Monday 11 August 2025

- Thought Leadership

In the food and drinks sector, data from the Office for National Statistics (ONS) shows even bigger movements: after having reached a 45-year high of 19.2% in March 2023, food price inflation plummeted to 1.3% in August 2024. Problematically, it has remained on a generally upward trend since then, coming in at 4.4% in May 2025, the highest reading since February 2024.

In the catering industry (which comprises of restaurants and canteens), inflation has also come down: after peaking at 12.6% in 2022-23, price pressures moderated, reaching 3.4% in January. Since then, inflation has been rising again, accelerating to 3.8% in May, according to latest ONS figures.

Looking ahead, inflation is forecasted to stay above the Bank of England’s (BoE) 2.0% target over the next quarters. Driven by one-off effects such as changes to government-regulated water and energy prices, CPI should come in around 3.7% in Q3 2025 before gradually moderating again. The average 2026-forecast among economists surveyed by the UK Treasury in June 2025 stands at 2.3% and the BoE expects inflation to be on target again not before early 2027².

Problematically, the outlook for the UK food sector is more clouded. Increases to the minimum wage and higher national insurance contributions came into effect in April 2025, thereby creating upward pressures on labour costs. Food, and in particular hospitality is impacted disproportionately by the recent changes as wages are a high proportion of overall cost. For example, food retailer Morrisons (annual turnover of around GBP4bn) is expecting additional costs of GBP85bn per year while pub chain Wetherspoons (turnover: GBP2bn) counts on additional costs of GBP60bn. The minimum wage increase in April 2025 is also problematic because it had already gone up significantly in previous years: since April 2020, it has increased by 40%.

Positively for the UK food and hospitality sectors, pressures on global commodity prices have been small over the past twelve months. Most products (such as wheat, sugar, soy, corn) have seen stable or even falling prices in y/y comparisons. Even cocoa and coffee (which have both seen steep price increases in 2024 and early 2025) have started to become cheaper again without falling to pre-2024 readings though.

Labour Market

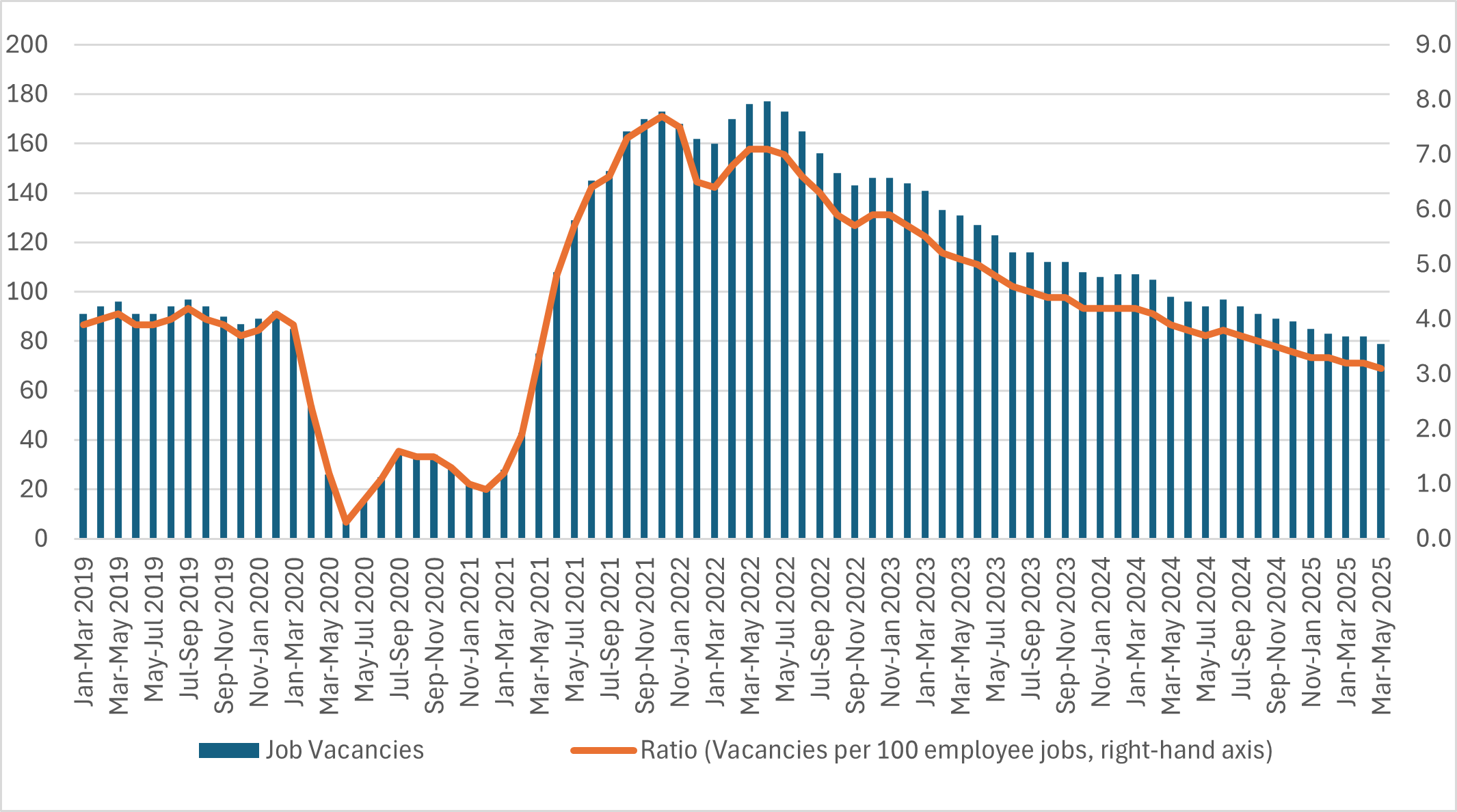

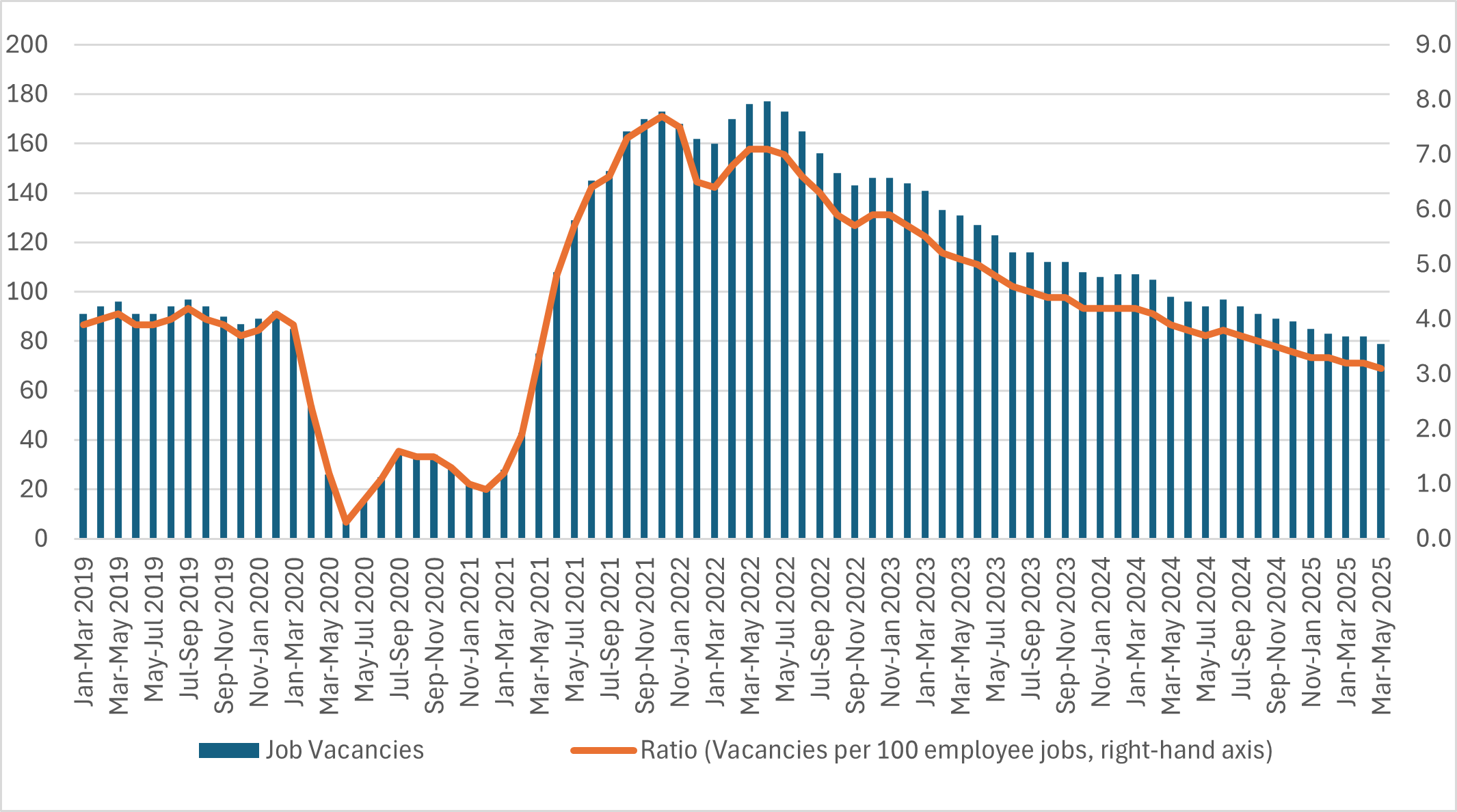

As the UK economy is experiencing a period of low growth, labour market conditions have also deteriorated gradually over the past quarters. This is especially visible in the number of job vacancies: after peaking on a new all-time of 1.3m open positions in March-May 2022 (following the end of Covid-lockdowns), figures have been declining steadily again over the past three years. In March to May 2025, the ONS reported 736k job vacancies in the UK, down from 886k one year earlier and also below the pre-pandemic reading of 881k in Q4 2019³.

Job Vacancies in the UK Accommodation and Food Services Industry (in thousands)

Source: ONS

In the accommodation and food services sector, the number of vacancies has also fallen over the past years. After having peaked at 176,000 in April-June 2022, the number of open positions has more than halved (to 79k) by spring 2025. However, despite the fall in vacancies, the sector is still one of the most impacted ones when it comes to labour shortages. Out of 22 sectors covered by the ONS, only electricity, steam, gas and air conditioning supply had a higher vacancy ratio (measuring the number of open positions per 100 employee jobs): with a reading of 3.1, the sector also displays a much higher ratio than the national average (2.3). Simultaneously, British food and drinks manufacturers also report ongoing labour shortages. According to the State of Industry Report Q1 2025, published by the Food and Drink Federation in May, vacancy rates in food manufacturing are currently roughly twice as high as in other manufacturing industries⁴.

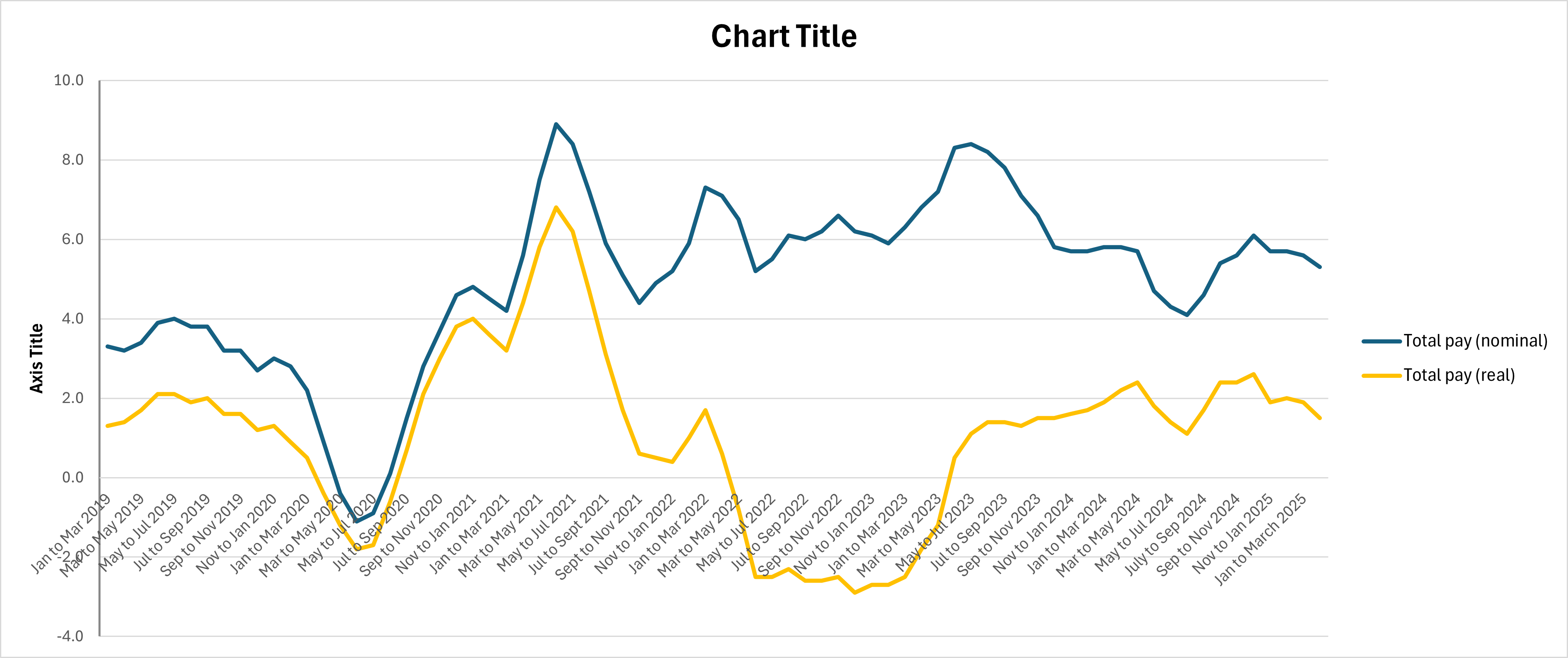

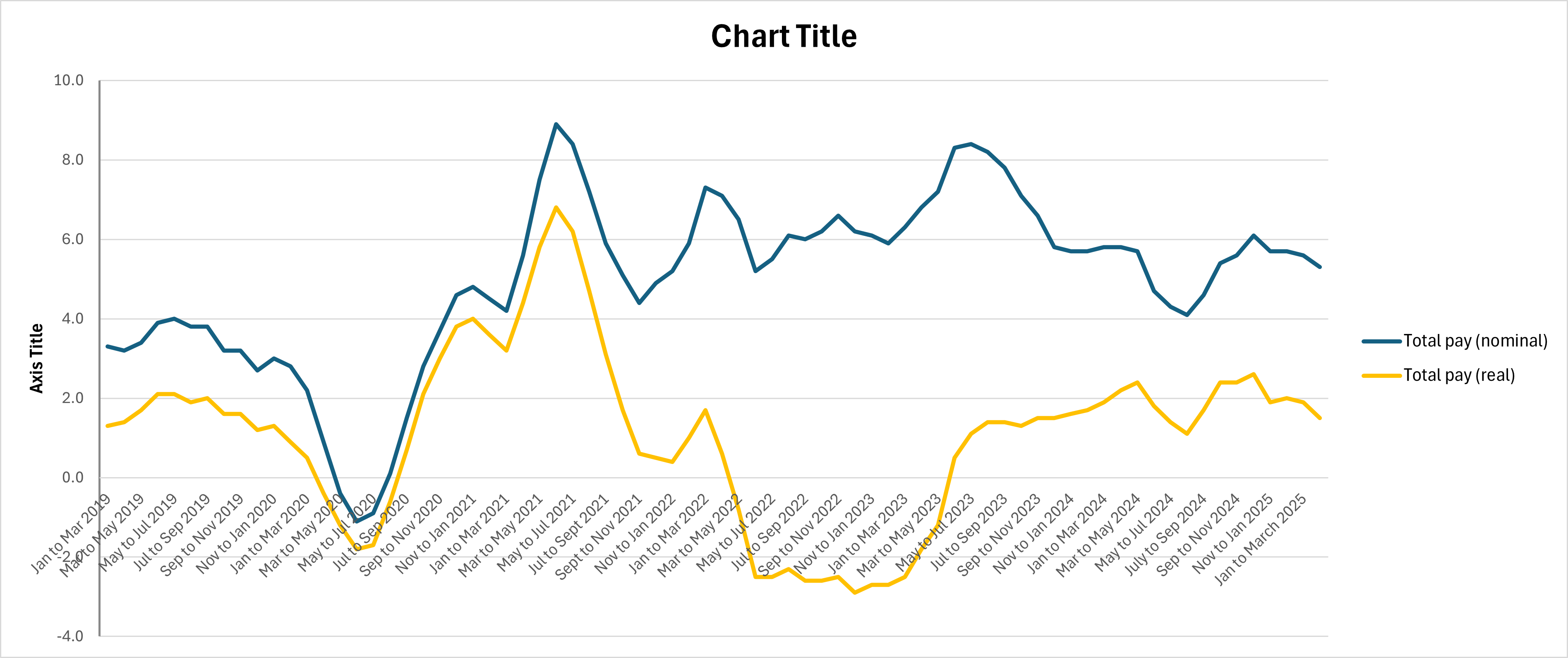

Wage growth figures also point towards a gradually cooling labour market. ONS data shows that average weekly nominal earnings growth for the UK has moderated to 5.3% y/y in the three months to April 2025, the lowest reading since July-September 2024. Real wage growth has also decreased in recent months, declining from 2.6% y/y in Q4 2024 to 1.5% in the three months to April 2025⁵. Looking ahead, the increase in the minimum wage, coming into effect in April 2025 will provide upward pressure on wages again, especially towards the lower end of the market. Wage growth should hence accelerate again in the second half of 2025, despite the generally lacklustre macroeconomic conditions.

Average Weekly Earnings Growth in the UK (y/y change in %)

Source: ONS

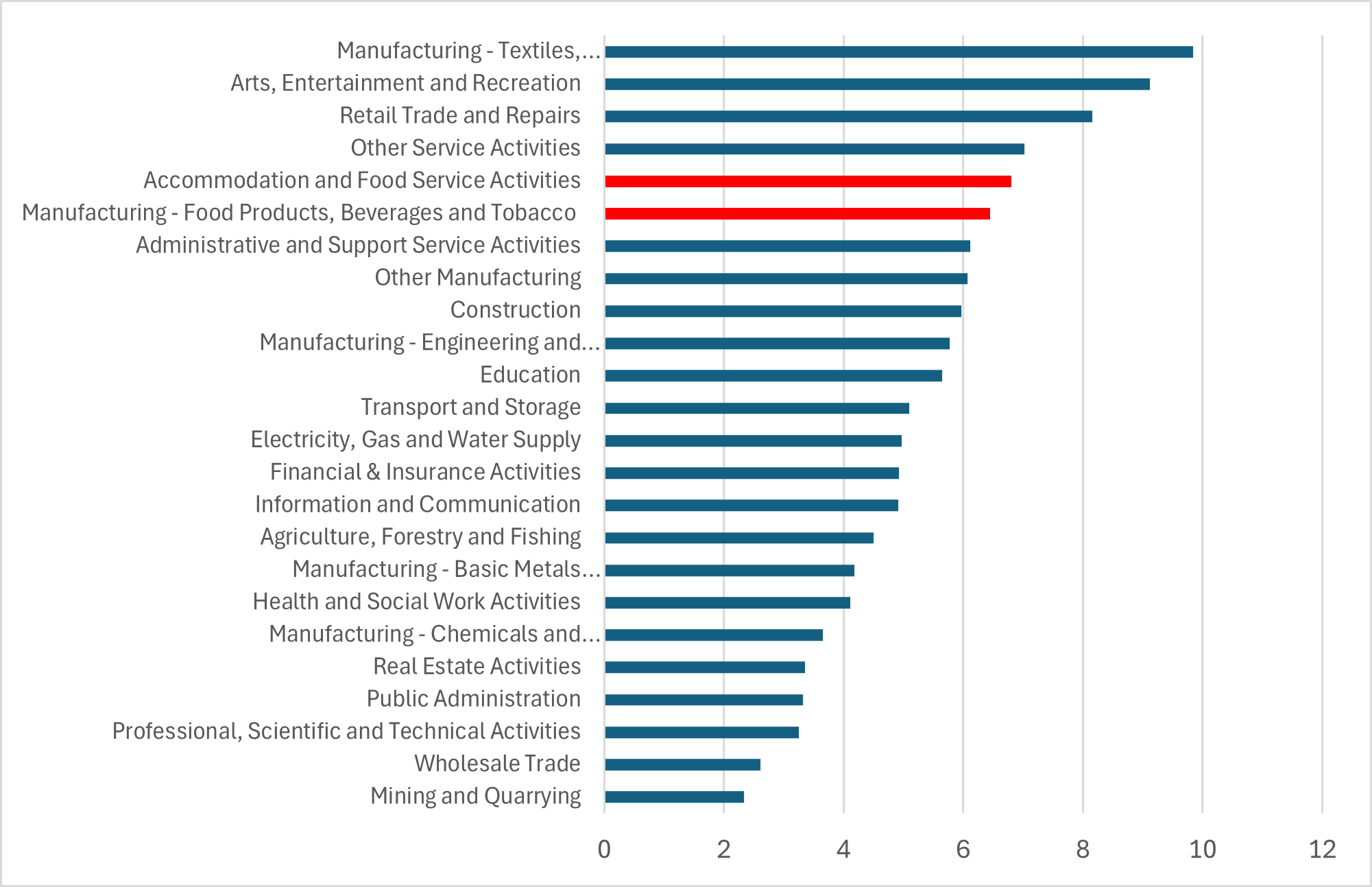

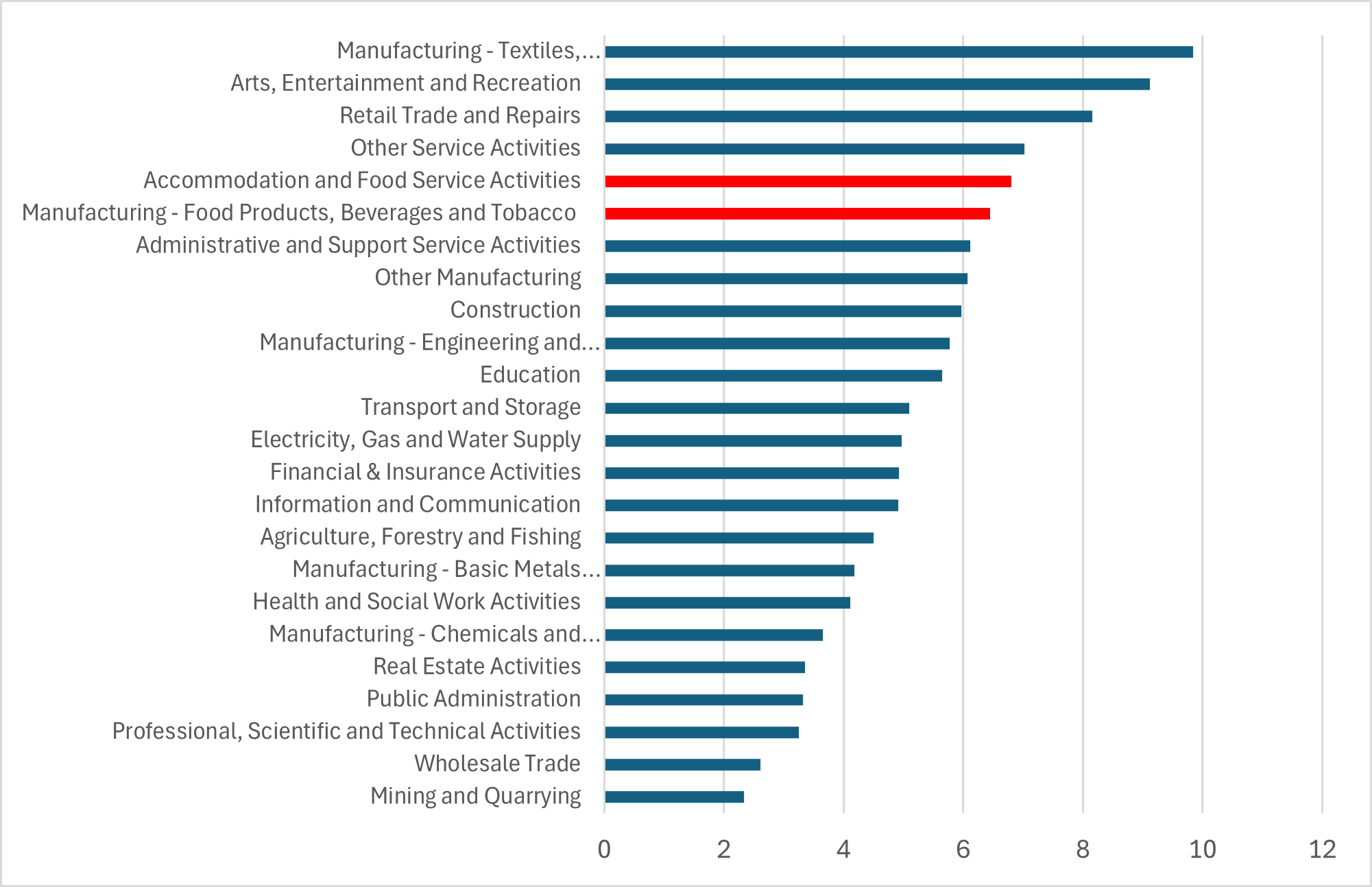

Problematically, the rise of the minimum wage (and its anticipated upward pressure on earnings in the food sector) comes at a time when salaries in the UK food industries had already been rising quickly. In the twelve months to April 2025, only four out of twenty-four sectors covered by the ONS reported higher average weekly earnings growth than the food products manufacturing (up by 6.5% in May 2024 to April 2025) and the accommodation and food service industries (+6.8%).

Average Monthly Median Pay Growth by Sector in May 2024 to April 2025 (y/y change in %)

EU-UK Common Sanitary and Phytosanitary (SPS) Area

Positively, in May 2025, the EU and the UK government have announced plans to create a common SPS area, which would stimulate trade in agri-food products, reduce red tape and support cross-border food supply chains⁶. The UK government has agreed to dynamically align (=adjusting UK rules and regulations to potential EU changes) on sanitary, phytosanitary, food safety and general consumer protection rules applicable to the production, distribution and consumption of agri-food products. The regulation of live animals and pesticides, the rules on organics as well as marketing standards applicable to certain sectors or products is also covered by the new EU-UK agreement, a treaty that was largely welcomed by the UK’s National Farmers’ Union⁷ .

As a result of an SPS agreement, the vast majority of movements of animals, animal products, plants, and plant products between the UK and the EU could be undertaken without SPS certificates and checks. Thereby, some of the frictions caused by Brexit would be minimised with positive repercussions on the amount of required red tape in the UK food sector.

These developments are important as the EU is the UK’s largest market for agri-food trade: in 2024 UK exports in value to the EU represented 68% out of total exports, while EU imports represented almost 71% of all UK imports. Worryingly, since Brexit, UK exports to the EU in volume terms have decreased by more than 37% while imports have marginally increased by around 5%.

2025 Outlook

Business Optimism

Worryingly, the country’s macroeconomic outlook has deteriorated in the first half of the year and the IMF has cut its 2025 real GDP growth forecast from 1.7% to 1.1% in its latest World Economic Outlook, released in April⁸. Positively, an upward revision in the next report seems possible as the prospect of a global trade war has subsided somewhat since April and the UK has also signed a free-trade deal with the US, coming into effect in July. This agreement will shield the British economy against some of the negative repercussions of higher tariffs and trade barriers when trading with the US but it will also increase competition in the domestic agricultural sector (especially in beef and bio ethanol production) as American companies have been granted easier market access⁹.

From a domestic angle, the UK continues to suffer from generally suppressed consumer and business confidence, thereby weighing on household spending and investment. Although disposable income has been rising for several quarters and should continue to do so, given the increased minimum wage, consumer confidence readings remain deeply in negative territory. Recent data from research firm NIQ shows that the UK Consumer Confidence Barometer has improved in May and June 2025 but with a reading of -18 points, it is still down in y/y terms¹⁰. The improvement in recent months was mainly driven by the “economic situation over the next twelve months” sub index (from -37 points in April to -28 in June) but generally, UK households remain fairly downbeat about the macroeconomic outlook.

UK Consumer Confidence Indicator

Source: NIQ/GfK

As a consequence, households have also reduced discretionary spending and pre-cautionary savings remain high, thereby also negatively impacting on the food sector, hospitality in particular. Data from the ONS shows that the household savings rate stood at 10.9% of disposable income in Q1 2025. Although this is down from 12.0% in late 2024, it compares unfavourably against pre-Covid readings when UK households put around 5%-6% of their disposable income aside¹¹. Given the very volatile economic backdrop, the gradually deteriorating labour market and high levels of geopolitical risks, it seems likely that British households will continue with their cautious spending approach in the second half of the year.

Meanwhile, business confidence in the UK food (and drinks) sector is also low. The State of Industry Report Q1 2025, produced by the Food and Drink Federation (FDF) shows that its Net Confidence Score has dropped quickly in recent quarters: After reaching a multi-year high of +20 (on a -100 to +100 scale) in early 2024, the score fell to -47 in Q4 2024 before recovering marginally, coming in at minus 43 points in Q1 2025¹². Problematically, production costs in the British food and drinks industry have increased by 4.5% y/y in the twelve months to March 2025 while at the same time, selling prices rose by 2.7% y/y only. For the April 2025 to March 2026 period, food producers expect selling prices to increase by 2.8% while production costs will rise by a much higher 4.8%, according to survey data from the State of Industry Report Q1 2025. While the higher minimum wage and increased national insurance contributions will cost a typical food producer around GBP870 per employee per year, the new packaging levy will cost the sector around GBP1.1bn a year, according to the FDF

FDF Net Confidence Score (Range: -100 to +100)

Source: Food and Drink Federation

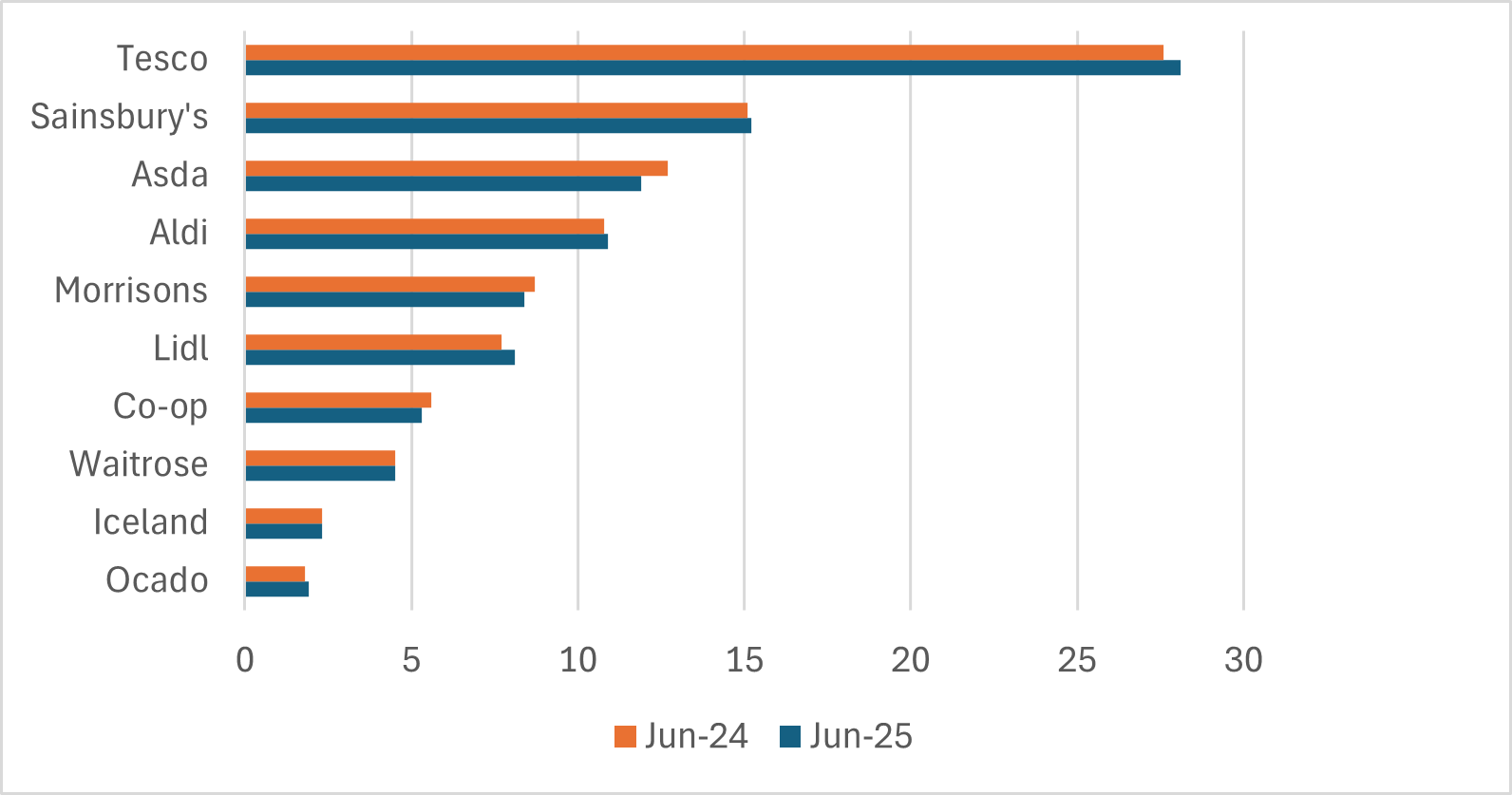

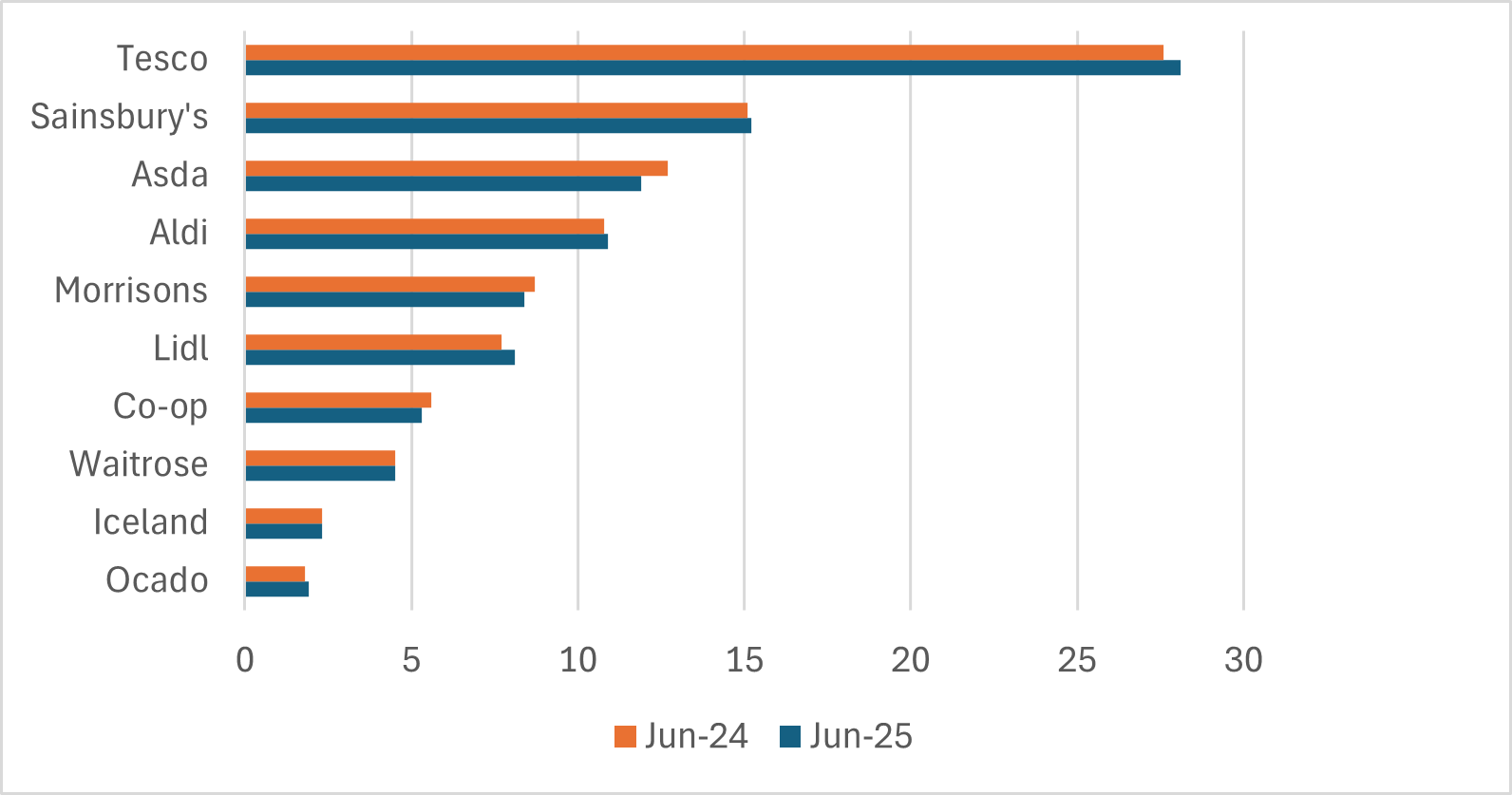

Grocery Market Share

Latest data from research company Kantar highlights that take home grocery sales increased by 5.0% in the twelve weeks to 15 June¹³. Footfall data for the four weeks to 15 June shows that UK shoppers made 490m trips to supermarkets, the highest share since March 2020 (when Covid restrictions led to stockpiling). Much of the increased spending occurs in supermarkets’ own label ranges (+4.2%) as shoppers are trying to balance their budgets. In volume terms, supermarket sales fell by 0.4% in June, indicating that much of the sales growth in 2025 to date is caused by food price inflation and not by rising volumes.

UK Grocery Market Share (in %), Twelve Weeks Ending

Source: Kantar

In terms of market share, Tesco is not only defending its leading position but even pulling ahead. Between June 2024 and June 2025, its market share increased from 27.6% to now 28.1%¹⁴. Sainsbury’s, ranked second, saw much smaller growth (up by 0.1 percentage points, pp to now 15.2%) with German-owned discounters Aldi (+0.1pp to 10.9%) and Lidl (+0.4pp to 8.1%) also gaining market share over the past twelve months. Morrisons (down by 0.3pp to 8.4%) and Asda (minus 0.8pp to 11.9%) continued to see a slump.

Looking ahead, Asda “Rollback Prices” strategy, launched in January 2025 led to a drop in Tesco’s, Sainsbury’s and M&S’ share prices but its commercial success seems to have been limited so far¹⁵. That said, the prospect of a price war in UK food retail will lead to lower profits for the two market leaders. Sainsbury’s expects profits to remain stagnant at around GBP1bn this year, despite cost cutting exercises such as warehouse closures and increased automation¹⁷. Tesco forecasts gross operating profits of between GBP2.7bn to GBP3.0bn this financial year (which ends in February 2026), down from GBP3.1bn in 2024/25, citing increased competition as the main driver for the deterioration.

Credit Risk

Positively, after reaching a 30-year high in 2023, the number of business failures in England and Wales fell last year. The government’s Insolvency Service registered 23,879 company insolvencies in 2024, down by around 5% against prior year. Most food-related sub-sectors followed this positive trend: manufacture of drinks saw a 11% drop in bankruptcies last year, manufacture of food products a 18% reduction with retail sale of food and beverages also reporting a 22% decline in business failures. Food and beverage service activities (which includes pubs and restaurants) also saw a 6% drop in company insolvencies in 2024 but the overall figure is still fairly elevated. The sector accounted for 3,257 bankruptcies, the third riskiest sector after construction (4,038 business failures) and wholesale & retail trade (3,575 insolvencies in 2024)¹⁸. Positively, data from business information provider Dun & Bradstreet shows that 63% of all invoices in the British food and drinks services industry were paid on time in Q4 2024, up from 61% in late 2023 and above the UK average of 59%¹⁹.

Sadly, the positive 2024-trend has come to a halt in the first four months of 2025. Data from the Insolvency Service for January to April shows that the total number of business failures in England and Wales has been stagnating with some food sub-sectors reporting increases again. Crop and animal production has seen another 25% y/y increase, after four consecutive years of rising business failures. Manufacture of food (+53% y/y in Jan-Apr 2025) and retail sale of food beverages (up by 6%) are also on a deteriorating trend again while, somewhat counterintuitively, insolvencies in food and beverage service activities continue to fall (-11%).

Year on Year Change (in %) In The Number Of Company Insolvencies In England & Wales

Source: Insolvency Service

Unfortunately, the credit risk outlook for the British food sector is clouded by several developments. Higher labour costs will negatively impact on already stretched balance sheets. According to the Night Time Industries Association, operating costs of clubs and bars have risen by 30%-40% since the pandemic and research from accounting firm Price Bailey shows that around 21% of all pubs in the UK had negative net assets in 2024 . The number of pub insolvencies in April 2025 was already the highest in twelve months and with the national living wage having increased from GBP8.72 per hour in April 2020 to GBP12.21 in April 2025 (plus higher national insurance contributions and higher business rates), insolvency risk in the hospitality sector is likely to increase over the next quarters as the effects of the recent changes will filter through.

Also problematically, energy costs remain above pre-Ukraine war levels, macroeconomic conditions are challenging, interest rates, albeit on a downward trend continue to stand above medium-term averages and changing consumer habits are also impacting adversely on insolvency risk in the UK food sector. Hence the number of corporate failures in the UK food sector should remain on an upward trend in the second half of the year, thereby increasing the risk of non-payment.

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.

Related links

1

2

3

4

5

5

6

6

7

8

9

10

11

12

13

14