Friday 21 April 2023

- Thought Leadership

Trade Credit UK Food Service Sector Report 2023

By Terry Macauley

Summary

- Food price inflation in the UK stood at almost 17% in January, the highest level since 1977 and demand in the sector is falling as consumers are spending less as a consequence.

- Supply chain problems and labour shortages also impact adversely: the accommodation and food service sector has the highest job vacancy rate of all sectors surveyed in the UK.

- Office occupancy rates have risen as Covid restrictions have been lifted but they still remain far below pre-pandemic readings, thereby creating problems for those elements of the sector city-focused.

- Food delivery businesses had a poor 2022 as consumers cut spending and increasingly shifted back to pre-pandemic demand patterns; 2023 looks challenging as well.

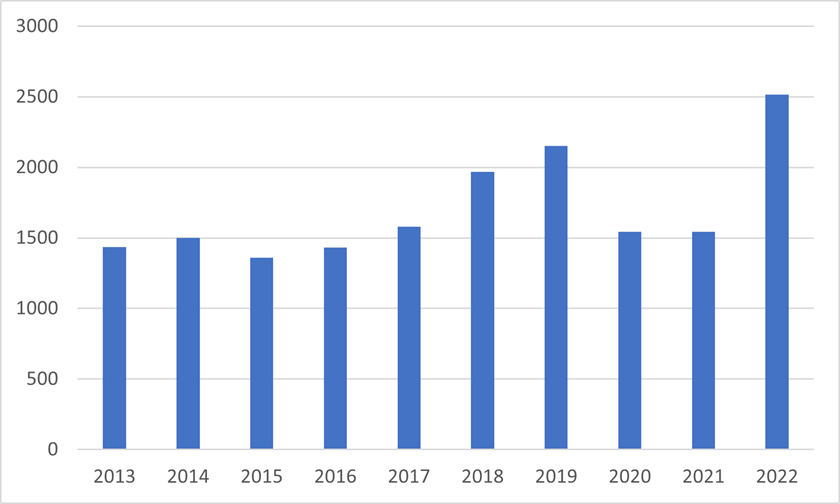

- The number of business failures in the sector has risen by a stark 63% in 2022; more than 2,500 pubs, restaurants and caterers in England and Wales went bankrupt.

- Inflation rates have fallen somewhat and the economic outlook has brightened marginally in late 2022 and early 2023; nonetheless, more business failures and poorer payment performance can be expected this year.

To view a pdf version, click here.

Key Trends in 2022

The UK’s food service sector was facing several severe challenges last year, many of them likely to persist in 2023. Most notably, the country is still in the middle of a cost of living crisis which is weighing on households’ disposable income. Consumer prices have started to come down in early 2023 but are still more than four times above the Bank of England’s 2% inflation target. Especially worrisome, food price inflation is particularly strong, thereby hitting low-income households which spend a higher fraction of their income on groceries. The ONS’ Opinions and Lifestyle Survey from February also shows that 43% of adults reported buying less food. This trend is more pronounced in deprived areas of the country, compared with the well-off regions5.

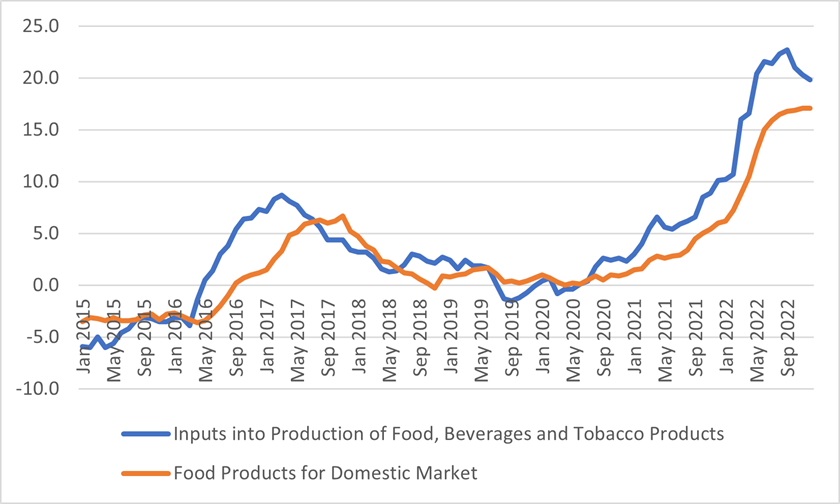

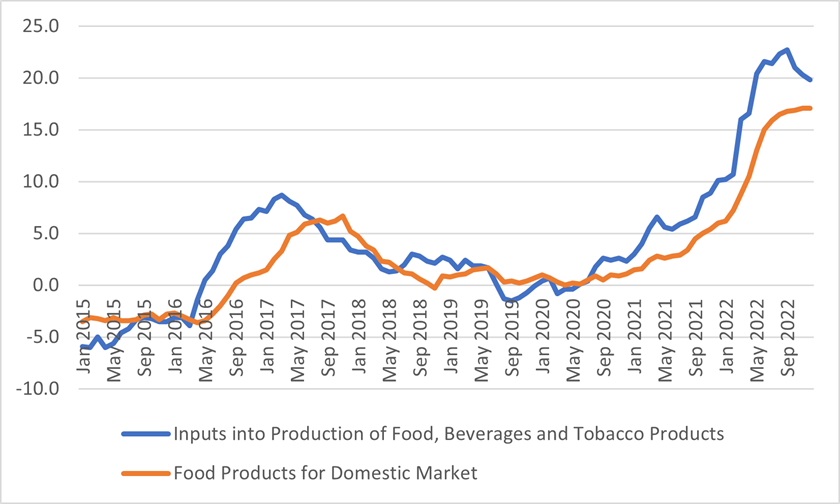

According to latest data from the Office for National Statistics (ONS), consumer prices increased by 8.8% year on year (y/y) in January but annual food and non-alcoholic drink consumer prices grew almost twice as quickly: +16.8%. This was marginally down from the 16.9% increase recorded in December and the first drop in seventeen months. Nonetheless, the current food price inflation is on the highest rate since 1977 and costs for restaurant and café visits are also rising by an above-average speed: up by 9.4% y/y in January . Equally worrying for the months ahead, producer price inflation (PPI) in the food sector still stands near its recently recorded record level. Annual PPI has been positive for the past 26 months and the 2022-average was the highest reading since the start of the data series in 1985 . Standing at just below 20% in January, the high PPI in the sector is likely to keep food price inflation in positive territory for the remainder of 2023.

Chart: Annual percentage change in inputs into the production of food, beverages, and tobacco products and food products for domestic market, UK, January 2015 to January 2023

Source: Office for National Statistics

Also problematically for the sector, supply chain stress remained an issue in early 2023 with several supermarket chains introducing restrictions for purchasing fresh vegetables. Amidst poor harvests in key agricultural markets such as Spain and Morocco, re-routed supply chains because of Brexit and the short-term nature of contracts UK supermarkets had signed with foreign producers, products like tomatoes and cucumbers became unavailable in many shops . As a consequence, 27% of UK consumers reported experiencing shortages when shopping for essential food items in early March, up from 19% in early February.

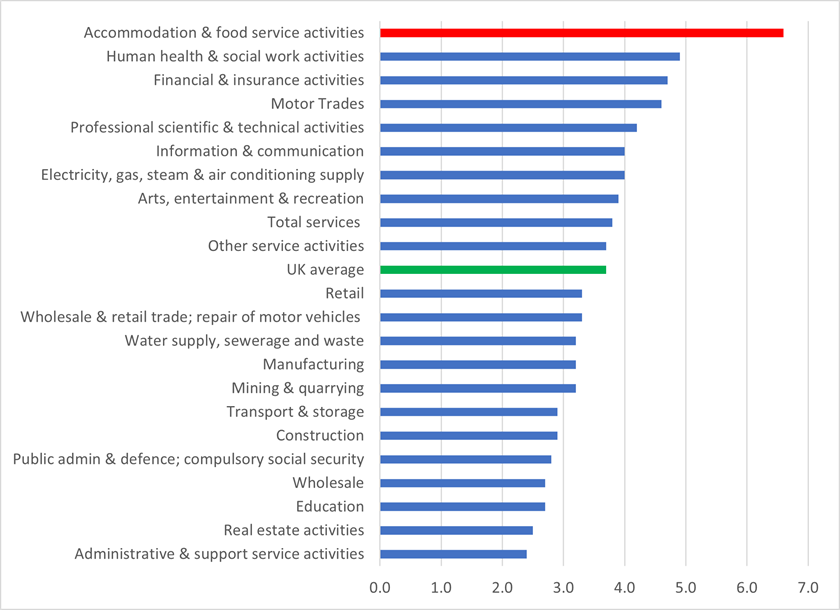

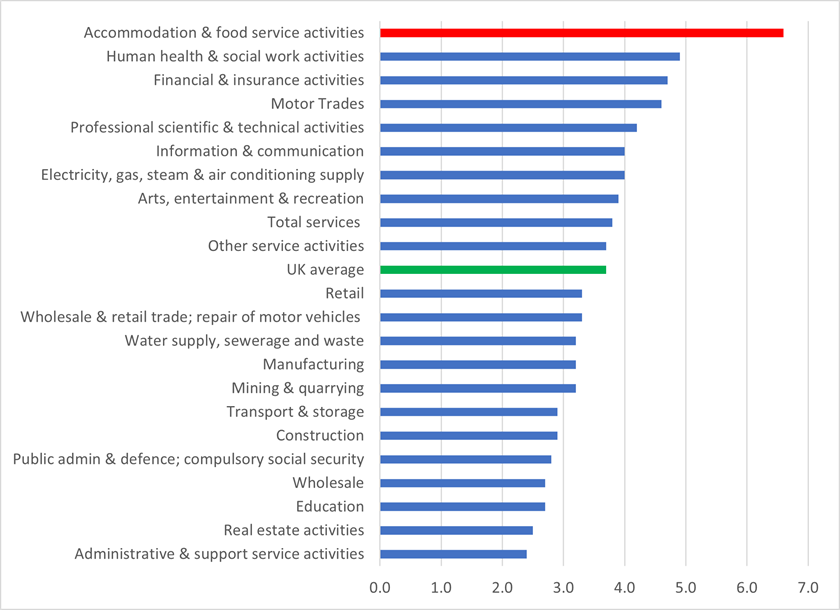

Equally negatively, labour shortages still remain an issue for the UK economy and the food service sector in particular, albeit to a slightly smaller degree than in early 2022. Overall, ONS data shows that 1.13m jobs could not be filled in the UK in in the three months to January 2023, down from the all-time high of 1.30m in March-May 2022. In the accommodation and food service sector, 146,000 positions remained vacant in November 2021 to January 2022 (down by 27,000 when compared with March-May 2022) which means that for 100 employee jobs, there are 6.6 vacant positions in the sector, the highest ratio of all sectors analysed by the ONS and far above the national average of 3.7 .

Chart: Vacancies per 100 employee jobs by sector, November 2021 to January 2022

Source: Office for National Statistics

Positively for businesses operating in urban environments, the lifting of all Covid restrictions over the past year has led to an increased number of workers returning to offices. Latest data from Remit Consulting shows that office occupancy rates in the UK have risen to 34.3% in late January, the highest rate since the start of the data series in May 2021. In certain parts of London, ratios even stood above 40% (West End: 43.9%, Docklands 49.4%). That said, despite companies trying to entice white collar workers back into offices, occupancy rates are still far below pre-pandemic readings (which averaged around 60%-80%) with harmful effects on restaurants, coffee shops and other businesses targeting commuters . On top of the ongoing working from home trend, the frequent train strikes were also reducing footfall in inner cities in late 2022 and early 2023 – anecdotally, having a disproportionally negative impact on hospitality where parties and gatherings were regularly cancelled due to concerns with getting trains home.

In terms of financial performance, the big supermarket chains in the UK saw heterogenous trends in 2022. While Morrisons and Tesco both warned about lower profitability, Sainsbury expects a better than projected financial result. Aldi and Lidl are both earning market share quickly, caused by opening more shops but also by attracting customers from other chains. Food delivery businesses like Hello Fresh , Deliveroo , Getir, Gorillas and Zapp are currently shedding jobs and revising growth projections downwards. Problematically, most companies in the food delivery sector struggled to make a profit even during the height of the Covid lockdowns (when demand was artificially inflated) and finding new investors in the current market and interest rate environment is becoming increasingly difficult.

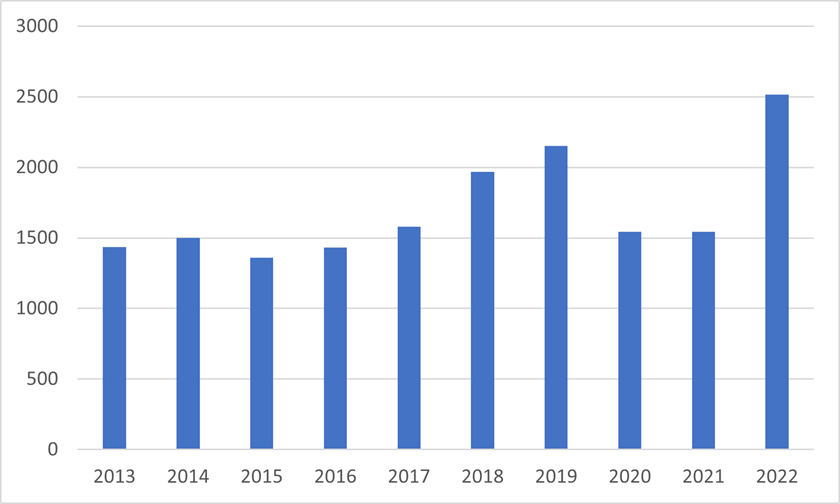

Worryingly, data from the government’s Insolvency Service shows that 512 pubs went out of business in 2022, up by 56% y/y and the highest reading in a decade. J D Wetherspoons, the biggest pub chain in the country said that Q4 2022 sales were still 2% below pre-pandemic readings, despite price increases of 7.5% last year. The whole “food and beverages services activity” sector (which, besides pubs includes caterers and restaurants) registered 2,515 company insolvencies in 2022, up by 63%.

Chart: Registered company insolvencies in England in Wales in the food and beverages services sector

Source: Insolvency Service

2023 Outlook

Many of the headwinds that weighed on sectoral performance last year will continue to play a role in 2023. Elevated costs for raw materials and labour, dented consumer confidence, lower disposable income, higher debt refinancing costs and skill shortages will all continue to adversely impact on the food service industry. The macroeconomic backdrop will also be challenging as the IMF forecasts a 0.6% contraction of real GDP in the UK (the only G-7 economy for which the Fund predicts a drop). That said, there is room for some cautious optimism as well. Forward looking indicators have improved in recent weeks, albeit from low bases. Research firm GfK’s consumer confidence indicator increased in September to December 2022 before moving lower again in January . Wheat prices are down by almost 40% in y/y terms, corn by 14% and soybeans by 12% , this will eventually help to push food price inflation rates lower later this year. Nonetheless, elevated energy price will continue to suppress disposable income as nominal wage growth will be outpaced by consumer price inflation for the remainder of this year. As a consequence, consumers are likely to restrict non-essential spending which will include less eating out and purchasing less luxury food items.

Medium and long-term trends such as higher demand for non-alcoholic beverages as well as vegan food options are likely to continue this year. While demand for organic food might take a temporary hit because of affordability reasons amidst the cost of living crisis, ESG topics will generally become more pressing over the next years. The food service sector will have to continue investing more in this area. In this light, supply chain intelligence will be an area of particular interest in order to ensure that customer demands can be met.

Concluding, low macroeconomic growth, restricted consumer spending and high inflation (albeit becoming less pressing over the next quarters, according to most forecasters) and the high interest rate environment will likely lead to another increase in credit risk in the sector. Payment performance is forecasted to become slower in 2023 while the number of business failures will rise. Appropriate measures such as conducting proper financial health checks of business partners and using trade credit insurance to minimise exposure are advised.

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.

Related links

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/january2023

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/costoflivinginsights/food

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/recenttrendsinukfoodanddrinkproducerandconsumerprices/january2023#data-sources-and-quality

https://inews.co.uk/news/food-shortages-aldi-asda-morrisons-rationing-cucumbers-tomatoes-shelves-empty-2165767

https://www.ons.gov.uk/peoplepopulationandcommunity/wellbeing/bulletins/publicopinionsandsocialtrendsgreatbritain/22februaryto5march2023

https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

https://www.costar.com/article/1063782777/uk-office-occupancy-starts-2023-at-new-pandemic-high

https://www.theguardian.com/business/2023/jan/26/morrisons-sales-profits-dive-2022-price-rises-shoppers-pessimistic-cost-of-living-political-uncertainty

https://www.reuters.com/business/retail-consumer/britains-tesco-sees-full-year-profit-lower-end-guidance-2022-10-05/

https://www.ft.com/content/216e639d-d755-4ab2-9a81-96e03589401c

https://www.theguardian.com/business/2022/sep/26/aldi-uk-profits-fall-but-chain-says-shoppers-are-switching-to-it-in-droves

https://www.reuters.com/business/retail-consumer/lidl-gb-profit-rises-says-more-shoppers-switching-it-2022-11-17/

https://www.reuters.com/markets/europe/hellofresh-sees-2023-core-profit-460-540-mln-euros-2023-03-07/

https://investingreviews.co.uk/news/cost-of-living-deliveroo-shares/

https://www.chargedretail.co.uk/2023/03/10/quick-delivery-bubble-burst/

https://www.gfk.com/press/uk-consumers-succumb-to-economic-january-blues

https://markets.ft.com/data/commodities