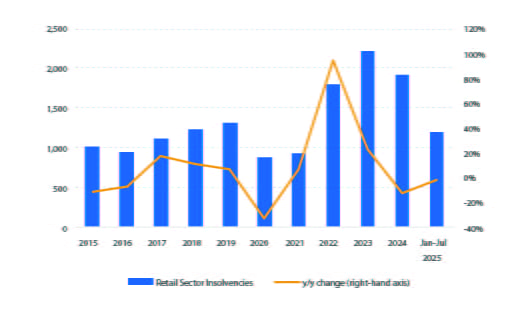

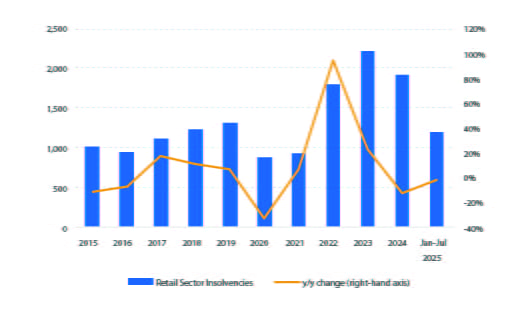

Encouragingly, insolvency risk in the UK has moderated in 2024, following three years of sizable increases. On the back of base effects, subdued economic growth, high inflation and tight monetary policy, bankruptcies in the UK had risen in 2021-23, reaching a 30-year high in 2023 when around 25,000 companies in England and Wales had to file for insolvency. The retail sector followed the national trend, recording 2,219 bankruptcies in 2023, up from 1,307 before Covid.

Encouragingly, this negative trend reversed in 2024 when the number of company insolvencies in England and Wales dropped by around 5% to 23,877. In the retail sector, the reduction was even more pronounced: 1,921 companies became insolvent, down by more than 13%. Unfortunately, this positive development has lost some momentum in the first seven months of 2025. Latest available data from the UK government’s Insolvency Service shows that the number of company insolvencies in England and Wales more or less stagnated in January-July (down by 0.2% y/y). The retail sector performs somewhat better though, reporting another 1.7% y/y drop27.

Insolvencies in the Retail Sector (England and Wales)

Source: Insolvency Service

Despite the general improvements in insolvency figures seen since early 2024, UK retail is still reporting high profile failures. Notable restructuring examples in 2025 year to date include Hobbycraft and Poundland with beauty chain Bodycare and fashion accessories’ brand Claire’s both going into administration in August and September too28 .According to restructuring specialist Begbies Treynor, financial distress has increased in all 22 sectors covered between Q2 2024 and Q2 2025. All in all, around 50,000 companies in the UK economy are experiencing “critical financial stress”, up by more than 21% y/y. After bars & restaurants (+41.7%) and travel & tourism (up by 39.0%), general retail was the third-worst performer (+17.8%)29 in the Q2 2024 to Q2 2025 period.

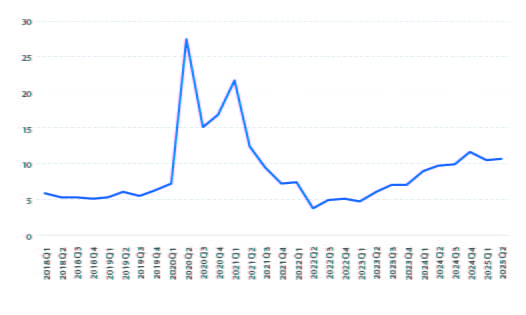

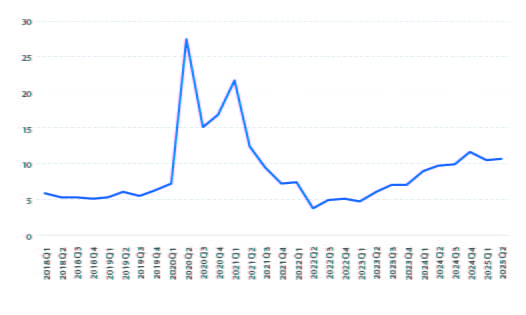

Disturbingly, the 2026-insolvency outlook remains negatively impacted by a mix of factors. Besides disappointing growth forecasts, high political risk levels, recent tax increases and elevated labour costs, refinancing conditions continue to be a source of concern. Latest data from the BoE shows that interest rates have come down over the past quarters but they continue to stand above historic averages. For example, the interest rate a UK-based non-financial corporation has to pay on a new, fixed interest loan stood at 5.7% in August, down from its multi-year peak of 6.9% in April 2024. However, between the global financial crisis in 2008 and the cost-of-living crisis in 2022, rates stood at around 2%-4% for most of that period30 .

Interest Rates (in %) On Fixed-Rate Loans to UK Non-Financial Corporations

Source: Bank of England

Furthermore, bank lending conditions remain comparatively tight and only one more rate cut is expected by market watchers in 2026. Hence companies’ refinancing conditions will likely remain challenging over the next quarters, thereby adding to the elevated level of credit risk in the UK.

Long-term Trends

Looking ahead, the sector will continue to see pressure on its operating models. Much needed investment in artificial intelligence and online presences, including augmented reality will continue to require sizable funding but could also lead to higher revenues because of a more personalised shopping experience. The investment will adversely impact on profits, at least over the short- to medium run. Improved omnichannel experiences (providing a seamless shopping experience across all channels,

from store to mobile and online) will also be key to maintain current and attract new customers.

Energy-efficiency is also becoming an increasingly important topic for consumers as energy costs have not dropped back to pre-crisis levels again. Additionally, supply chain management (e.g. ensuring that no child labour is used at suppliers) and sustainability are likely to feature heavily in the sector’s in-tray over the next years.

Furthermore, UK retail will also be impacted by a change in consumer habits. The second-hand market share continues to grow, also because of online platforms such as Vinted and Depop31. Meanwhile, shoppers, especially younger ones are increasingly eager to spend on experiences such as holidays and entertainment, rather than material goods. Luxury goods (which are also suffering because of a lack of demand from overseas tourists, especially from China) and consumer durables are hence under pressure on several fronts: higher spending on services, increased households’ savings rates and still elevated food and energy costs (compared with pre-Covid years) which all undermine budgets for big ticket items.

[1] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/august2025

[2] https://brc.org.uk/news-and-events/news/corporate-affairs/2025/ungated/government-must-support-high-street-footfall-revival/

[3] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/datasets/retailsalesindexinternetsales

[4] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/august2025

[5] https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceinflation

[6] https://www.bankofengland.co.uk/monetary-policy-report/2025/august-2025

[7] https://www.fidelity.co.uk/markets-insights/markets/uk/when-will-interest-rates-fall/

[8] https://brc.org.uk/market-intelligence/retail-in-numbers/

[9] https://www.theguardian.com/business/2024/dec/29/nearly-170000-uk-retail-staff-lost-their-jobs-this-year-data-shows

[10] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/workforcejobsbyindustryjobs02

[11] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

[12] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

[13] https://ifs.org.uk/articles/combined-impact-minimum-wage-and-tax-increases-may-reduce-opportunities-young-people

[14] https://nielseniq.com/global/en/news-center/2025/uk-consumer-confidence-down-two-points-in-september-to-19/

[15] https://corporate.asda.com/newsroom/2025/26/08/middle-income-households-see-first-income-drop-in-two-years-following-inflation-surge

[16] https://corporate.asda.com/newsroom/2025/23/09/family-budgets-under-pressure-as-living-costs-soar

[17] https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/dgd8/ukea#

[18] https://www.imf.org/en/News/Articles/2025/07/23/pr-25262-united-kingdom-imf-executive-board-concludes-2025-article-iv-consultation

[19] https://brc.org.uk/news-and-events/news/corporate-affairs/2025/ungated/400-of-britain-s-largest-shops-at-risk/

[20] https://www.bbc.com/news/articles/cvgdgx8vze8o

[21] https://www.reuters.com/world/uk/uk-pays-high-price-sell-record-14-billion-pounds-government-debt-2025-09-02/

[22] https://www.bbc.com/news/articles/cly9m4lqznro

[23] https://www.theguardian.com/business/2025/jun/20/uk-borrowing-rises-adding-to-pressure-on-rachel-reeves

[24] https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry?utm_source=chatgpt.com

[25] https://www.newyorkfed.org/research/policy/gscpi#/interactive

[26] https://www.bbc.com/news/articles/c0el31nqnpvo

[27] https://www.gov.uk/government/statistics/company-insolvencies-august-2025

[28] https://www.retailresearch.org/whos-gone-bust-retail.html

[29] https://www.begbies-traynorgroup.com/news/business-health-statistics/critical-financial-distress-increases-across-the-economy

[30] https://www.bankofengland.co.uk/boeapps/database/fromshowcolumns.asp?Travel=NIxSUx&FromSeries=1&ToSeries=50&DAT=RNG&FD=1&FM=Jan&FY=2008&TD=3&TM=Oct&TY=2025&FNY=&CSVF=TT&html.x=155&html.y=27&C=IP6&Filter=N

[301 https://www.businessoffashion.com/news/sustainability/uk-second-hand-shopping-to-top-6-billion-this-year/