Thursday 09 March 2023

- Thought Leadership

Trade Credit UK Retail Sector Report 2023

By Fiona O'Brien

Summary

- UK retailers experienced a solid 2022 with sales growing by 3.1% year on year in terms of value

- However, when focussing on sales volumes (which ignore price developments), the picture is less rosy: data from the Office for National Statistics shows a 5.7% year on year drop in Q4

- Insolvencies in the sector have almost doubled (+92.5%) in 2022 and credit risk is likely to remain elevated in 2023

- A poor macroeconomic backdrop, tight labour markets, high input costs and tight monetary policy will all create headwinds for the sector this year, but supply chain stress is likely to ease

- The coming reduction in Government support for energy costs is a notable immediate concern – subject to the pending Budget announcement

- Topics like compliance with ESG practices, AI and metaverse investment and new concepts for existing bricks and mortar stores will remain important over the medium term

To view a pdf version, click here.

Key Trends in 2022

The UK retail sector has experienced several challenges in recent years. Lockdowns for non-essential shops, supply chain disruptions due to the pandemic, high energy prices, business rates reducing profitability and a general shift in consumer patterns away from bricks and mortar shops to online shopping are all heaping pressure on the sector.

Despite this, the sector’s performance in 2022 was better than initially expected and the year finished on a high. According to data from the sector’s trade association, the British Retail Consortium (BRC), total retail sales grew by a solid 6.9% year on year in December, compared with a weaker expansion of 2.1% in December 2021. For 2022 as a whole, retail sales grew by 3.1% against 2021. Most of the growth in the three months running up to Christmas came from the food sector which saw a 7.9% year on year increase in sales while non-food retail turnover expanded by a more modest 1.5%.

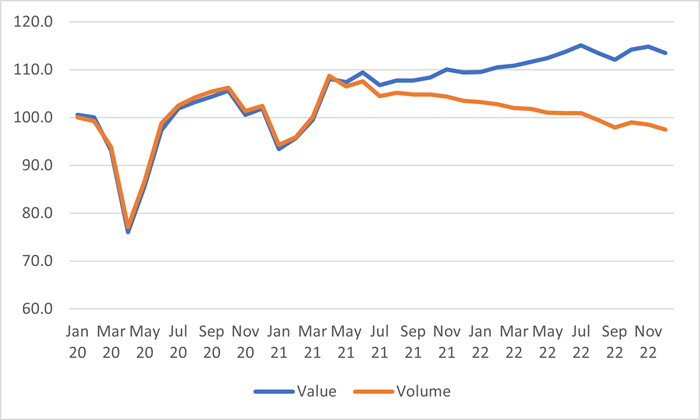

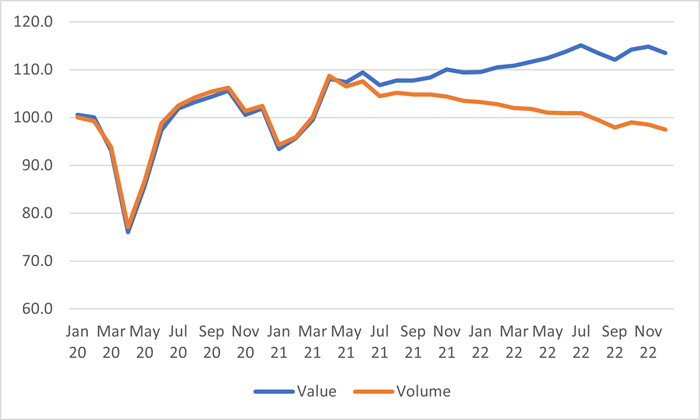

Worryingly, the BRC’s relatively positive assessment changes somewhat when the angle of the analysis shifts from sales value (the amount being spent) to sales volume (the quantities being purchased). According to data from the Office for National Statistics (ONS), sales volumes in the UK retail sector have dropped by 5.7% year on year in Q4 2022 while sales values have increased by 4.5%.

Chart: Volume and Value sales, Seasonally Adjusted, Great Britain, January 2020 to December 2022 (Index 2019=100)

Source: Office for National Statistics

This discrepancy can be explained by the relatively high consumer price inflation rate (around 10% in late 2022) which means that stable sales volumes would generate a 10% uplift in sales values when compared year-on-year. Furthermore, data from the ONS shows that sales volumes in the UK are still 1.7% below the February 2020 reading, the last month before the start of the Covid pandemic. In terms of value, they are up by close to 14%.

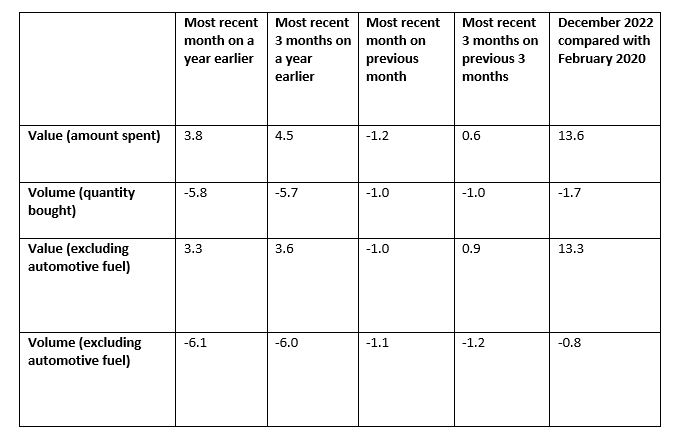

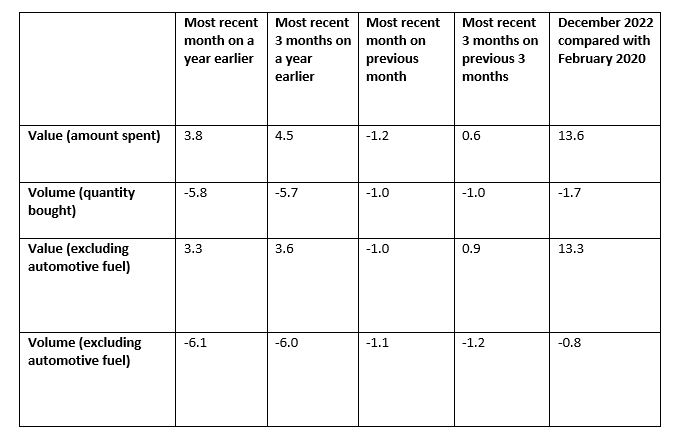

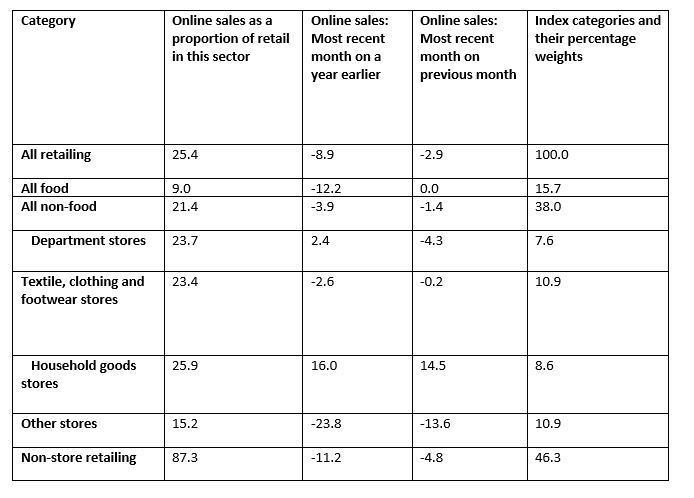

Table: Retail Figures December 2022 (seasonally adjusted, percentage change)

Source: Office for National Statistics

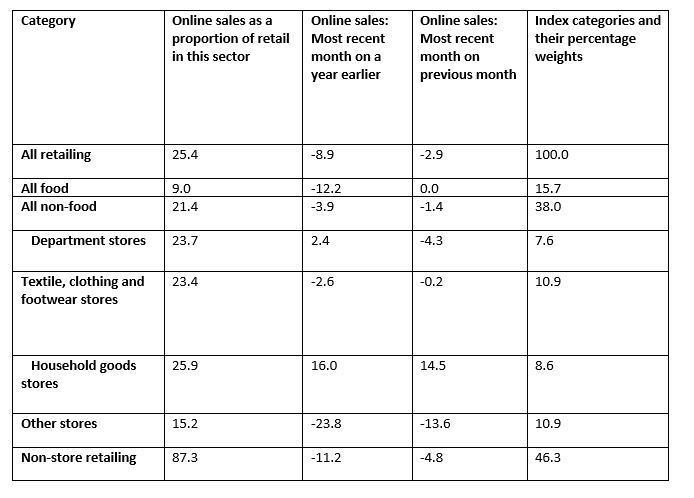

In online sales, the Christmas period saw a slight shift away from e-commerce with the percentage share of online sales (as a fraction of overall sales) dropping from 25.9% in November to 25.4% in December. ONS statisticians cite strike action at Royal Mail (and the potential delays in receiving time-sensitive shipments) as the reason for this minor deterioration. However, e-commerce was still a much more popular way to shop in late 2022 compared to the last pre-Covid figures from February 2020, where the share of online sales stood at 19.1%.

Table: Summary of Online Sales Statistics (Value, Seasonally Adjusted, Percentage Change, UK December 2022)

Source: Office for National Statistics – Monthly Business Survey, Retail Sales Inquiry

Insolvencies

Despite the uptick in sales figures (at least when measured in value and not volume terms), several high-profile business failures occurred in the UK retail sector in 2022. Companies like M&Co, Joules, Made.com, T M Lewin, Missguided and McColl’s Retail Group all went into administration last year. For some, this was not their first experience of administration.

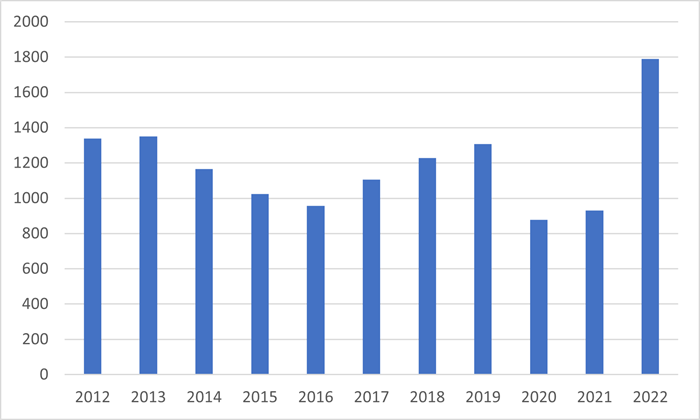

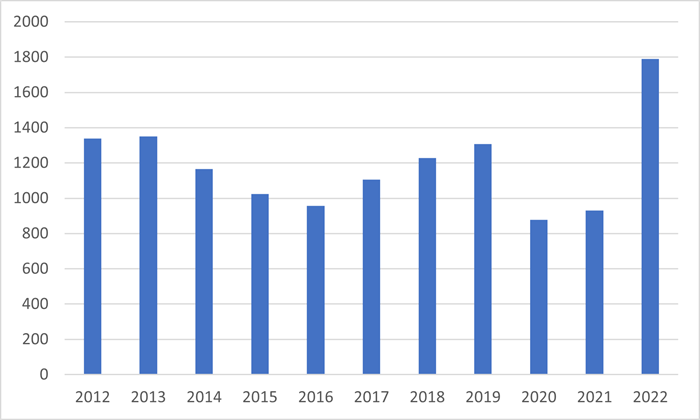

Overall, more than 2,300 individual stores and around 35,000 employees were impacted by business failures in the UK retail sector last year, according to the Centre for Retail Research. This is the highest figure since the financial crisis in 2008-09. Data from the UK Government’s Insolvency Service shows a total of 1,790 registered retail company insolvencies in England and Wales in 2022, more than the 2020 and 2021 figures combined and far above the pre-pandemic readings.

In a year on year comparison, registered retail sector company insolvencies in England and Wales almost doubled last year (up by 92.5%) and the sector now accounts for 8.1% of all business insolvencies in the UK. Worryingly, the increase recorded in the retail sector outstripped the rise seen in the overall data - 92.5% increase in retail versus the 57.0% rise seen for the overall business universe in England and Wales. Scotland and Northern Ireland publish separate data but numbers are small with Scotland seeing 98 retail sector bankruptcies in 2022, compared with the almost 1,800 in England and Wales and mirror the trends recorded in England and Wales.

Chart: Registered Company Insolvencies in the Retail Sector in England and Wales by Year

Source: Insolvency Service

2023 Outlook

Positively, following several years of severe, Covid-related stress, the British retail sector will benefit from the return to normality in supply chain management. The US Federal Reserve Global Supply Chain Pressure Index for January 2023 shows a further improvement as stress in supply chains, although still up from pre-Covid years, has come down substantially over the past few months. With China abandoning its zero-Covid policy, further improvements are expected with UK-based retailers likely to benefit from cheaper shipping costs and quicker transactions with foreign suppliers.

Furthermore, research carried out by inventory management firm Unleashed shows that British clothing and fashion businesses are holding 57% more stock compared to pre-Covid levels, severely undermining company profitability levels. Against this backdrop, it is likely that UK retailers (not only in the fashion industry) will run down their elevated inventory levels over the coming months in order to reduce costs and generate cash flow.

Although supply chain pressures are easing, the retail sector faces several other headwinds this year, some of which are increasing in strength. Unfortunately, macroeconomic conditions are set to deteriorate in 2023 with the IMF forecasting a 0.6% real GDP contraction in the UK. While the country might avoid falling into recession, pessimism amongst consumers and businesses remains widespread.

The latest data from research firm GfK shows that consumer confidence remained below minus 40 points for the past nine months, an unprecedented event in the index’ 40-year history. With real wages falling by 2.5% in Q4 2022 (according to ONS data) the cost of living crisis will continue to weigh on the sector throughout the year, especially as experiences such as holidays or days out will compete with goods for discretionary spending. In this light, retailers’ pricing power and ability to roll over rising costs is set to diminish in 2023.

It is also feared that many businesses will be at risk of failure following the announcement that the Government support measures for energy costs will be reduced from April. It is feared that the new scheme will expose many businesses to volatile market prices rather than offering a fixed wholesale price. This cut in support could create a catastrophic cliff-edge at the end of March for many businesses – the coming Budget will confirm the full impact of this.

A tight labour market will also continue to drag on the sector and the wider economy. Although job vacancies have decreased in recent weeks as the economy switches down to a lower gear, there are still around 148,000 unfilled positions in the wholesale and retail sector, up by 14,000 when compared with the pre-Covid reading.

Expansion plans will be complicated by a lack of workers (plus rising nominal wages) meaning that investment in automation is likely to rise. The poor macroeconomic backdrop, higher interest rates and tougher lending conditions are set to have an adverse effect on 2023 business failures, not only in the retail sector. As company cost bases are negatively impacted by high input price inflation from energy and wages and Covid support loans have to be repaid, the risk of non-payment will remain elevated this year.

Furthermore, several long-term trends will continue to play out over the coming years. The importance of ESG criteria in procurement and supply will rise, thereby creating challenges for retailers to adhere to new standards and best practices. Technology investment in areas like augmented or virtual reality or artificial intelligence will also become more and more important over the next years as footfall in bricks-and-mortar shops continues to fall. In this light, revamping existing store locations (potentially into mixed use spaces) will also be a key topic for the sector in 2023 and beyond.

Written by Fiona O’Brien, Senior Risk Underwriter – Credit

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.