Wednesday 08 February 2023

- Thought Leadership

Trade Credit UK Economic Conditions Report

By TMHCC Trade Credit

Summary

- The prospects for the UK economy have brightened slightly but the IMF still expects a 0.6% contraction in 2023, risking a recession

- Inflation remains four times above the target rate of 2% but data is showing a slowdown with levels of 5% expected by the end of the year, compared to the current rate of over 9%

- Interest rates are set to rise further this year but the terminal rate is likely to be at around 4.5% (compared with the current level of 4.0%)

-

The labour market is still very tight with unemployment predicted to rise in 2023-24 but the Office for Budget Responsibility forecasts unemployment to stay below 5%

-

The UK is one of the most sluggish payers across Europe with average payment being two days worse than the European average

-

Business insolvencies in England and Wales have risen by 57% year on year, the highest reading since 2009 with further increases likely

-

Companies should expect more challenging operating conditions in 2023 with credit risk projected to rise.

Forward looking indicators

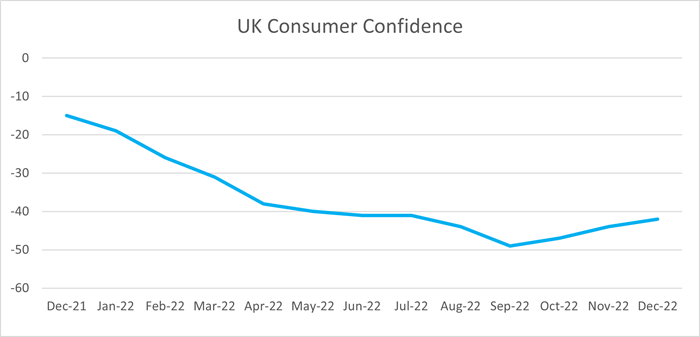

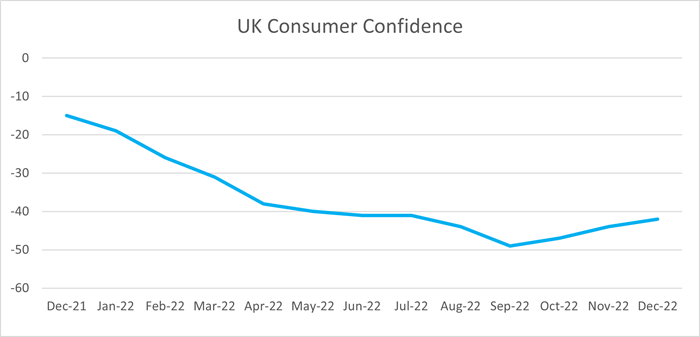

Positively, the outlook for the British economy brightened in the final quarter of 2022 evidenced by the improvement of several high frequency indicators. Consumer confidence maintained an upward trajectory from September to December with the GfK Consumer Confidence Index showing a 7 point improvement from -49 in September to -42 points by the end of the year. That said, despite recent improvements, the reading is still significantly down from values recorded twelve months ago (-15 points in late 2021) and only marginally up from the Index’s all time low in September. For the past seven months, UK consumer confidence has stood below -40 points (the first time this has happened in the Index’s 50-year long history) as households are hit heavily by the cost of living crisis.

UK Consumer Confidence

Source: GfK

Unfortunately, the most recent UK Purchasing Managers’ Index (PMI), compiled by S&P Global and CIPS, showed a sharp drop in business activity in January 2023 but positively, growth expectations are rebounding, pointing towards a likely improvement in sectoral performance in the second half of the year.

The UK Composite Output Index stood at 47.8 points in January, down from December’s 49.0 points and below the neutral 50-points line for the sixth consecutive month. Most of the deterioration in January can be attributed to the performance of the service sector with the decline in the UK manufacturing sector being the least marked since July 2022. The backlog of work and employment sub-indices of the PMI both deteriorated in January, highlighting persistent headwinds but the cost pressures component, although still elevated, improved for the second month running. Equally positively, business expectations in the private sector have once more brightened (a trend that started in October) and the sub-index is now on the highest reading in eight months.

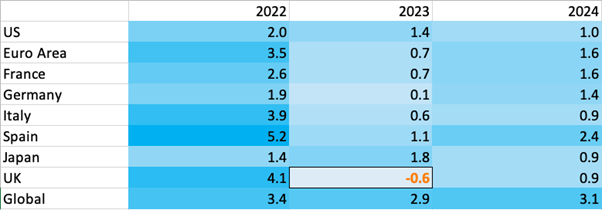

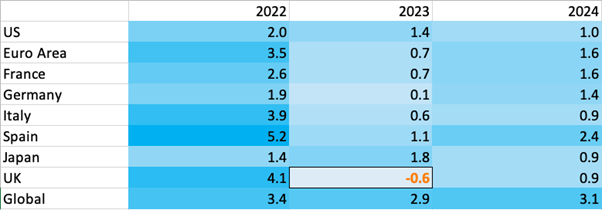

Real GDP growth

From a real GDP perspective, 2023 will be a challenging year for the UK with the prospect of recession looming large. Despite the recently improved forward looking indicators, the IMF forecasts the British economy to shrink by 0.6% this year, the worst performing G7 state (and the only one expected to see a drop in GDP levels). Some of the downturn this year can be explained by base effects, caused by the good performance in 2022 when the UK grew by an estimated 4.1% (and thereby outperforming all other G7 countries). However, tax increases, rapid interest hikes by the Bank of England, tighter lending conditions for borrowers and persistently elevated energy prices are all also dragging on growth in 2023.

Source: IMF

Looking further ahead, the IMF (in line with other forecasters) expects a return to growth in the UK, narrowing the gap on other European economies. While UK real GDP expansion will lag Eurozone growth by 1.3 percentage points this year (0.6% contraction in the UK versus a 0.7% expansion in the euro zone), this gap will almost halve to 0.7 percentage points in 2024 (0.9% growth in the UK compared with 1.6% in the euro area). That said, with less fiscal room to manoeuvre, the UK will lag its continental counterparts for the next few years.

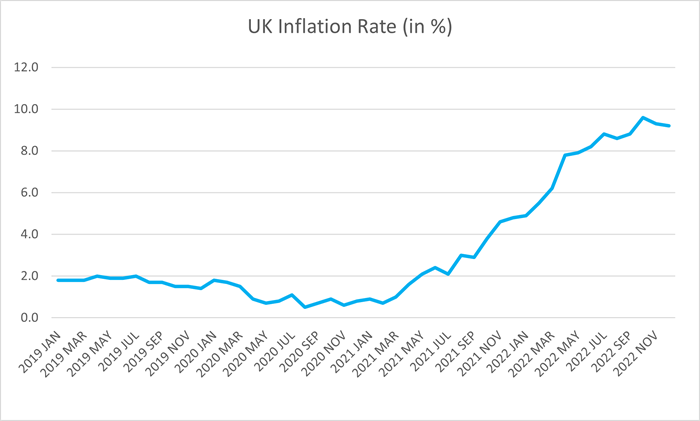

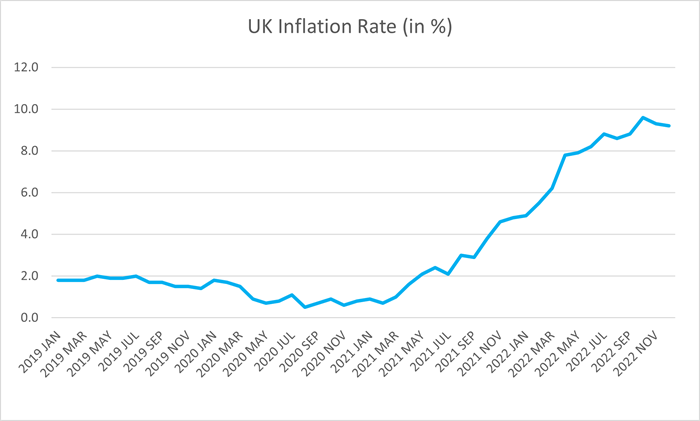

Inflation

While the economy will struggle this year, thereby creating additional obstacles for companies operating in the UK, the slowdown will have positive repercussions on the still rampant UK inflation rate. Although latest figures from the Office for National Statistics show a moderation in price pressures, consumer prices are still rising almost five times quicker than desired by the Bank of England (BoE).

Source: Office for National Statistics

In December 2022, the latest available data point, the consumer price index, including owner occupiers’ housing costs (CPIH), increased by 9.2% year on year, well ahead of the BoE’s target of 2%. Although December saw the third consecutive month of decline (the CPIH peaked at 9.6% in October, the highest reading in 41 years), housing and household services (principally from electricity, gas and other fuels) once more kept prices levels elevated with food prices (up by almost 17% year on year) also making a noteworthy contribution.

Positively, price pressures will ease throughout 2023 on the back of several factors. The prices of several commodities have started to normalise recently, thereby having a positive effect on producer price inflation which, in turn, will also keep consumer prices in check. Secondly, base effects will be at play while thirdly, the slowing UK economy will also reduce the CPIH.

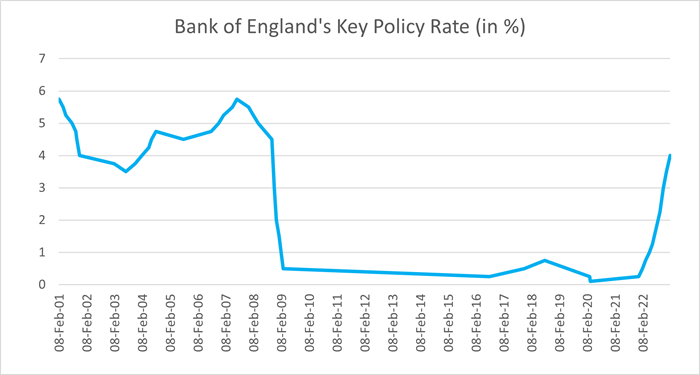

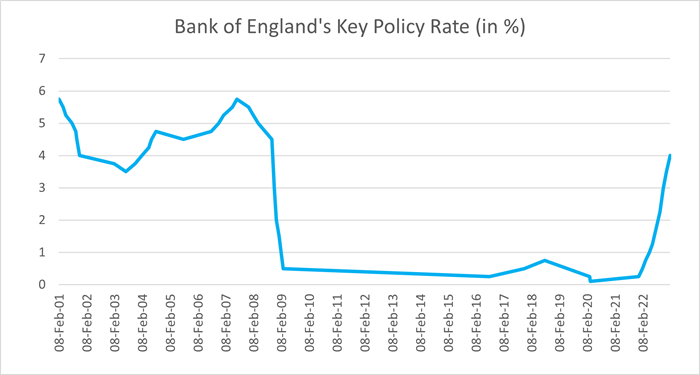

Lastly, the monetary policy response by the BoE will also play a role. In order to arrest inflationary pressures, the Bank has quickly increased the main refinancing rate: from 0.1% in November 2021 to 4.0% in February 2023. While further increases in 2023 still seem likely, market watchers expect the pace and the magnitude of the tightening to drop substantially. Based on comments made by the BoE Governor Andrew Bailey, interest rates are likely to peak at 4.5% in mid-2023 as inflation is forecasted to remain on its current downward trajectory.

Chart Key Policy Rate

Source: Bank of England

As a result of the various factors at play, the BoE forecasts UK inflation to drop to around 5% by the end of the year. Although still significantly above the target rate of 2%, this would be more manageable and would reduce the squeeze on living standards in the UK. For 2024, a further drop in inflation as well as a return to a more neutral monetary policy is currently the most likely scenario.

Labour market

Encouragingly, the UK labour market continues to show resilience, despite the slowdown in economic activity in the second half of 2022. The number of job vacancies has dropped by 75,000 open positions in Q4 2022 but still stands at almost 1.2m, a very high figure by historic standards - the number of open jobs currently stands 365,000 above the pre-pandemic January-March 2020 period. That said, 14 out of the 18 sectors covered by the Office for National Statistics (ONS) showed a decline in the number of vacancies in October-December 2022 with art, entertainment and recreation (-23.3% on the previous quarter) and transport and storage (down by 15.3% on last quarter) recording the steepest deteriorations.

However, employment figures continued to improve in late 2022 with the ONS’ estimated number of workforce jobs reaching a new all-time high of 36.2m, up from 35.7m in December 2019. That said, sectoral performances have been heterogenous and eight out of 20 sectors covered still employ fewer people than before the outbreak of the pandemic. Positively, while a large number of jobs were lost in sectors like wholesale and retail trade and construction, these drops were more than offset by gains in industries like human health and social work, professional, scientific and technical activities as well as information and communication.

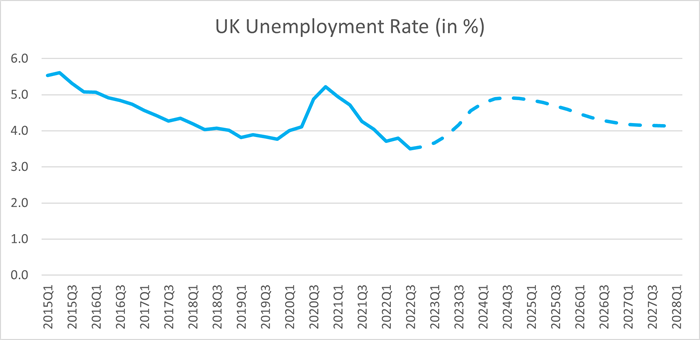

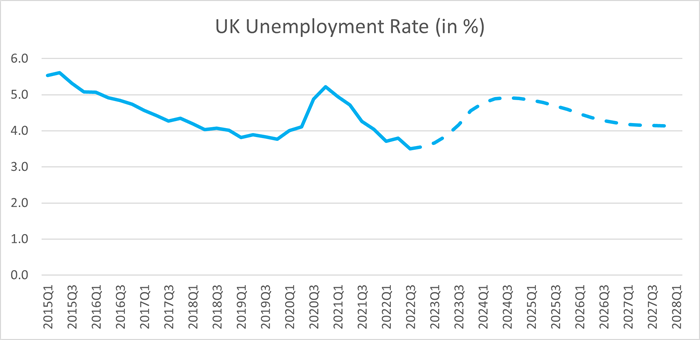

UK Unemployment Rate

Source: Office for Budget Responsibility

Meanwhile, the UK’s Office for Budget Responsibility (OBR), in line with other professional forecasters expects a minor labour market deterioration in 2023-24. As the economy switches to a lower gear and recession looms, the number of vacancies will continue to drop while unemployment will rise. That said, the deterioration will be rather small. From the current level of just below 4%, the OBR forecasts unemployment to increase gradually throughout 2023-24, peaking at 4.9% in the second half of 2024 before dropping back to 4.6% at the end of 2025. In this light (and despite the period of weak growth in 2023-24), the shortage of workers currently experienced in many sectors is unlikely to disappear, thereby remaining a key factor for businesses trying to hire additional employees.

Exchange rate

The Pound Sterling has had a disappointing 2022 and lost 5.8% against the Euro and an even higher 8.7% against the US dollar in the twelve months to February 2023. While in theory this should have boosted the UK’s international price competitiveness and helped with the country’s export performance, supply chain constraints as well as increased red tape and paperwork following Brexit reduced the potential upside of the currency depreciation. Negatively, the weaker British currency contributed to the elevated inflation rates in the UK as imported goods became more expensive.

Looking further ahead into 2023, forward rates show little movement in the GBP:EUR exchange rate but monetary policy decisions could change the outlook. With the European Central Bank likely to increase its key policy rate more often than the BoE will hike theirs in 2023, further downward pressure on the Pound could be created throughout the year, potentially testing the EUR1.11:GBP benchmark which had remained the lower floor for the Pound Sterling in recent years.

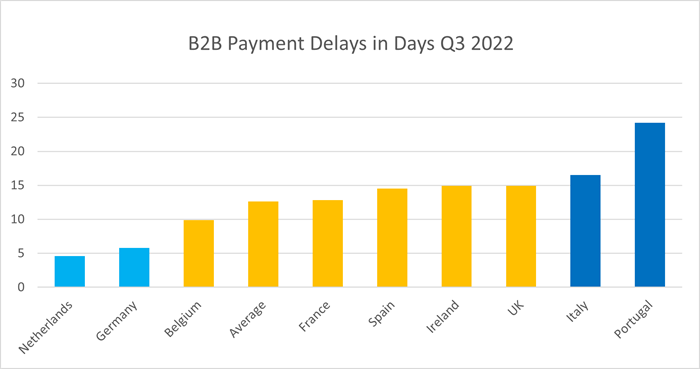

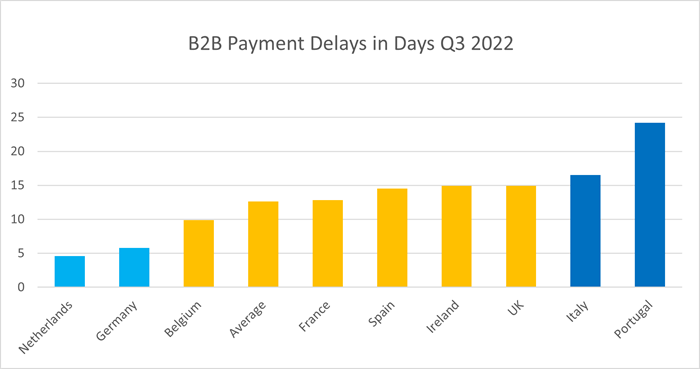

Payments performance

Positively, business-to-business payment performance in Europe has continued to improve in the first three quarters of 2022, according to data from Dun & Bradstreet, a global business information provider. The average payment delay has fallen from 13.6 days at the end of 2021 to 12.6 days in September 2022 as the economy rebounded quickly from the Covid lockdowns in 2020-21. Unfortunately, there are outliers to this positive regional trend. While most countries reported shorter payment delays in Q1-Q3 2022, the UK is one of two economies (together with Ireland) that saw an increase: in December 2021, payment delays in the UK stood at 14.5 days beyond agreed payment terms (often 30 days in the UK), this reading had increased to 14.9 days in September 2022.

Payment Delays in Europe

Source: Dun & Bradstreet

Problematically, while the UK outperformed the European average by 0.3 days in late 2020 (14.2 days payment delays in the UK versus the European average of 14.5 days), the country is now trailing the average by 2.3 days. Also, noteworthy, France and Spain leapfrogged the UK between Q4 2020 and Q3 2022 with now only Italy and Portugal displaying a worse B2B payments performance in Europe.

Even more worryingly, the outlook for prompt payments and credit risk in the UK is grim. This comes on the back of the already mentioned bleak macroeconomic outlook. The sizeable risk of a recession in 2023, as well as relatively poor growth prospects in 2024, will weigh on companies’ ability to create sufficient cash flow to pay bills promptly (or at all). Furthermore, the increase in interest rates on the back of high inflation rates throughout 2022 also has negative repercussions on credit risk.

The BoE’s latest Credit Conditions Survey for Q4 2022 shows that commercial banks already saw less supply in lending to medium sized companies in October-December 2022 (but no changes for small and large enterprises) and that an across-the-board deterioration is forecast for Q1 2023. At the same time, the survey also predicts lower demand for credit in January-March 2023 while simultaneously, commercial lenders count on higher corporate default rates in the near-term future. As a result of these developments, worse payment patterns in the UK (but also other European economies) are likely.

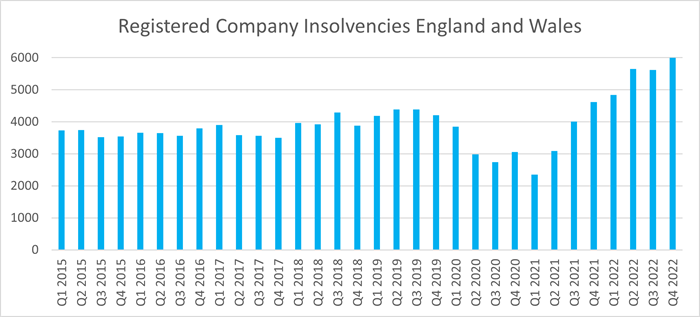

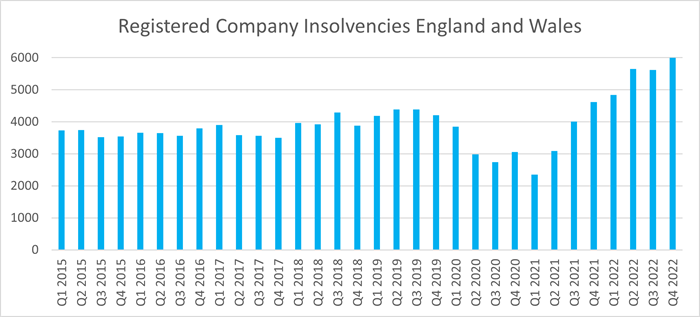

Business failures

Worryingly for the UK’s credit risk environment, the number of business failures has remained on a steep upward trend throughout 2022, according to data from the Government’s Insolvency Service. Latest available figures for England and Wales (insolvency regulation is a devolved matter and Scotland and Northern Ireland publish separate data series which also show an increase) show that almost 6,000 company insolvencies were registered in the final quarter of last year. For the year as a whole, the overall figure came to 22,109 which is 57% higher than the 2021 reading and the worst performance since 2009.

Business failures England and Wales

Overall, one out of 202 active companies (equivalent to 49.5 out of 10,000 active companies) entered insolvency liquidation in 2022, up from the 32.9 per 10,000 companies recorded in 2021 when Covid support packages and temporarily suspended filing requirements distorted the comparison base though. That said, even when compared with 2019 when the liquidation rate stood at 41.9 per 10,000 companies, 2022’s performance was poor. In a historic comparison, the 2022 liquidation rate was the highest since Q3 2015 but is still much lower than during the global financial crisis In 2009, the corresponding reading was almost twice as high (94.7 registered insolvencies per 10,000 active companies).

Business failures by sector

Data from the Insolvency Service shows that in 2022, almost a fifth of all registered business insolvencies in England and Wales occurred in the construction sector (which saw a total of 4,143 insolvencies), followed by wholesale and retail trade (3,263 insolvencies, equivalent to 15.0% of the overall figure) and accommodation and food services (2,704, 12.4% of total). Manufacturing, reflecting its limited importance for the UK economy, saw 1,687 registered insolvencies in 2022 while agriculture, forestry and fishing, mining and quarrying and public administration combined accounted for less than 1% of the overall figure.

Source: Insolvency Service

Looking further into 2023, the cost of living crisis is likely to suppress household spending once more (albeit by a smaller degree than last year) while the looming recession, as well as the higher interest rates and lower credit availability will also increase the risk of companies filing for insolvency.

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.