Wednesday 12 November 2025

- Thought Leadership

UK Energy Sector Report 2025

Summary

- Global oil and gas prices have fallen further in 2025 and are forecasted to drop further as supply growth, especially in the oil sector, will be exceeding demand by a far margin.

- Government schemes will help to reduce the record-high industrial electricity prices over the next years with energy-intensive companies and sectors benefitting the most.

- The Labour government remains committed to achieving carbon-neutrality, timelines have been brought forward but renewable energy deployment is still too slow and the power grid requires more funding.

- UK oil and gas output will continue to shrink over the next years (effectively halving in this decade) while at the same time, renewable energy capacity will continue to grow quickly.

- The number of business failures in the energy sector remains low (given the small number of companies out of the active business universe) but figures have increased by 20% y/y in January to August 2025.

- The freight haulage sector continues to suffer from labour shortages, underfunded infrastructure, higher operating costs and requires sizable investment in decarbonisation and digitalisation, all adding to a generally elevated level of sectoral credit risk.

To view a PDF version, click here

Fossil Fuels

The UK’s energy sector is in the middle of a seismic change as the country has pledged to become a net-zero economy by 2050. The transition is already well under way and carbon emissions have dropped by around 50% since 19901. While the UK’s energy mix has changed significantly over the past decades and coal has been phased out of the country’s energy mix last year, oil and gas extraction in the North Sea continues to play a sizable, but decreasing role in the British energy sector.

Oil Prices

In 2025 to date, oil prices continued to remain on a downward trajectory, a trend that started in early 2024. The price for a barrel of Brent crude oil has dropped by around 12% year on year (y/y), coming in at USD66.10 in late October2. West Texas Intermediate (WTI) has also decreased in y/y terms: minus 13.9%, falling to USD61.763.

Crude Oil Prices (in USD per barrel)

Source: ONS

According to the latest International Energy Agency (IAE) forecasts, oil prices will remain under downward pressure next year as signs of a severe supply glut have become more and more visible. The overall oil surplus stood at an already high 1.9 million barrels a day (mb/d) in the January-September 2025 period but in 2026, this figure is forecasted to rise to 4.0mb/d, thereby lowering prices further. Global oil inventories are already up to the highest reading in four-and-a-half years with China accounting for a third of the increase. The oil import-reliant country has introduced a new energy law in January 2025 and is trying to build up reserves ahead of a potential clash with the US4.

At the same time, voluntary production cuts launched in 2023 by eight OPEC+ countries are phased out, bringing an end to five years of production constraints. Non-OPEC countries, including the US, Brazil, Canada and Guyana are also projected to ramp up oil production in 2026, driven by operational efficiency gains. Global supply is forecasted to grow by 3mb/d in 2025 and a further 2.4md/d in 2026.

On the other side, demand growth is expected to be lacklustre. Against a backdrop of meagre economic performance, increasing vehicle efficiencies and the accelerating shift to electric vehicles, the IAE forecasts global oil demand to increase by a modest 0.7mb/d next year, way below supply growth. As a result of the imbalance, rating agency S&P forecasts the price for a barrel of Brent crude oil to fall from an average USD69 in 2025 to USD52 in 20265.

Natural Gas Prices

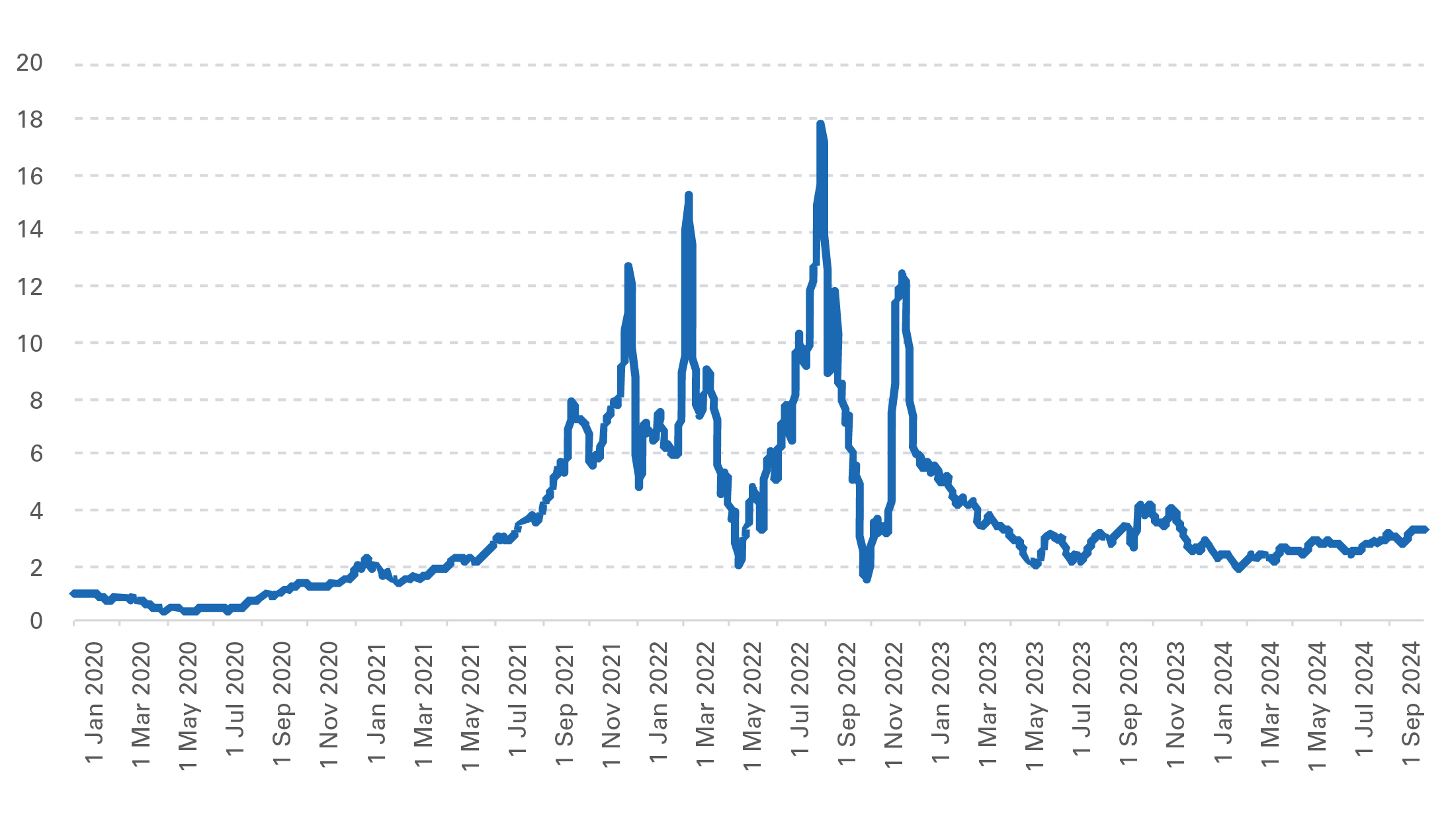

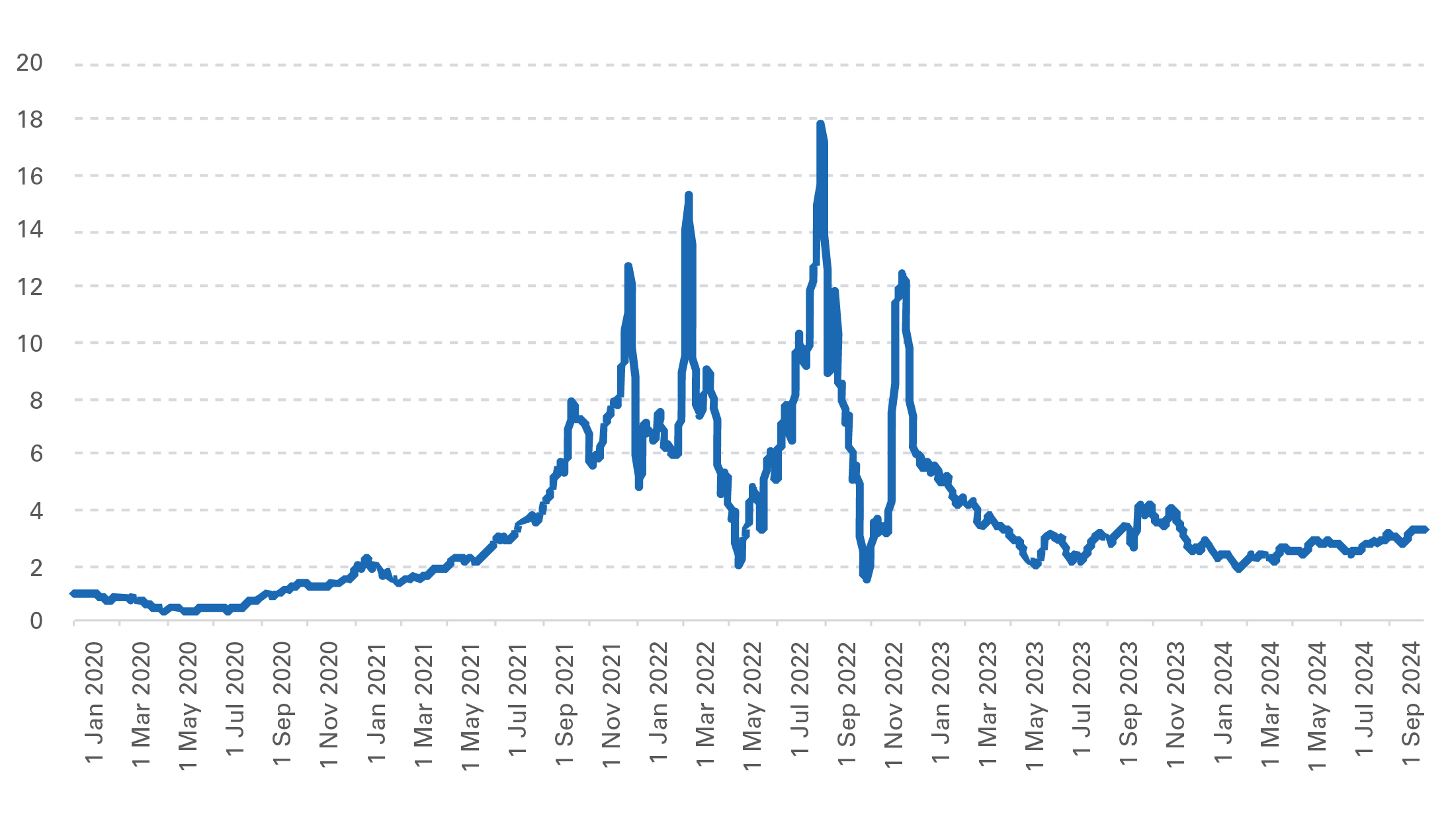

Following sizable turmoil during the early phases of the Russia-Ukraine war, natural gas prices in the UK have moved lower again. The system average price (seven days average) peaked at close to 18 pence per kWh in August 2022 but has since moderated immensely: in the twelve months to September 2025, the price averaged 3.3 pence, according to data from the Office for National Statistics (ONS)6.

System Average Price of Gas (monthly average, in pence per kWh)

Source: ONS

Source: ONS

Despite the recent price decreases, natural gas prices in the UK are still far above pre-pandemic readings. Compared with the 2019-average, prices are almost thrice as high. Positively, the World Bank forecasts a modest decrease in European natural gas prices in 2026: following an anticipated 9% increase in 2025, prices are forecasted to fall by 6% next year, thereby supporting households’ disposable income and decreasing companies’ cost base (against 2025-levels)7.

UK Oil and Gas Production

Problematically for the country’s energy security, the UK is no longer self-sufficient as energy imports have been outstripping energy exports for more than two decades now. Following the discovery of oil and gas fields in the North Sea in the 1970s, the UK became a net exporter of energy in 1981. North Sea production peaked in 1999 and since 2004, the UK has been an importer of energy again8. Over the past years, the US has replaced Norway as the country’s most important source of oil imports (US: 37%, Norway: 31%). Meanwhile, 25% of all gas imports are now LNG (of which 68% were from the US in 2024). Overall Norway remains the most important source of gas imports though, providing 76% of total gas imports in 20249.

UK Energy Dependency over Time by Energy Source

Source: Department for Energy Security and Net Zero

UK Oil and Gas Production

Source: North Sea Transition Authority

Following the closure of the Coryton refinery in 2013, the UK has also become a net importer of fuels. The shutting down of the Grangemouth refinery in April 202511 and the closure of Lindsey refinery in July 2025 exacerbated this trend, leaving the UK with only four major refineries12. When all sources are combined, 44% of the country’s energy consumed was imported in 2024, up by 4 percentage points on the previous year.

Looking ahead, UK oil and gas production is forecasted to fall further, making the country even more reliant on (hydrocarbon) energy imports. According to the UK government’s North Sea Transition Authority (NSTA), crude oil production is set to fall by 5.7% in 2025 (on top of a double-digit contraction in 2024) as fields continue to mature. Further reductions in output are pencilled in for the 2026-2030 period, with domestic crude oil production effectively halving between 2021 and 2030. UK gas extraction is also expected to drop: the NSTA expects a 9.8% decrease in 2025, after a 10.0% contraction in 2024. Between 2021 and 2030 oil and net gas production in the UK is forecasted to drop from 72.4 million tonnes of oil equivalent (mtoe) to 33.2 mtoe13. Until 2050, UK oil and gas production will fall by 90% (against 1999 levels, the peak production year), according to the NSTA14.

Labour Market

Meanwhile, employment in the sector has increased slightly over the past years. Latest data from the ONS shows that 566k people were working in the mining, energy and water supply sector (the ONS does not break down employment further) in Q2 2025, up by around 10k against the same period last year. In a medium-term comparison, employment has risen by 2.6% against Q2 2019 (when the sector employed 551k workers)15.

Employment in the UK Mining, Energy and Water Supply Industry (in thousands)

Source: ONS

Compared with other blue-collar industries, the energy sector is holding up well: in the same period, manufacturing has shed 11.3% of its workforce, construction has lost 11.8% of its workers and agriculture, forestry and fishing employment has dropped by 21.3%. The adjacent transport (and storage) sector has also seen a rise in employment levels: from 1,581k workers in Q2 2019 to now 1,663k employees (+4.3%). However, in an economy-wide perspective, employment growth in the energy sector is below average. Overall employment in the UK has increased by 3.8% in the past six years, standing at a new all-time high of 34.2m workers.

Looking ahead, in October 2025 the government has announced to create 400k additional jobs in the wider energy sector. Under the Clean Energy Jobs Plan, the Labour administration has vowed to recruit and train 400k workers in 31 priority occupations (including plumbers, electricians and welders) by 203016. In addition, 10k more workers are required at the Sizewell C nuclear power plant construction site (see below). Unfortunately, current reports from the Scottish government show that job growth in the renewables sector is currently not sufficient to compensate for losses in the traditional North Sea oil and gas sector (and supporting industries)17.

From a renumeration perspective, developments in the electricity, gas and water supply sector mirror the generally mediocre performance. Weekly earnings growth figures (including bonuses and arrears) were good but not stellar. Between September 2024 and August 2025, ONS data shows an average y/y growth figure of 5.7%18. In 2019 (the last year without Covid-caused distortions), the corresponding figure stood at 2.8%.

Average Y/Y Weekly Earnings Growth (including bonuses & arrears) Sep 2024 – Aug 2025 in %

Source:ONS

However, when compared to other sectors, the growth rate looks less impressive. Out of the 24 sectors covered by the ONS, 13 industries reported lower wage growth than the electricity, gas and water supply sector, 10 industries saw higher growth. Also noteworthy, inflation averaged 3.0% during the same period, thereby reducing the effects of the relatively high nominal wage increases somewhat.

Power Generation

The UK’s energy mix has changed significantly over the past decades. In September 2024, Ratcliffe-on-Soar power station, the last remaining operational coal-fired power station closed, bringing an end to 142 years of coal generating electricity in the UK19. Coal production in the UK has also virtually ended with the last large surface mine in Ffos-Y-Fran closing in late 202320.

At the same time, the proportion of energy produced from lowcarbon sources (renewables plus nuclear) has increased sharply over the past two decades. According to the government’s UK Energy in Brief 2025 Report, the country obtained 21.7% of its primary energy from low-carbon sources in 2024, up from 9.4% in 2000. The importance of nuclear energy has actually dropped over the past years as existing reactors are ageing and more renewables capacity is installed21. Between its peak in 2016 and 2024, nuclear power generation has fallen from 71.7TWh to 40.6TWh.

Proportion of UK Energy Supplied from Low Carbon Sources (in % of Total Energy Supplied)

Source: Department for Energy Security and Net Zero

Meanwhile, overall electricity production in the UK has fallen for the second year in a row in 2024: from 324.7TWh in 2022 to now 285.0TWh. As demand was stable, electricity imports made up for the shortfall. More than half of last year’s electricity production came from renewable sources (50.4%) and 2024 was the first year in which wind and solar generation surpassed gas-fired generation, according to UK Energy in Brief 2025 Report. The importance of fossil fuels for electricity production has fallen by a high 11 percentage points since 2021 and came in on a new alltime low in 2024: 36% of all electricity production was oil, gas or coal related last year.

Electricity Generated by Fuel Type 2024

Source: Department for Energy Security and Net Zero

The Challenges Ahead

Renewables

Looking ahead, the importance of fossil fuel for the UK’s energy and electricity production is likely to fall further. In order to achieve that, previous, Conservative-led UK governments have promised to fully decarbonise the power sector by 2035. The timeline was changed by the incoming Labour administration, now targeting 2030 as the new deadline for full decarbonisation22. This will require sizable investment in renewables (and, to a smaller degree, nuclear) as heating and transport systems will become more electrified. The UK’s National Energy Systems Operator (NESO) released new forecasts in mid-2025, now expecting electricity demand in the UK to rise by 30% until 2035, up by 8 percentage points23. Against this backdrop, the Labour government has reiterated that it remains committed to increasing offshore wind capacity to 50GW, onshore wind to 30GW and solar capacity to 47GW by 203024.

Positively, some progress has been made over recent years. Between Q2 2012 and Q2 2025 (latest available data), renewable electricity capacity in the UK has increased by 611% (to 62,103MW)25. Solar photovoltaics capacity grew by almost 40,000% (to 18,900MW), onshore wind by 315% (to 16,280MW) with offshore wind capacity rising by 1,492% (to 16,550MW capacity in Q2 2025). Offshore wind is particularly lucrative and the UK is already the second-biggest operational market (behind China). Dogger Bank A, one of the world’s biggest offshore wind farms (with a capacity of 1.2GW) has become operational in 2025 with the two remaining projects (Dogger Bank B and C) forecasted to be completed by 2027, generating another 2.4GW26. Planning on Dogger Bank D (capacity: 1.5GW) has also progressed recently with a seabed lease being completed in August 202527. However, the completion of Dogger Bank A had been delayed several times because of supply chain issues, its remote position more than 100km away from the coast, poor weather as well as vessel and worker shortages. All problems will likely re-occur at other off-shore projects28.

Also problematically, the recent renewables roll out growth rates, despite being impressive, are not sufficient to meet the aggressive decarbonisation targets. Offshore wind capacity would need to treble while solar and onshore wind output would need to double, all also posing a severe strain on the UK’s unprepared power grid. Positively in this light, National Grid is now receiving an additional GBP8bn via the government’s Electricity Transmission Partnership (ETP)29. The initiative will replace traditional short-term contracts with long-term, regional agreements with around 130 projects expected to be completed by 2031. The ETP is a part of wider large-scale grid upgrade project (called RIIO-T3, budget: GBP35bn), the biggest electricity grid improvement in 70 years30.

That said, the National Energy Systems Operator estimates that grid investment of around GBP60bn in required to remove bottlenecks, especially along the Scottish-English border31. Also problematically, fierce opposition from locals can be expected, this will slow down the construction of new lines. Meanwhile, GB Energy (a publicly-owned green power company) has been created in May 202532. While the company’s budget of GBP8.3bn will help to achieve the UK’s ambitious decarbonisation targets, critics say that it is too small to make a significant difference.

Furthermore, renewable energy projects, like all investment projects have been impacted by higher interest rates and double-digit inflation rates in 2022-23. In 2023, Swedish energy giant Vattenfall cancelled plans for a 140-turbine offshore wind development in the North Sea as costs had increased by 40%33. In Scotland, Community Windpower put its Sanquhar II onshore project on hold after development costs had increased from GBP300m to GBP500m34. More recently, in 2025, Danish developer Orsted abandoned its Hornsea 4 offshore wind farm in East Yorkshire (capacity: 2.4GW), citing “adverse economic developments”. Furthermore, BP has cancelled its green hydrogen project in Teeside in March, also because of financial reasons35. These decisions tie in nicely with research from consultancy firm Cornwall Insight. According to their analysis, around two thirds of renewable energy projects in the UK were cancelled in the planning stage between 2018 and 202336.

Positively, interest rates are declining gradually again and commodity prices have moderated somewhat as well. In the solar industry, which is dominated by Chinese producers (accounting for 85% of global solar panel output37 and 68% of British solar panel imports in 202438), prices for panels have fallen by around 75% between 2021 and mid-2025 because of immensely increased supply from China39. While this is enabling costeffective capacity increases in Europe, it is also putting domestic producers at risk of bankruptcy while simultaneously creating exposure to communist-led China.

Nuclear

Problematically, four of the country’s five operational nuclear power plants (all operated by EDF) are reaching the end of their life span over the next years. Hartlepool and Heysham1 were scheduled to go offline in 2026 with Heysham 2 and Torness following in 2028. However, in late 2024, schedules were adjusted with Hartlepool and Heysham 1 now being decommissioned in 2027 and Heysham 2 and Torness closing down in 203040. Sizewell B (the last remaining reactor, opened in 1995) was scheduled to be decommissioned in 2035 but EDF has announced plans to extend its life by at least 20 years41.

Currently, only Hinkley Point C is under construction, a nuclear power plant that will include two 1,630Mw reactors. It is privately built and operated (also by EDF) but the UK government is ensuring the owner’s returns through so called “contracts for difference” and is hence financially liable. Problematically, the project is already several years behind plan and significantly above budget. Initial estimates foresaw costs of GBP18bn and the project to be completed by 2025. However, these targets have since then slipped immensely. Currently, experts expect the power plant to go online in in the early 2030s and costs to come in at around GBP40bn42.

Despite the immense delays and cost increases at Hinkley Point C, the UK government is committed to investing in nuclear energy going forward. Ahead of its Spending Review in June 2025, the administration has allocated more than GBP14bn of taxpayers’ money to the Sizewell C project (another nuclear power plan that, ten years in, is still in the planning phase though)43. According to government estimates, the project will create 10,000 jobs and create carbon-free electricity for up to 6m homes. That said, it is already severely delayed and construction will take around 10 years, making this a medium to long-term project.

Insolvency Risk

As energy prices are a significant input cost for almost every sector, insolvency risk is directly linked to industrial gas and electricity prices. Worryingly, the UK had the highest industrial electricity price in the IEA in 2023, coming in at 25.85 pence per kWh (the IEA average stood at 17.70 pence). Industrial gas prices are more competitive though: 5.58 pence per kWh, below the IEA median of 6.00 pence44. Worryingly, data from the ONS shows that output in energy intensive industries in the UK have fallen significantly over the past years: between Q4 2021 (before the start of the Russia-Ukraine war) and Q4 2024, gross value added in the paper industry has dropped by 28.9%, by 30.2% in the petrochemical industry and by 46.5% in basic metals and castings manufacturing. Overall, output in energyintensive industries in the UK now stands on the lowest level in 35 years.

Industrial Electricity and Gas Prices 2023 (in pence per kWh)

Source: International Energy Agency

Positively in this light, the government has vowed to tackle this international price competitiveness issue over the next years and electricity prices for commercial consumers will drop going forward. In mid-2025, the 10-year industrial strategy was announced, including several measures to lower energy prices for companies. The British Industrial Competitiveness Scheme (BICS) will have the biggest impact: eligible manufacturers will be exempt from certain energy-related charges and tariffs such as the renewables obligation, the feed-in-tariff and capacity market charges. These account for roughly GBP40 per MWh of a typical manufacturing company; the scheme could reduce electricity costs by up to 25% for certain businesses. BICS will become operational in 2027 and eligibility will depend on electricity intensity, the sector and the company’s importance for the UK economy. It is currently expected that around 7,000 companies will qualify for it with a heavy focus on steel, chemicals, ceramics, glass, aerospace and automotive45.

Gross Value Added in Chained Volume Measures (Index 2015 = 100)

Source: ONS

Encouragingly, BICS is the second measure in just over one year that a British government has launched in order to support energy-intensive companies. It comes on top of the British Industry Supercharger Programme which came into effect on 1 April 2024. The programme targeted around 370 companies in electricity intensive sectors (employing around 400k workers), lowering their costs by around GBP24-GBP31 per MWh46.

The recently announced measures are positive news for credit risk in energy-intensive industries in the UK. Sadly, the energy sector has seen some high-profile failures this year: in June, Prax Lindsey oil refinery went into administration over loan irregularities47, a development that will also impact on the company’s retail arm which owns 87 forecourts in the UK48. In October, energy service firm Petrofac (which employs 2,000 workers, mainly in Scotland) went under. The North Sea-focussed company lost a major offshore wind contract from Dutch grid operator TenneT which ultimately led to the collapse of the firm. Share trading had already been suspended in May and the company had also been investigated by the Serious Fraud Office. Following several profit warnings over the past quarters, the collapse does not come as a surprise but it highlights the elevated risks in the North Sea energy sector.

Despite the recent insolvencies, business failure risk in the energy sector is still generally low though, according to data from the government’s Insolvency Service49. In 2024, less than 90 companies that were involved in oil or gas extraction, manufacturing of energy sector related equipment and the generation or distribution of electricity and gas went under in England and Wales. At the same time, overall insolvency figures stood at 23,877, down by 5% against the 30-year high recorded in 2023.

Company Insolvencies in England and Wales

Source: Insolvency Service

The low insolvency risk in UK energy is not surprising, given the small size of sector, relative to the active business universe. However, year to date figures for 2025 show immense movements in bankruptcies in the industry, also caused by the small size of the sector. For example, business failures in crude petroleum and natural gas extractions have doubled in the first eight months of this year. That said, in absolute numbers, the increase is much less concerning: insolvencies rose from 1 to 2 failures. Worryingly, in aggregated terms, the energy sector has seen a 20% y/y increase in company insolvencies in England & Wales in January to August 2025, compared with a stagnation in overall figures.

The Transport Sector

Meanwhile, the UK haulage sector (which sits adjacent to the domestic energy sector) faces a set of challenges. While rising labour costs (a consequence of the 2024 Autumn Budget which increased minimum wages and national insurance contributions) are felt in other industries too, the transport sector also displays unique problems, ranging from workforce demographics to elevated insolvency risk.

Problematically, around 55% of all HGV drivers in the UK are between 50 and 65 years old which will add to persistent labour shortages over the medium-run50. Because of unsociable working hours away from home, poor roadside conditions and a generally negative image, the sector is already struggling to attract new employees. As a result, the industry is currently lacking 50,000 drivers, according to the Road Haulage Association with Brexit also having caused an outflow of personnel over the past five years.

Higher operating costs, caused by wage growth and increased fuel expenses coincide with generally meagre infrastructure conditions, especially in rural parts of the UK. Wear and tear has become an increasing issue with poor road surfaces and road closures also causing costly delays. In a 2023 survey, less than 50% of freight and coach businesses were satisfied with the state of UK motorways and major A roads51.

Amidst these challenges, it does not surprise that business failure risk remains a key issue. Half of the transport sector companies that have been incorporated since 2019 have already gone under or ceased trading52. At the same time, insolvency risk has gone up quickly over the past years, according to data from the UK government. While 282 road freight transport companies went bankrupt in England and Wales in 2019 (the year before Covid), this figure has increased to a new all time high of 501 in 2023 before moderating slightly in 2024. However, even with another improvement in 2025 (in January-August 2025, figures have fallen by 14% y/y), insolvency risk in the road haulage sector is likely to remain above its pre-Covid readings for the next years.

Company Insolvencies in the Road Freight Transport Sector in England and Wales

Source:Insolvency Service

Looking ahead, the transport industry will also have to invest heavily in new technologies. HGVs account for a sizable 6% of UK greenhouse emissions and the sector is under political (and reputational) pressure to decarbonise quicker. At the same time, creating (or improving) digital and AI capabilities will also feature heavily on companies’ to do list as it is a prerequisite to improve supply chain management and profitability (and also helps to achieve environmental targets).

-----------

About Tokio Marine HCC

Tokio Marine HCC is a leading specialty insurance group conducting business in approximately 180 countries and underwriting more than 100 classes of specialty insurance. Headquartered in Houston,Texas, the company comprises highly entrepreneurial teams equipped to underwrite special situations, companies and individuals, acting independently to deliver effective solutions. Our products and capabilities set the standard for the industry, as many of our employees are industry-leading experts.

-----------

Related links

[1] https://www.bbc.com/news/articles/cx238yyr40qo

[2] https://markets.ft.com/data/commodities/tearsheet/summary?c=Brent+Crude+Oil

[3] https://fred.stlouisfed.org/categories/32217

[4] https://www.iea.org/commentaries/as-oil-market-surplus-keeps-rising-something-s-got-to-give

[5] https://www.spglobal.com/commodity-insights/en/news-research/latest-news/crude-oil/100725-oil-prices-to-decline-as-global-oversupply-builds-through-2026- us-eia

[6] https://www.ons.gov.uk/economy/economicoutputandproductivity/output/datasets/systemaveragepricesapofgas

[7] https://blogs.worldbank.org/en/opendata/natural-gas-markets--price-swings-amid-a-shifting-global-landsca

[8] https://assets.publishing.service.gov.uk/media/688890c3a11f859994409132/UK_Energy_in_Brief_2025.pdf

[9] https://assets.publishing.service.gov.uk/media/688890c3a11f859994409132/UK_Energy_in_Brief_2025.pdf

[10] https://www.bbc.com/news/articles/cm24jlm08y9o

[11] https://www.bbc.com/news/articles/cql0n9dp7xwo

[12] https://www.bbc.com/news/articles/cvg3gwkkk4mo

[13] https://www.nstauthority.co.uk/data-and-insights/insights-and-analysis/production-and-expenditure-projections/

[14] https://www.gov.uk/government/news/government-to-unleash-the-north-seas-clean-energy-future

[15] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employmentbyindustryemp13

[16] https://www.bbc.com/news/articles/c3vnr45x5qyo

[17] https://www.bbc.com/news/articles/cz0x19rx0x2o

[18] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

[19] https://www.neso.energy/energy-101/great-britains-monthly-energy-stats

[20] https://assets.publishing.service.gov.uk/media/66f423473b919067bb48270e/Energy_Trends_September_2024.pdf

[21] https://assets.publishing.service.gov.uk/media/688890c3a11f859994409132/UK_Energy_in_Brief_2025.pdf

[22] https://www.gov.uk/government/publications/clean-power-2030-action-plan/clean-power-2030-action-plan-a-new-era-of-clean-electricity-main-report

[23] https://www.techerati.com/news-hub/uk-energy-demand-forecast-increased-to-30-report/

[24] https://www.edie.net/uk-government-publishes-10-year-infrastructure-strategy-promises-clean-energy-workforce-plan/

[25] https://www.gov.uk/government/statistics/energy-trends-section-6-renewables

[26] https://www.imperial.ac.uk/news/265054/dogger-bank-learning-lessons-from-worlds/

[27] https://doggerbank.com/press-releases/sse-and-equinor-finalise-seabed-lease-to-progress-dogger-bank-d/

[28] https://www.rechargenews.com/markets-and-finance/new-delay-to-worlds-largest-offshore-wind-farm-dogger-bank/2-1-1849707

[29] https://www.edie.net/national-grid-announces-8bn-clean-energy-infrastructure-overhaul/

[30] https://www.gatherinsights.com/blog/all-you-need-to-know-about-national-grids-ps35bn-investment-plan-riio-t3

[31] https://www.nationalwealthfund.org.uk/blogs/unlocking-investment-unblock-uks-power-grid

[32] https://energysavingtrust.org.uk/great-british-energy/

[33] https://www.weforum.org/stories/2023/11/why-offshore-wind-cost-pressures-rising/

[34] https://www.edie.net/report-rising-costs-threaten-wind-power-industrys-viability/

[35] https://fuelcellsworks.com/2025/03/05/hydrogen/bp-cancels-first-uk-green-hydrogen-project-amid-strategic-shift

[36] https://www.theguardian.com/business/article/2024/jun/24/green-energy-projects-great-britain-planning-renewables

[37] https://ember-energy.org/latest-insights/china-solar-cell-exports-grow-73-in-2025/

[38] https://www.bbc.com/news/articles/c1lj21pjn72o

[39] https://ember-energy.org/latest-insights/china-solar-cell-exports-grow-73-in-2025/

[40] https://www.bbc.com/news/articles/c33dvekx021o

[41] https://namrc.co.uk/intelligence/uk-new-build/

[42] https://www.tradingview.com/news/invezz:cb02f0a4f094b:0-apollo-backs-4-5bn-loan-for-delayed-hinkley-point-c-nuclear-plant/

[43] https://www.bbc.com/news/articles/c4gr3nd5zy6o

[44] https://www.ons.gov.uk/economy/economicoutputandproductivity/output/articles/theimpactofhigherenergycostsonukbusinesses/2021to20

[45] https://ngpltd.co.uk/why-bics-could-be-a-defining-moment-for-uk-manufacturing/

[46] https://www.bbc.com/news/articles/c33dvekx021o

[47] https://namrc.co.uk/intelligence/uk-new-build/

[48] https://forecourttrader.co.uk/news/87-forecourts-up-for-grabs-as-administrators-unpick-prax-insolvency/708473.article#toggle

[49] https://www.gov.uk/government/statistics/company-insolvencies-september-2025

[50] https://www.grantthornton.co.uk/insights/haulage-sector-faces-significantheadwinds/

[51] https://www.transportfocus.org.uk/news/less-than-half-of-lorry-and-coachcompanies- satisfied-with-englands-major-roads/

[52] https://www.addleshawgoddard.com/en/insights/insights-briefings/2025/ transport/heavy-goods-hazards-new-horizons-challenges-opportunities-ukhaulage/