Tuesday 06 May 2025

- Thought Leadership

UK Construction Sector Report; April 2025.

Summary

- The tentative recovery in UK construction has largely come to a halt and most high frequency indicators now point towards a disappointing 2025.

- Repair & maintenance has been on a steeply deteriorating trend for several quarters and overall construction sector output has been falling in December 2024 and January 2025.

- Construction material price inflation has turned negative (-0.9% in January 2025) but wage pressures are sizable and labour shortages remain an issue for the sector.

- The UK Construction Sector Purchasing Managers’ Index has deteriorated quickly: from 57.2 points in September to 46.4 in March, new order inflow was negative in Q3 and Q4 2024.

- Interest rates will continue to fall, albeit by a smaller pace than previously expected.

- Credit risk in the sector will remain elevated, a consequence of low profit margins, fixed-price contracts, high geopolitical risk, disappointing macroeconomic conditions and poor payments performance.

- Regulatory changes such as Gateway 2 requirements, higher national insurance contributions and a minimum wage increase are also adversely impacting on the sector.

To view a pdf version, click here.

Inflation

Positively, inflationary pressures in the sector have come

down over the past quarters, thereby providing support for UK

construction companies (which predominantly operate on fixed-

price contracts). According to data from the Office for National

Statistics (ONS), construction material prices have moved lower

since mid-2022, in line with general consumer price index

developments1 In June 2022, the “all work” construction price

index had increased by 26.4% year on year (y/y), the highest

growth rate in 40 years. The “repair and maintenance” (24.7%)

and the “new housing” sub-indices (24.0%) also saw immense

increases with “other new work” inflation coming in at an even

higher 30.5% y/y in June 2022.

Since then, construction material price inflation has quickly

dropped back to more sustainable levels. Since March 2023,

it has been in the single-digit range again before falling into

deflation territory in June 2023. Latest available data for January

2025 shows that the “all work” sub-index was still decreasing

by 0.9% y/y while “repair and maintenance” as well as “new

housing” reported 1.0% increases. While material price inflation

has moderated in recent years, construction companies’ operating

costs are still under pressure because of rising wages (see Labour

Market chapter below).

Meanwhile, output price inflation (prices charged by construction companies) has also eased over the past quarters2. ONS data shows that output price inflation in the sector peaked in mid-2022: in June, inflation for new construction work stood at a very high 12.1%. Repair and maintenance inflation came in at 7.9% y/y, leading to average construction sector output inflation of 10.7%.

Output price inflation in the British construction sector has dropped to 1.4% y/y in March 2024, the lowest reading since late 2020. In the second half of 2024, prices charged by UK construction companies moved higher again (reaching 3.0% y/y in December). Positively, this is supporting profit margins following several years of material price inflation severely outstripping output price inflation.

Output

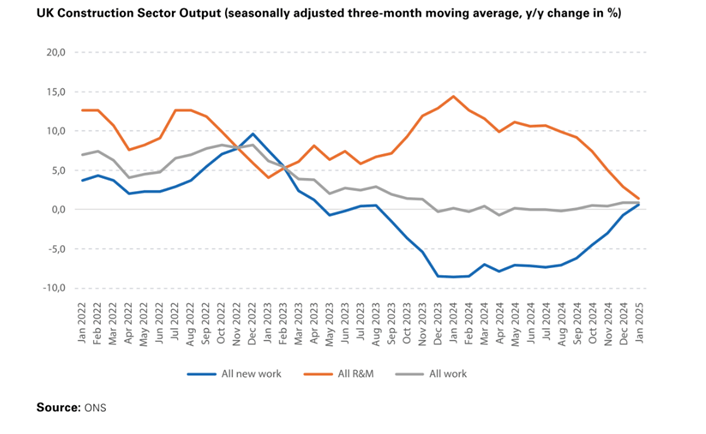

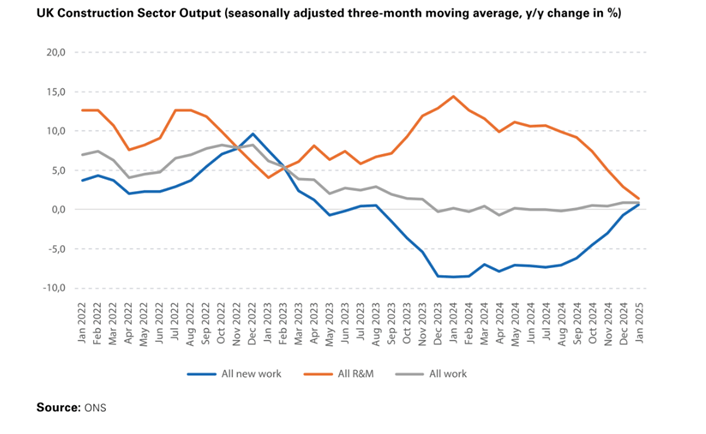

UK construction did not finish 2024 on a high and ONS sectoral output data for January 2025 highlights ongoing headwinds3. Following a 0.2% month on month (m/m) drop in December, construction sector output contracted by an additional 0.2% in January, attributed to heavy rain and storms. Meanwhile, the three months moving average (which is more resilient to outliers) shows a more positive trend. In a y/y comparison, the three months to January 2025 have seen construction sector output growth of 0.9%, unchanged from the previous month and the best reading since November 2023. That said, the value still compares unfavourably against the long-term average: in 2015-19 (Covid distorts the comparison), output growth came in at an average 3.3% y/y each month.

Drilling down deeper, it becomes evident that the recent y/y

output expansion is still driven by repairs and maintenance

(R&M). Over the past twelve months (February 2024 to January

2025), R&M growth averaged 9.0% y/y each month while new

work contracted by -5.5% y/y. That said, R&M activity has been

moderating for several quarters now with output growth falling

from 14.4% y/y in January 2024 to 1.4% only one year later.

Meanwhile, new work output moved higher: from -8.6% in early

2024 to 0.6% (in growth territory for the first time since August

2023) in January 2025.

Generally, construction remains a mixed bag: while private new

housing (a key component of the sector) has been growing

by 4.0% y/y in the three months to January 2025 (the best

performance in two years), infrastructure (-3.9%) and public

new housing (-16.6%) continue to contract. Private industrial

new work has been growing for four straight months now but

private commercial new work continues to fall (for the thirteenth

consecutive month).

Labour Market

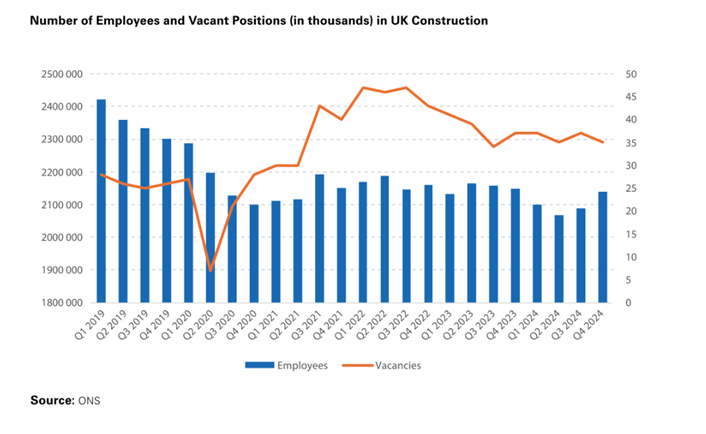

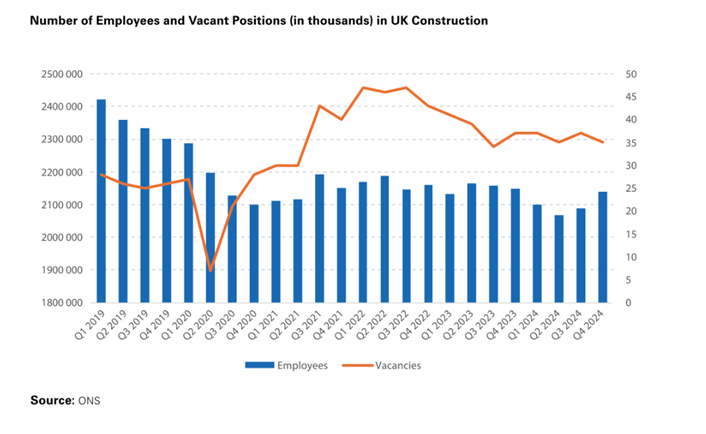

Largely, the UK labour market has performed solidly over the past years. That said, the unemployment rate has increased somewhat last year: between Q4 2023 and Q4 2024, it grew from 3.9% to a still low 4.4%4. In the construction sector, employment has fallen marginally in 2024: from 2.148m workers at the beginning of the year to 2.140m in Q4. UK construction accounts for 6.3% of total employment in the country but its importance has diminished over the past years. While employment in the UK has risen by around 797k workers (+2.4%) since the start of the Covid pandemic, the construction sector has lost 7.0% of its jobs, equivalent to 161k workers5.

Meanwhile, the sector continues to struggle to attract workers

to fill open positions though. ONS data shows that while the

number of job vacancies in the UK has dropped from 930k in Q4

2023 to 820k in Q4 2024, figures remained more or less stagnant

in the construction sector (37k vacancies in late 2023 compared

against 35k open positions in Q4 2024). Compared against pre-

Covid years, the construction sector has seen a sizable rise in job

vacancies (from 26k in Q4 2019 to 35k five years later) and the

job vacancy ratio, which measures the number of open positions

per 100 jobs in the sector has also moved higher: from 1.7 to now

2.36.

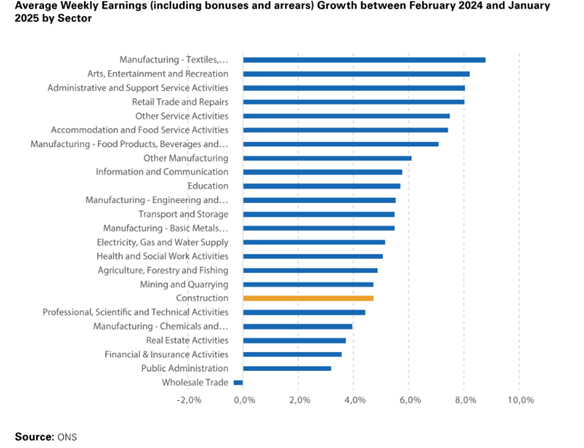

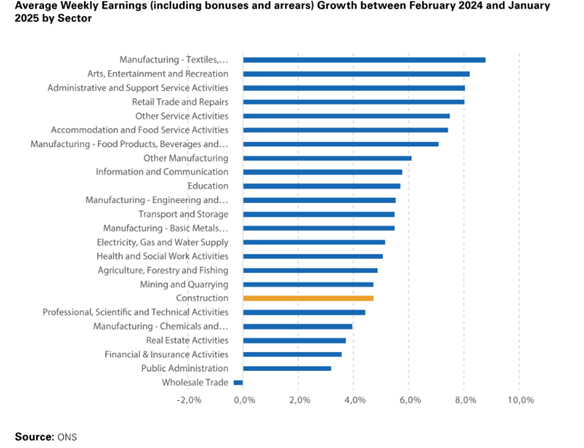

Furthermore, wages continue to increase, thereby reducing

companies’ profitability. Positively, recent data from the ONS

shows that construction is recording below-average pay rises.

In the twelve months to January 2025, average annual earnings

growth stood at 4.7% y/y. While this is high in a historical

comparison, it is far behind sectors like accommodation and food

services (7.4%) and retail trade and repairs (8.0%). Overall, 17 out

of 24 sectors covered by the ONS witnessed higher wage growth

than the construction sector in February 2024 to January 20257.

That said, construction, like all other sectors, will have to deal with higher national insurance contributions from April 2025 onwards. The 7% increase of the country’s minimum wage will probably not directly impact on the industry (as wages tend to be higher) but the incoming change has the potential to impact on salary structures and pay bands indirectly in order to reflect the new, higher salary floor.

Amidst a persistently tight labour market, construction companies will hence have to brace for higher wage costs going forward.

Outlook

The outlook for UK construction has darkened since the start of the year as macroeconomic

conditions have deteriorated, high frequency data has softened and confidence indicators

have tumbled, caused by a mix of domestic and foreign developments. Credit risk continues to be a source of concern with UK construction already accounting for an above- average share of all insolvencies in the country.

Macroeconomics

Economic conditions have deteriorated over the past months and

several forecasters, including the Bank of England, have lowered

their 2025 real GDP growth projections. The Bank has halved its

forecast from 1.5% to now 0.75% in its Monetary Policy Report

in February and the British Chamber of Commerce and the

Office for Budget Responsibility have also carried out downward

adjustments in early 2025. This was caused by the fallout of

the UK government’s Autumn Budget which foresees higher

wage costs and national insurance contributions for companies.

Subsequently announced social welfare spending cuts and tighter

fiscal policy have also negatively impacted on growth prospects.

Furthermore, the escalating trade tensions between the US

and the rest of the world also have adverse effects on growth

prospects, both domestically and internationally.

Consumer price inflation has increased somewhat over the past

quarters also: from 2.0% in June 2024 to 3.0% in January8

Although February has seen a small improvement (to 2.8%), it is

likely that inflation will remain higher for longer following recent

market turbulence, thereby limiting the BoE room to manoeuvre.

Although additional interest rate cuts, following those carried

out in 2024 and early 2025 are likely, the magnitude of monetary

loosening will be smaller than initially expected. Markets are now

counting on a further 50 basis points drop during the remainder of

2025, compared with 75 basis points previously.

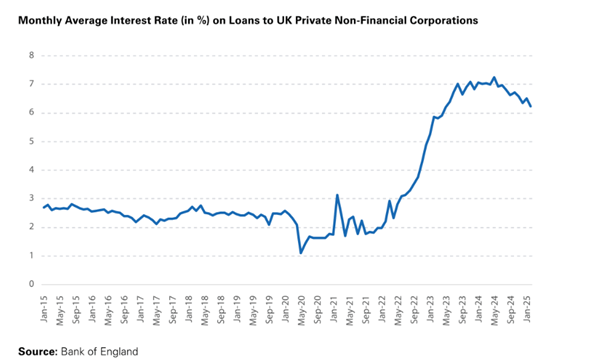

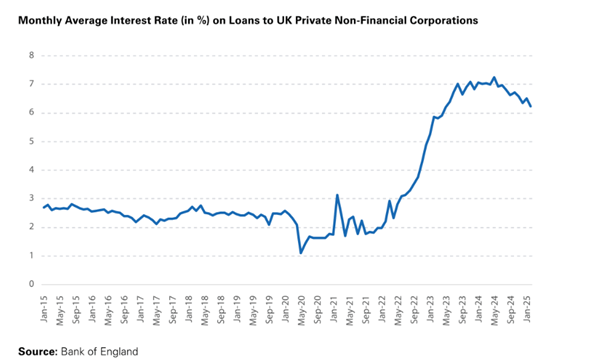

This development is noteworthy as despite the latest interest cuts, the average rate British non-financial corporations have to pay on new loans remains very elevated. Since peaking at 7.03% in November 2023, interest rates have come down to 6.23% in February 2025. However, this is still severely above the 2009-22 average of around 2%-3%9. At the same time, lending terms have tightened, thereby complicating companies’ (and households’) access to credit.

Confidence Indicators

As macroeconomic headwinds are increasing, sectoral confidence indicators are deteriorating, highlighting the widespread pessimism in UK construction. Latest Purchasing Managers’ Index (PMI) data for March shows a small improvement but with a reading of 46.4 points, the index is still close to February’s 57-month low of 44.6 points and far below the neutral 50-points line that divides expansion in sectoral activity from contraction10. The low reading is especially problematic as before the Autumn Budget in October, construction sector PMI had stood at a very high 57.2 points. In March, all three sub-sectors came in below the 50 points line with civil engineering (38.8) performing much weaker than residential construction (44.7) and commercial building (47.4).

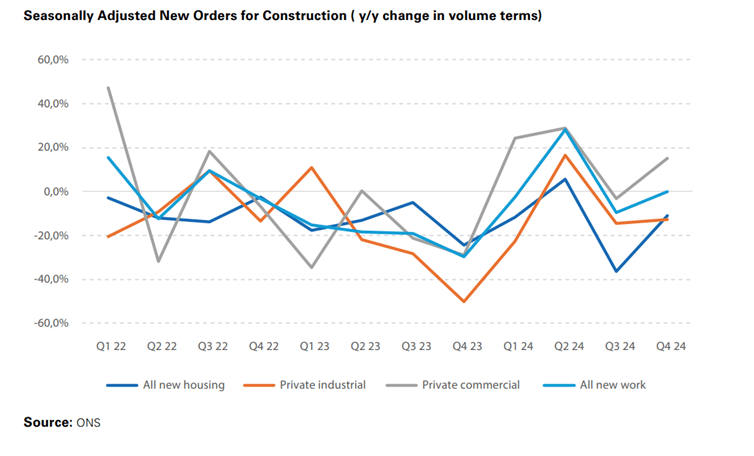

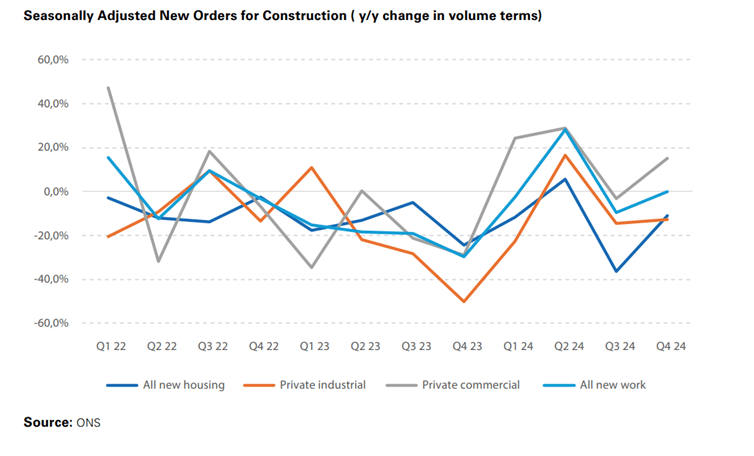

PMI data is also showing depleting pipelines: order books have been deteriorating in the first quarter of 2025. This mirrors 2024- data from the ONS. New order inflow has been falling in Q3 and Q4 (by 9.7% y/y and 0.1% y/y respectively)11. Seasonally adjusted new order inflow (in volume terms) in UK construction has been

falling in 9 out of the 11 past quarters.

Furthermore, housing starts in Q1-Q3 2024 have slowed down to

around 100k, down from 153k in the same period one year earlier

(and far below the government’s target of 300k new homes per

annum12). In its latest set of projections from January 2025, the

Construction Products Association forecasts private housing

output to increase by 6.0% in 2025 and by 8.0% in 202613.

However, as order inflow in new housing has fallen by 13.7% in

2024, an uptick in residential building in 2025-26 seems unlikely,

especially as interest rates will remain higher for longer and

geopolitical risks have dented confidence even further.

Politics and Regulatory Environment

The construction sector featured prominently in the government’s

Autumn Budget in late 2024. The Chancellor of the Exchequer

announced investment in railway infrastructure (a Trans-Pennine

upgrade and limited work on High Speed 2 in London), earmarked

GBP5bn for affordable housing projects (with a focus on Liverpool

and Cambridge14) and GBP3.4bn for the warm homes plan

(which will fund insulations) as well as increasing spending on

school refurbishments (budget: GBP2.1bn for maintenance and

GBP1.4bn for rebuilding schools)15.. Increased spending on the

NHS will also partially support UK construction as GBP1bn has

been earmarked for repairs and upgrades. Furthermore, GBP1bn

was set aside for removing hazardous fire cladding, a result from

the Grenfell Tower Fire inquiry.

On the planning side, the government has reintroduced

mandatory housing targets for local governments (which were

abolished by the previous administration) and has pledged to build

1.5m houses during this 5-year parliamentary term. In addition, a

promised overhaul of planning laws (a major bottleneck) and hiring

an additional 300 planning officers are also measures that will

help to “get Britain building again”.16

Unfortunately, to date, reform progress has been slow, thereby

holding back building activity. As government finances are

stretched, large scale infrastructure investment during this

parliamentary term is at risk. New infrastructure orders have

already fallen in six out of the past eight quarters.

Positively, the government has finally announced building safety

levy rates (a consequence of the Grenfell Tower fire in 2017)

and delayed implementation until autumn 202617. Meanwhile,

uncertainties around newly introduced so-called Gateway 2 safety

approvals (required for high rise buildings, also a result of the

Grenfell Tower fire) is holding back 92 new construction projects

at the moment (plus an additional 641 existing blocks)18. The

current approval backlog is sizable, adding around 6 months to

project pipelines plus also causing additional costs19.

Meanwhile, ESG topics and decarbonisation targets will also

impact on construction companies going forward. Generally,

net zero policies have become less popular over the past years

and on an international stage, the topic has been put on the

backburner since the election of Donald Trump as US president.

In the UK, the government has watered down targets in the

troubled automotive industry recently, giving car makers more

time to transition from internal combustion engine cars to electric

vehicles20. That said, no changes to the goalposts for the UK

construction sector have been announced yet. With the sector

accounting for around a quarter of the UK’s carbon footprint,

emissions will need to be cut by 76% by 2035 (and reduced to

zero by 2050). Achieving these aggressive targets will require

sizable investment and seismic changes to operating models but

also provide opportunities for companies embracing change.

Credit Risk

Positively, the number of business failures in the construction sector has fallen in 2024. After three consecutive increases in 2021-23,last year saw an 8.1% drop in England and Wales (which accounts for around 94% of all company insolvencies in the UK). Overall, 4,032 construction companies went under in 2024, down from 4,388 in 2023 but still far above the pre-Covid reading of 3,217 in 2019.21

The UK construction continues to display an above-average

insolvency risk. While the sector accounts for around 6%-7%

of gross value added in the country, it is responsible for almost

17% of all insolvencies (4,032 out of 23,879 in 2024). This is

largely due to small profit margins, usually around 2%-4% and the

inability to pass on unexpected cost increases to customers due

to fixed-price contracts.22

Anecdotal evidence also suggests that payment patterns in the

sector are deteriorating again. While things improved during the

Covid pandemic, bigger companies would appear to be holding

on to cash longer again, thereby adversely impacting on working

capital requirements in their supply chain. A recent report from

Begbies Traynor, a business recovery consultancy ,shows that

the number of UK construction companies in financial distress

has risen by 58% in 202423. According to the report, almost 98k

construction companies in the UK are experiencing significant

financial stress, more than in any other sector in the economy,

with 6,830 construction companies seeing critical levels of

financial distress.

Furthermore, the rising number of employee ownership trusts

in the sector is also a source of concern, given the high amount

of EOT failures in recent quarters (often caused by too-high

committed contributions to previous owners). It remains to be

seen whether EOTs are a suitable model for the very volatile

construction sector.

Taking all factors into account, the 2025 credit risk outlook

remains challenging. Although interest rates reductions this year

will be very welcome, sectoral insolvency risk remains elevated.

With turnover expansion over the past years largely been driven

by inflation, rather than organic growth, the high degree of

economic and political uncertainty could easily derail the already

weak recovery. Greater progress on speeding up planning and

safety approvals may be needed, especially as limited contractor

capacity, a consequence of the elevated number of business

failures, could also cause delays.

Related links:

[1] https://www.gov.uk/government/collections/building-materials-and-components-monthly-statistics-2012#2025-monthly-bulletins

[2] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/interimconstructionoutputpriceindices

[3] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/bulletins/constructionoutputingreatbritain/january2025

[4] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

[5] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employmentbyindustryemp13

[6] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

[7] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

[8] https://brc.org.uk/market-intelligence/retail-in-numbers/

[9] https://www.bankofengland.co.uk/statistics/visual-summaries/effective-interest-rates

[10] https://www.pmi.spglobal.com/Public/Home/PressRelease/ce95e791e0bf493c9cabcaff6538c527

[11] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/newordersintheconstructionindustry/current

[12] https://www.ons.gov.uk/peoplepopulationandcommunity/housing/datasets/ukhousebuildingpermanentdwellingsstartedandcompleted/current

[13] https://assets.publishing.service.gov.uk/media/66a76bf2ce1fd0da7b592e5d/UK_Energy_in_Brief_2024.pdf

[14] https://www.financial-news.co.uk/uk-budget-2024-opportunities-for-construction-sector/?utm_source=email&utm_medium=sfmc&utm_campaign=UK-FUTBU-LON_Newsletter_EM_Subscriber_Prom_08_Nov_379

[15] https://www.pbctoday.co.uk/news/planning-construction-news/labour-delivers-their-first-autumn-budget-but-is-construction-being-left-behind/145195/

[16] https://www.cityam.com/chancellor-rachel-reeves-unveils-planning-reforms-to-get-britain-building-again/

[17] https://www.osborneclarke.com/insights/building-safety-levy-delayed-rates-confirmed-uk-government

[18] https://www.housingtoday.co.uk/reeves-says-she-will-not-renege-on-building-safety-regulation-as-90-new-high-rise-projects-held-up-by-rules/5134088.article

[19] https://www.building.co.uk/focus/what-the-delays-at-the-building-safety-regulator-mean-for-high-rise-development/5134101.article

[20] https://www.bbc.com/news/articles/cj3xe7ppmn2o

[21] https://www.gov.uk/government/statistics/company-insolvencies-february-2025

[22] https://www.linkedin.com/pulse/profitability-shrinking-margins-uks-construction-tpr7c/

[23] https://www.begbies-traynorgroup.com/news/business-health-statistics/historic-jump-in-the-number-of-firms-in-critical-financial-distress