Monday 04 December 2023

- Thought Leadership

Trade Credit UK Construction Sector Report H2 2023

By Alice Bremner and Karen Crowley

Summary

-

Following a difficult 2023, operating conditions will continue to be challenging in 2024 with interest rates high, low profitability, reduced demand and elevated credit risk all bringing pressure to bear.

-

Material costs in the construction sector are falling but following high inflation in 2021-22, many businesses are losing money, particularly those who operate on fixed price contracts and have been unable to pass on higher costs to customers.

-

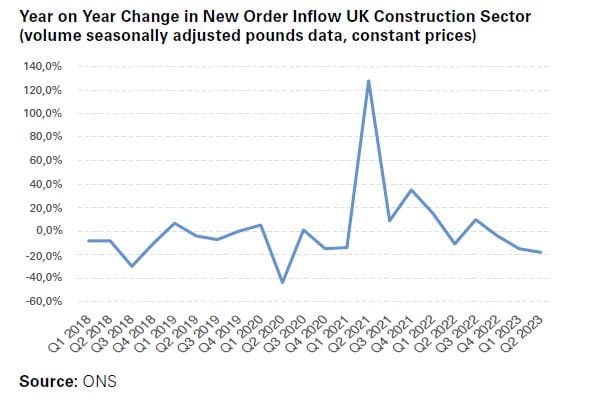

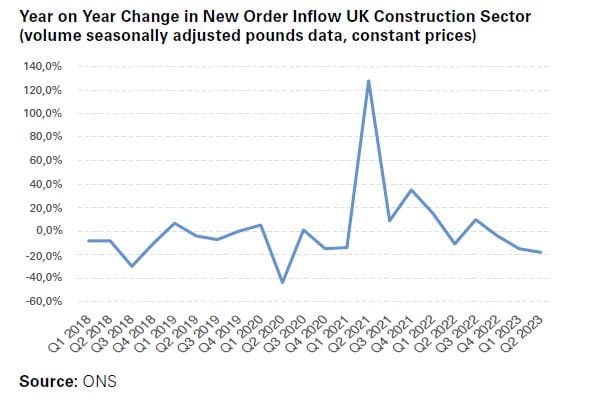

The latest data shows a drop in sectoral output in mid-2023 while new order inflow has been falling since Q4 2022.

-

Confidence indicators also suggest that 2024 will be a challenging year with the Purchasing Managers’ Index in the construction sector deep in contraction territory.

-

Salaries in the sector have risen by 5.7% year on year in the three months to August 2023. While this is below the national average of close to 8%, it is still undermining profit margins.

-

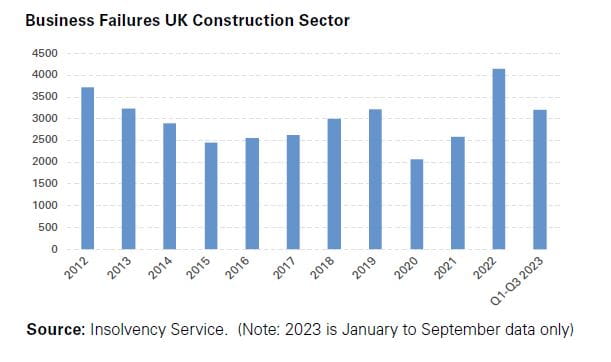

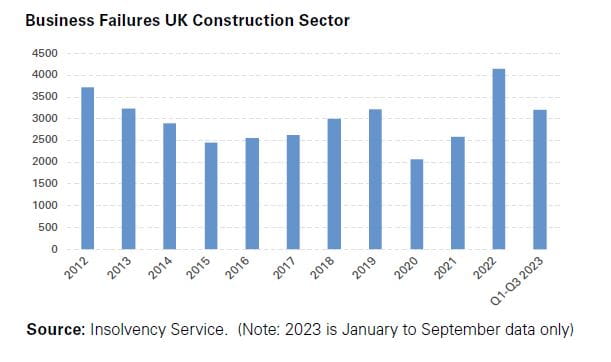

Credit risk in the sector is high: construction accounts for almost a fifth of all corporate insolvencies in the country and figures have risen by an additional 4% year on year in Q1-Q3 2023.

-

Payments performance has largely reverted back to pre-Covid patterns with longer delays being reported. For suppliers, who had adjusted to prompter payments in recent years, this creates pressure on their working capital cycle.

-

Political uncertainty ahead of the next parliamentary elections has created a dampening effect on long-term planning while the cladding crisis continues to weigh on balance sheets.

To view a pdf version, click here.

Key Trends in 2023

Inflation

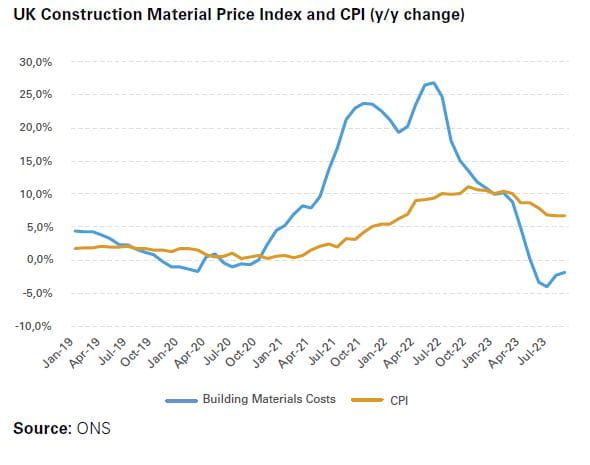

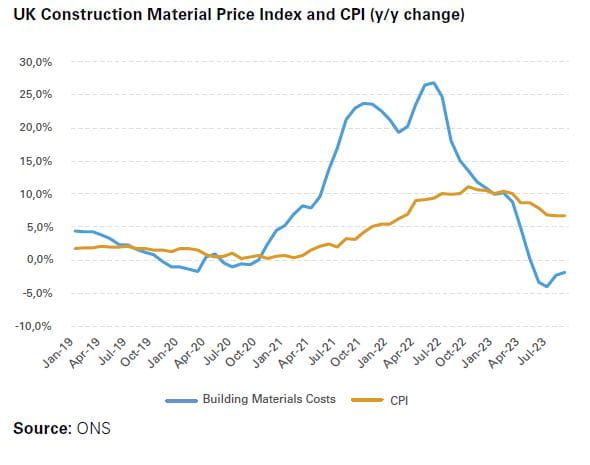

In line with most sectors of the British economy, construction has had a challenging 2023, despite the recent easing in inflation rates. In line with the consumer price index (CPI), price pressures in the sector are easing. In fact, construction outperformed the CPI by some margin, peaking at 11.1% in October 2022 but following a downward trend since then. However, despite the easing of inflationary pressures in Q1-Q3 2023, the CPI still increased by 6.7% in September 2023, more than three times above the Bank of England’s (BoE) 2% inflation target.

The cost of building materials in the UK has entered a deflationary period, according to data from the Office for National Statistics (ONS) Building Materials and Components Statistics . In September 2023, the Construction Material Price Index decreased by 1.8% on last year, the fourth consecutive month of price reductions. This will be welcome news following the steep increases seen previously when the Index increased by more than 10% in a year, peaking at more than 20% by mid-2022.

Output

According to the ONS, production in the construction sector has fallen in recent months with the latest data showing that monthly construction output dropped 0.5% in volume terms, following a downwardly revised 0.4% contraction in July. Five out of the nine sub-sectors covered in the ONS analysis showed a deterioration with private commercial (down 4.1%) and private new housing (minus 1.4%) being the worst performers . While the Monthly Business Survey indicates that some of this downturn was due to poor weather , deeper structural issues (such as a generally poor macroeconomic backdrop and high interest rates) are also at play.

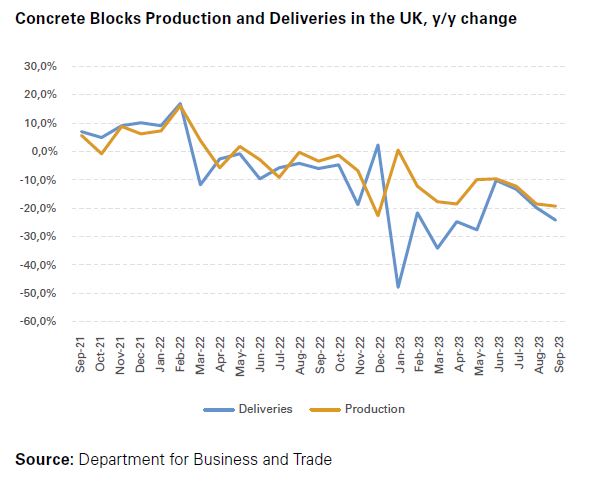

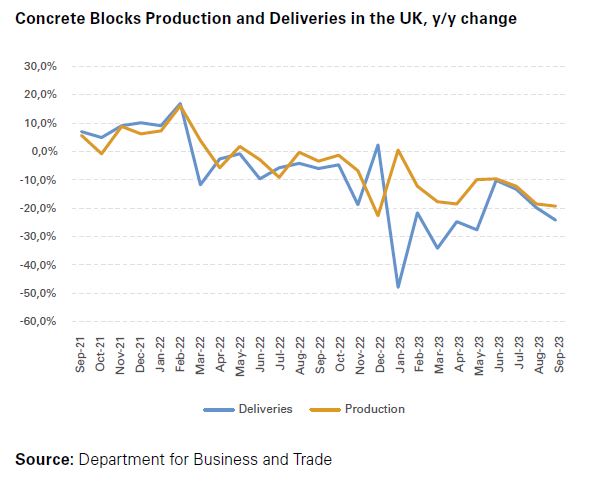

Meanwhile, the production of key input products for the sector is also falling rapidly, mirroring the generally strong headwinds in construction. According to the Building Materials and Components Statistics, in September brick deliveries decreased by a sizable 32.8% compared to last year, on the back of similar drops in previous months . In Q1-Q3 2023, brick deliveries contracted by an average of almost 30% on last year. Concrete block deliveries are also trending downwards with September volumes down 19.5% on the previous year, contributing to an average reduction of 24.8% since January. Equally worryingly, the production of concrete blocks has contracted every month since June 2022 with the exception of January which witnessed a slight increase of (0.5%).

Labour Market

Generally speaking, the UK labour market started to cool down in 2023. The unemployment rate has increased somewhat in recent months, coming in at a still very low 4.2% in the three months to August 2023, up by 0.2 percentage points against the March-May period. At the same time, job vacancies are decreasing with open positions down from a peak of 1.3 million in March-May 2022 to 988,000 in Q3 2023.

The construction sector is not immune to this deteriorating trend. Between February-April 2022 and July-September 2023, the number of open positions in the sector dropped from 49,000 to 35,000, although this is still above the pre-pandemic reading of 26,000. When viewed in terms of vacancies per 100 employee jobs, the sector is below the UK average (3.1 vacancies per 100 jobs); out of the 22 sectors analysed by the ONS, only administrative and support activities (2.0 vacancies per 100 jobs) and real estate activities (1.8) had lower vacancy ratios than construction (2.1).

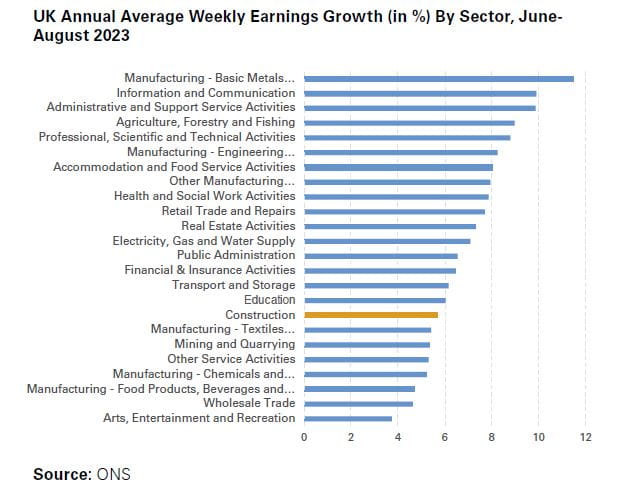

On the salaries front, the labour market slowdown is not yet visible. For the UK as a whole, annual pay grew (excluding bonuses) 7.8% on last year for the June-August period, one of the highest levels recorded since the launch of the data series in 2001 . Once bonuses are included, the figure rises to 8.1% but this is mainly driven by one-off payments made to public sector workers. As inflation remained on a downward trajectory and nominal wages rose quickly, real wages also continued to grow in mid-2023 with total pay rising 1.3% and core pay (excluding bonuses) increasing by 1.1% between June and August.

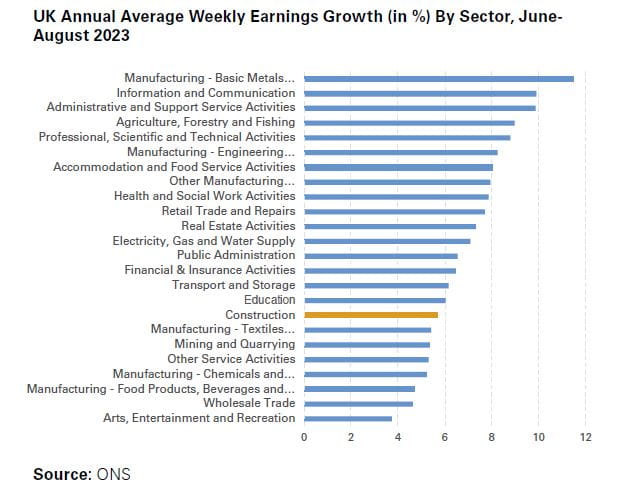

Pay growth in the construction sector lags the national average at 5.7% for the three months to August 2023, meaning workers in the sector are still experiencing a fall in real wages and purchasing power. Out of the 23 sectors covered by the ONS in its analysis, only seven recorded poorer wage growth. That said, despite being relatively benign on a national comparison, the higher wages are increasing construction cost bases for companies and weighing on profits at a time when headwinds are already substantial.

2024 Outlook

The outlook for 2024 is clouded by a familiar combination of factors: poor macroeconomic performance, dented consumer and business confidence, high interest rates and rising credit risk will continue to undermine growth in the UK construction sector. Political developments with elections to take place before January 2025 and longer-term trends (such as the plan to reduce CO2 emissions) will also impact the sector going forward.

Credit Risk

The number of business failures in the sector fell from 3,221 in 2019 to 2,061 in 2020. Since then, insolvencies have been rising steadily, coming in at a high 4,165 in 2022. Traditionally, construction has always been a sector with a large number of bankruptcies due to the generally low profit margins and although comparatively small in size, the sector accounted for almost 19% of all insolvencies in 2022. Unfortunately, the experience of 2023 so far shows further deterioration in line with the broader business environment (the number of business failures in the UK increased by 14% year on year), with the construction sector experiencing a further increase in insolvencies for the first three quarters of 2023. The period saw a 4% increase on the same period in 2022 with the demolition and site preparation sub sector (+39%) and construction of residential and non-residential buildings (+14%) being particularly poor performers. Overall, 3,204 construction companies failed in January-September 2023, up from 3,093 insolvencies in the same period last year.

Anecdotal evidence shows that payment delays in the sector are lengthening again. This is not necessarily a sign of financial distress but likely signals a return to pre-Covid payment patterns when delays were the norm. During the pandemic the sector pulled together, and smaller suppliers and contractors were paid by their customers in a more timely fashion. The return to the pre-Covid world is now creating problems for them as working capital cycles had adapted to on-time payments.

Looking ahead, credit risk is likely to remain elevated next year. The BoE’s monetary tightening cycle is coming to an end but 2024 interest rate cuts, if any, will be very small in size as inflation will be higher for longer. Coupled with a sizeable recession risk (the BoE currently assigns a 50% chance ), high refinancing costs will endanger the financial viability of many construction companies. The latest sectoral survey data from the ONS already highlights the rising risks in the sector: 45% of all survey respondents reported negative revenue growth in January to June 2023 . Equally worrying, ONS data shows a deteriorating pipeline: in Q2 2023, new order inflow dropped by 18% on 2022, in seasonally adjusted constant GBP terms. This is on top of contractions in Q4 2022 and Q1 2023, highlighting that the pent-up demand created during Covid has now disappeared.

Meanwhile, sectoral confidence indicators mirror the poor high frequency data from the ONS. The Construction Sector Purchasing Managers’ Index (PMI), compiled by IHS Markit, ranged deep in contraction territory in October . Coming in at 45.6 points, it was marginally up from September’s 45.0 points but was still the second lowest reading since May 2020. The October reading is also far below the neutral 50-points line that divides sectoral expansion from contraction. Business expectations for the 12 months ahead dropped to the lowest reading recorded so far in 2023 with interest rate-related weaknesses in the house building sector blamed for waning optimism. Furthermore, the latest PMI continues to show increasing capacity in the sector with sub-contractor prices dropping for the first time since mid-2020. This will also have an impact on credit risk as lower prices will increase insolvency risk.

Medium Term Developments

Political developments are creating additional headwinds that are of particular concern to the infrastructure sub-sector, following the cancellation of large parts of the Highspeed 2 railway project . The National Audit Office also reported that the Department for Education were behind in their school rebuild and refurb programme, having awarded just a fraction of the targeted projects earlier this year.

Positively, the sector might benefit from additional public funding after the next parliamentary elections (which will take place in January 2025 latest). As a change in government seems likely, the centre-left Labour Party might allocate more funds for infrastructure investment as well as social housing. However, as increases will have to be financed by tax rises, spending cuts in other areas or increasingly expensive debt, changes are likely to be small.

In addition to the unknown public infrastructure spending plans, the incumbent Government’s recent changes in environmental policy are also creating uncertainty. In October 2023, the Prime Minister postponed the phasing out of internal combustion engine cars by five years and although not a direct impact on the construction sector, it remains to be seen whether the sector’s current timeline for becoming net-zero (currently scheduled for 2050) will remain in unchanged, especially after the next parliamentary election. While watering down climate change targets could reduce operating costs in the short run (the costs of becoming a net zero company are sizable), it could create additional expenditure over the medium to long run.

In addition, the fallout from the Grenfell Tower fire in 2017 continues to weigh on the sector. Following the tragedy which killed more than 70 people, changes implemented by the Housing Secretary resulted in developers having to commit to paying at least £2bn to fix buildings in which they had a role in constructing with a further £3bn payable over the next decade via the Building Safety Levy . This fire safety remediation work is starting to have an adverse impact with very large provisions hitting once strong balance sheets. Many companies in the sector have now lost their ‘back up’ funds putting even more pressure to ensure all new work is profitable. Contractors traditionally hold “hidden reserves” in provisions they do not expect to be needed, to release in difficult years – those seem to have now been largely used up.

A whole host of pressures continue to bear down on the construction sector making trading difficult, a trend we expect to continue throughout 2024. High insolvency rates, dampened consumer confidence, higher input costs and inflation rates swallowing up any potential interest rate cuts, will all contribute to the challenging headwinds in the year ahead. A looming election and potential change in political leadership is also expected to deter longer term UK construction investment until after the next election. We will continue to support our clients by working closely to understand future requirements and review up to date financial information as a core element to our monitoring and support as we navigate the year ahead to a brighter more stable 2025.

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.

Related links

https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7g7/mm23

https://www.gov.uk/government/statistics/building-materials-and-components-statistics-october-2023

https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/bulletins/constructionoutputingreatbritain/august2023

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/august2023#the-construction-sector

https://www.gov.uk/government/statistics/building-materials-and-components-statistics-october-2023

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/october2023

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/october2023

https://www.theguardian.com/business/2023/nov/02/bank-of-england-leaves-interest-rates-unchanged-inflation-slowdown

https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/outputintheconstructionindustry

https://www.pmi.spglobal.com/Public/Home/PressRelease/f3386a51b4b04628a7675e301195ace7

https://www.reuters.com/world/uk/whats-happening-hs2-britains-costly-high-speed-railway-2023-10-04/

https://www.reuters.com/world/uk/british-carmakers-slam-flip-flop-petrol-car-ban-seek-certainty-2023-09-20/

https://www.bbc.com/news/explainers-56015129