Monday 16 February 2026

- Thought Leadership

UK Retail Sector Report : February 2026

Summary

- The UK retail sector remains subdued: while retail sales volumes improved modestly in 2025, they are still below pre-pandemic levels, with growth heavily reliant on promotions and selective consumer behaviour.

- Inflation has persisted above the Bank of England’s 2% target, with CPI reaching 3.4% in December 2025. This continues to erode household purchasing power and keeps consumer confidence fragile.

- Labour costs have risen further, driven by increases in the National Living Wage and higher employer national insurance contributions, both of which have a disproportionate impact on retail margins and hiring appetite.

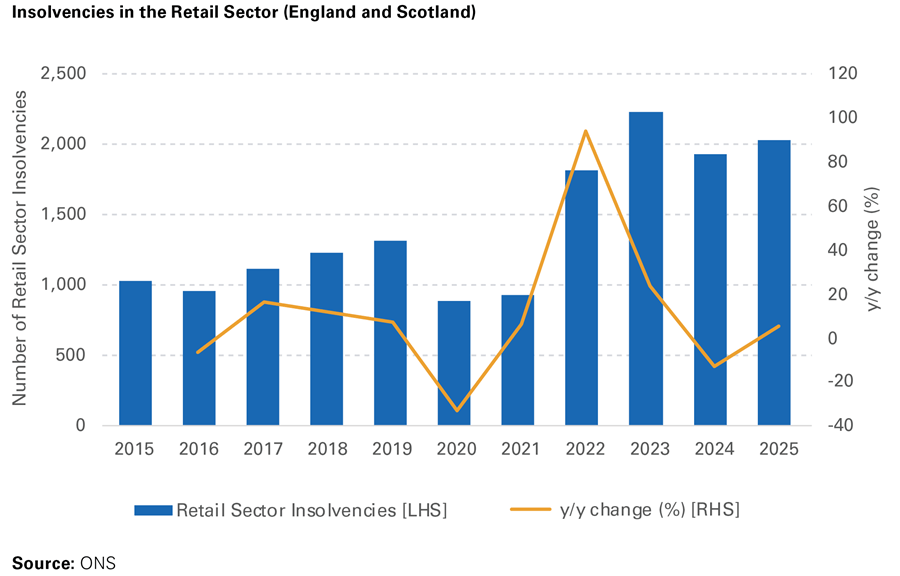

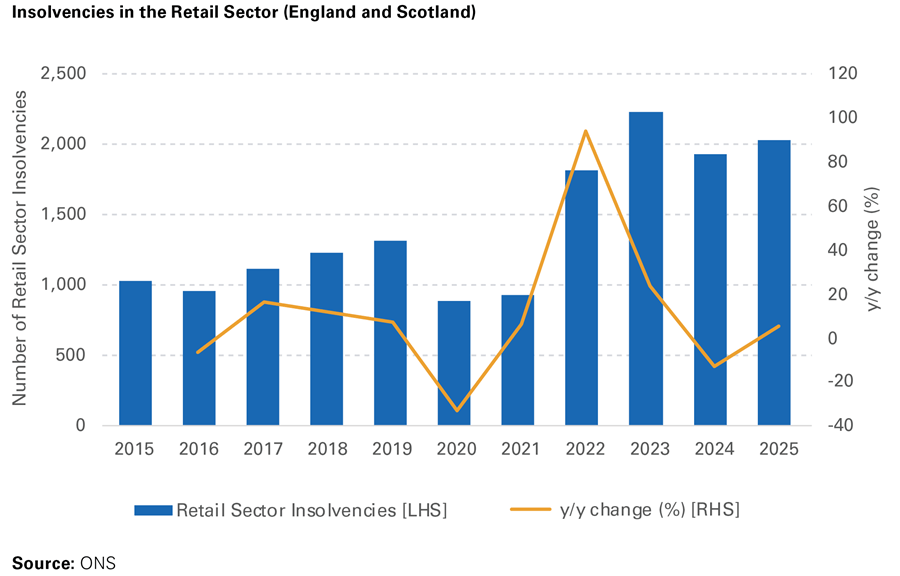

- Retail insolvencies remained elevated in 2025 (increasing more than 5% over 2024) and early 2026, with business failures stabilising but refinancing conditions and credit access remaining tight, especially for smaller firms.

- The sector’s outlook is characterised by weak macroeconomic growth, ongoing fiscal constraints, and persistently high household savings rates, all of which limit discretionary spending and keep demand uneven.

- Long-term trends such as AI adoption are likely to succeed but require deep understanding of the data it produces and being able to react to changes quickly. However, it’s clear the consumers still value in-person customer experiences.

To view a PDF version, click here

Key Trends in 2025

Retail sales volumes in the UK saw modest improvement through 2025, but remain

below pre-pandemic levels, reflecting ongoing weakness in underlying demand. The

sector continues to face significant headwinds, with employment contracting further

and wage growth staying elevated – driven by increases in the National Living Wage

and higher national insurance contributions, both of which disproportionately affect

retail. Cost pressures, policy uncertainty, and subdued consumer confidence are

constraining recovery, while selective consumer behaviour keeps growth uneven and

heavily reliant on promotions.

Retail Sales Figures

The UK retail sector remains under pressure, with modest improvements in headline sales continuing to mask weakness in underlying

demand. While real wage growth has been positive for much of the past year, elevated inflation in essential items and persistently

cautious consumer backdrop have constrained discretionary spending. Retail sales volumes increased 1.3% in 2025 compared to 0.2%

growth in 2024, but overall activity remains subdued relative to pre-pandemic levels and uneven across categories.

Short-term dynamics over the final months of 2025 underline the fragility of demand. Retail sales volumes declined in both October (-0.9% m/m) and November (-0.1%), despite extensive Black Friday discounting, before recovering modestly in December (+0.4%). As a result, overall performance during the Golden Quarter fell short of expectations. On a quarterly basis, Q4 2025 sales volumes declined 0.3% compared to Q3, although they were 2.0% higher year-on-year, largely reflecting a weak outturn in Q4 2024 rather than a material strengthening in underlying momentum1.

Footfall data reinforce this cautious picture. British Retail Consortium (BRC) and Sensormatic figures show that footfall across high streets and shopping centres continued to decline in December (-2.9% y/y), indicating ongoing pressure on physical retail formats2 . However, Boxing Day data highlighted increasingly targeted consumer behaviour. Footfall remained below the previous year until mid-afternoon before rebounding strongly into the evening, with total footfall later in the day up 4.4% y/y. Retail parks outperformed other formats in particular, recording an 8.8% increase, suggesting consumers are increasingly combining online research with focused, value-driven in-person shopping trips rather than engaging in prolonged browsing.

Retail performance has been highly uneven across sectors. Supermarkets continued to outperform during the Golden Quarter, supported by resilient demand for essentials and effective promotional strategies, while department stores underperformed, with ONS data pointing to persistently weak sales volumes through late 2025 amid subdued footfall and limited discretionary appetite. Among non-food retailers, operators with strong omnichannel models and clear value propositions, including NEXT3 and Currys4, delivered relatively robust trading, whereas discretionary-focused and large-format retailers such as Asda, JD Sports5 and B&M struggled, reflecting heighted price sensitivity and ongoing pressure on non-essential spending.

Structural pressures across the sector have become increasingly visible. A number of high-profile retail failures occurred in late 2025 and early 2026, including Game Retail6, Claire’s, Original Factory Shop and Saks Fifth Avenue7 , alongside CVAs and restructurings at Poundland, River Island8 and Hobbycraft. These developments reflect the combined impact of weak discretionary demand, sustained margin pressure from discounting, and rising operational and financing costs.

Overall, retail sales entering 2026 point to a sector still adjusting

to structurally weaker demand and increasingly selective

consumer behaviour. Although real wages remain higher than

a year ago and consumer confidence has improved modestly,

elevated essential costs, high household savings rates and

ongoing cost pressures for retailers suggest that sales growth is

likely to remain modest, uneven and promotion-dependent over

the near term.

Online Sales

Online sales continued to increase their share of total UK retail activity towards the end of 2025, underscoring the ongoing structural

shift in consumer purchasing behaviour amid a still-challenging macroeconomic environment. ONS data shows that by December

2025, online sales penetration had risen to around 28.3%, the highest in four years, compared with 27.5% in August 2025 and 26.7%

a year earlier9. This expansion took place against a backdrop of subdued high-street footfall and persistent cost-consciousness among

consumers, suggesting that growth in online channels remains driven more by behavioural and pricing dynamics than by a broad-based

recovery in discretionary demand.

Adoption rates, however, continue to vary widely across retail sub-sectors: less than 10% of food shopping is conducted online,

reflecting logistical constraints and entrenched consumer preferences, while categories such as textile, clothing and footwear stores

as well as household goods show markedly higher ecommerce penetration10. These segments remain particularly responsive to

online promotions and price comparison, reinforcing the role of ecommerce as the primary channel for discretionary and non-essential

spending.

In value terms, online retail sales gained momentum towards

the end of 2025. In December, average weekly internet sales

grew 11.1% y/y, the strongest monthly growth in more than four

years, following 7.4% in November and just 1.9% in December

202411. While this acceleration partly reflects easier base effects,

it also points to a concentration of demand around promotional

periods, with discounting and extended seasonal sales playing

a central role. As such, growth in online sales values is likely to

have been driven by a combination of higher transaction volumes

and promotional pricing, rather than a material improvement in

underlying pricing power.

The 2025 holiday period further highlighted the continued

strength of online channels. Adobe Digital Insights12 estimates

that £26.9bn was spent online across November and December

2025 – while online retail spending for the year reached

approximately £118.5bn, a new record level, albeit with modest

year-on-year growth. Key trading events such as Black Friday

and Cyber Monday remained critical drivers of online demand

with UK shoppers spending an estimated £3.8bn online over the

four-day period, up 4.6% on the previous year, supported by deep

discounting across categories including electronics, apparel and

household goods.13

Within this broader trend, social commerce platforms continued

to gain importance. TikTok Shop, in particular, recorded a 50%

y/y increase in sales during Black Friday and Cyber Monday,

alongside strong growth in small business participation.14 While

still relatively small in absolute terms, the rapid expansion

of social and live-stream commerce points to a gradual

reconfiguration of online demand channels, especially among

younger and price-sensitive consumers.

Consumer behaviour at the turn of the year remained shaped

by ongoing integration of online and offline shopping. Early

Boxing Day indicators showed that while initial physical footfall

lagged, stronger evening activity suggested increasingly blended

purchasing patterns, with consumers using online tools for

research, price comparison and deal discovery before making

targeted in-store purchases. Public commentary from the period

also highlighted the growing use of digital and AI-enabled tools to

optimise spending decisions, reinforcing the role of ecommerce

as a cost-minimisation channel rather than a purely convenience-

driven one.

Inflation

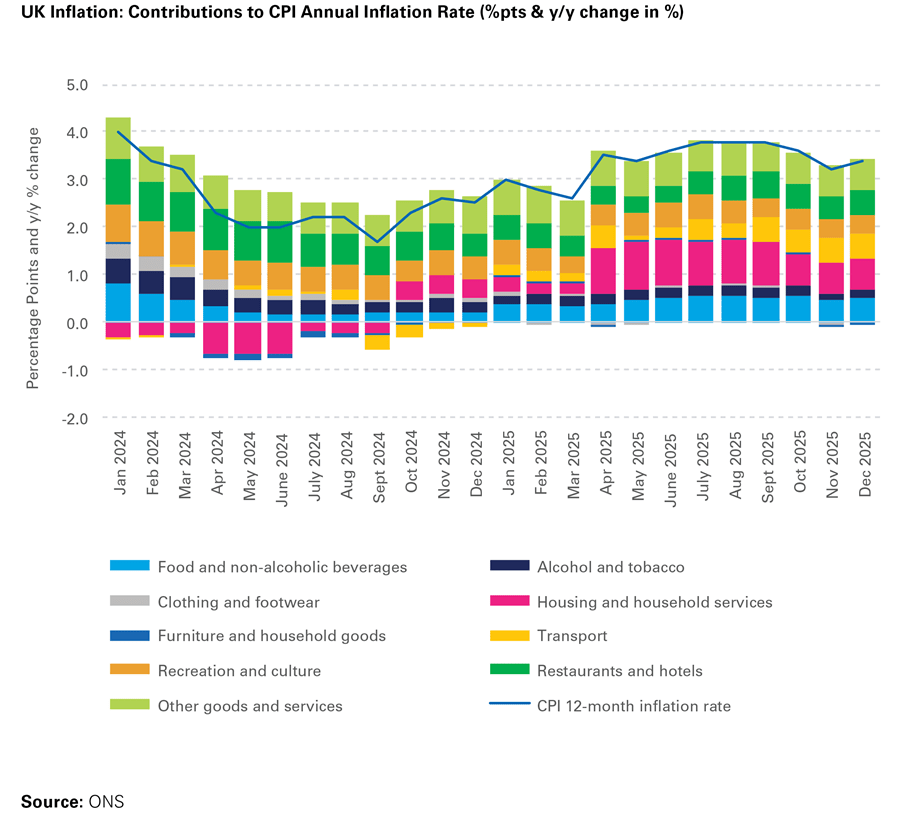

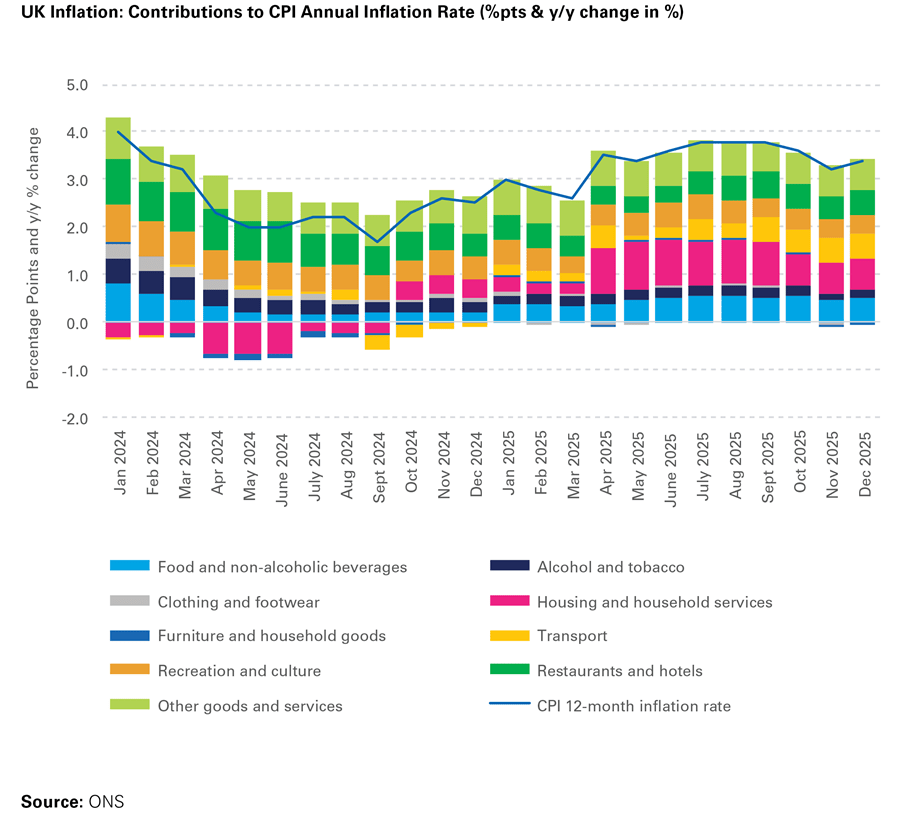

Cost inflation remains a persistent challenge for both retailers and the broader UK economy. After a period of relative disinflation earlier

in 2025, headline consumer price inflation (CPI) picked up again in the final months of the year. CPI rose to 3.4% in December 2025,

up from 3.2% in November. Core inflation, which strips out volatile items such as energy and food, remained at 3.2%, unchanged from

November. Although these levels are down from mid-2025 peaks (CPI of 3.8% in August 2025), inflation remains well above the Bank of

England’s 2.0% target, highlighting the persistence of price pressures.

A closer breakdown shows that inflation continues to be driven

by both goods and services, though the pattern is uneven. In

goods markets, essential items such as food and non-alcoholic

beverages and transport costs each contributed 0.5 percentage

points of the 3.4% headline CPI rate, while housing and

household services contributed 0.6 percentage points15. Service

sector inflation continues to be felt at 4.1%, reflecting ongoing

pressures from labour costs and other operational expenses. The

combination of sticky service inflation and continued growth in

essential goods has flattened the disinflation profile observed

earlier in 2025, preventing headline CPI from falling below 3% as

the year closed.

Labour cost pressures have been a particularly durable source

of inflationary tension. The National Living Wage rose by 4.1%

to £12.71 per hour, with younger cohorts facing even larger

increases: 8.5% for 18-20-year-olds and 6.0% for 16-17-year-

olds16. These wage uplifts, combined with earlier increases in

national insurance contributions, have contributed to raised core

inflation, particularly in services, and complicated the disinflation

path for the wider economy and for retailers’ margins.

Monetary policy has remained cautious in response. At its

February 2026 meeting, the Bank of England’s Monetary Policy

Committee opted to hold the Bank Rate at 3.75%, citing ongoing

inflation above target and a delicate outlook for price stability

and economic growth17. While inflation is expected to moderate

gradually through 2026, the decision not to cut rates underscores

the stickiness of inflation and the limited room for further

monetary loosening.

Overall, inflation in early 2026 remains above target and

somewhat persistent, driven by labour cost pass-through and

continued price growth in essential household items. This

environment continues to pose challenges for retailers’ pricing

strategics, wage negotiations, and margin management, as well

as for policymakers seeking to achieve a sustained return to the

BoE’s 2.0% inflation target.

Labour Market

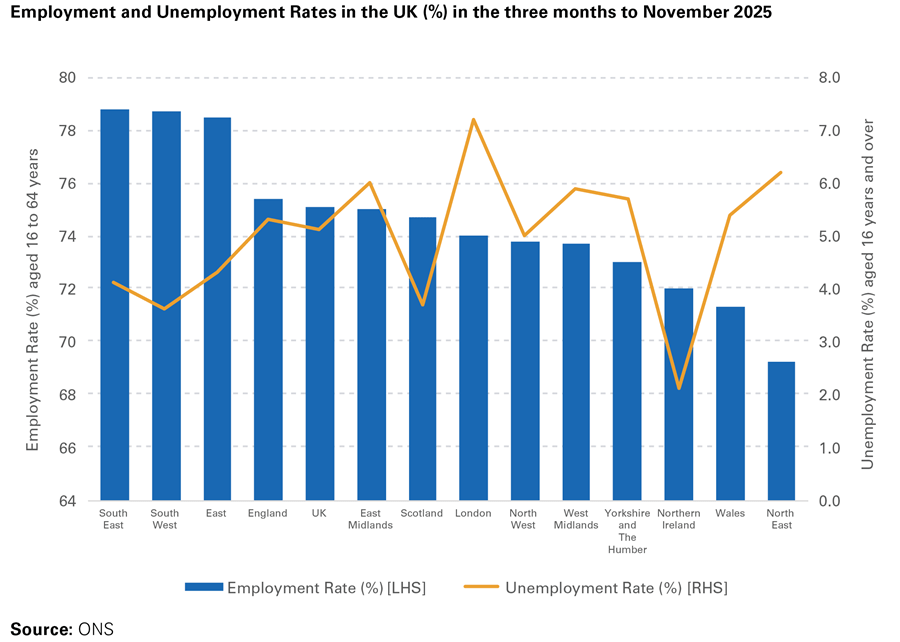

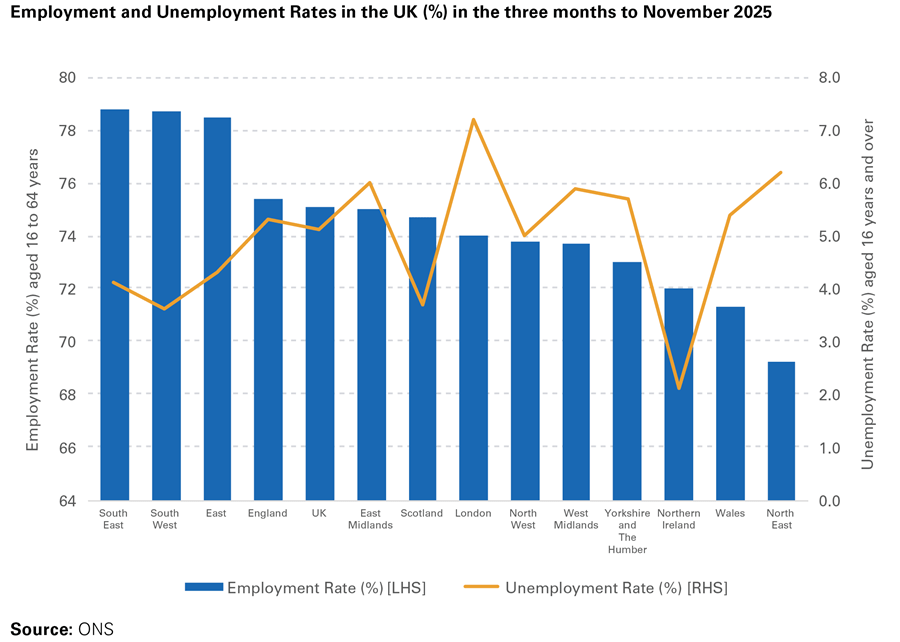

The UK labour market showed further signs of weakening through late 2025, with implications for retail employment and hiring activity.

The UK unemployment rate stood at 5.1%18 in the three months to November 2025, up on both the quarter and the year, and near

its highest level in several years, reflecting a softening in labour demand across the economy. The employment rate for people aged

16-64 was estimated at 75.1%, broadly unchanged on the previous three months but slightly up on a year earlier, while the economic

inactivity rate for the same age group remained elevated at about 20.8%, suggesting that higher joblessness is occurring alongside

continued labour-market detachment. Regional variations exist with the south and east of the country seeing considerably higher rates of

employment than the north.

Labour demand continued to ease. Early ONS estimates for

vacancies indicated that total UK job vacancies were broadly

unchanged into late 2025, with around 729,000 vacancies in the

three months to November, slightly below the levels of mid-2025

and a substantial decline from pandemic-era highs. Vacancies

have been on a multiyear downward trend, with quarterly declines

recorded in most periods since 2022, pointing to increasingly

subdued hiring intentions among employers. The vacancy rate in

September to November 2025 was 2.5 unemployed people per

vacancy, up from 1.9% in the same period in 2024.

Within retail specifically, anecdotal and sectoral indicators point to

continued weakness in recruitment demand. Retailers reported

that the slower pace of consumer spending through the latter part

of 2025, including a subdued Golden Quarter, reduced the need

for seasonal and entry-level hiring, while cost pressures have weighed on capacity to expand payrolls. This is consistent with

broader labour market signals from employer surveys suggesting

that recruitment difficulty has eased but that employers remain

cautious about adding staff.

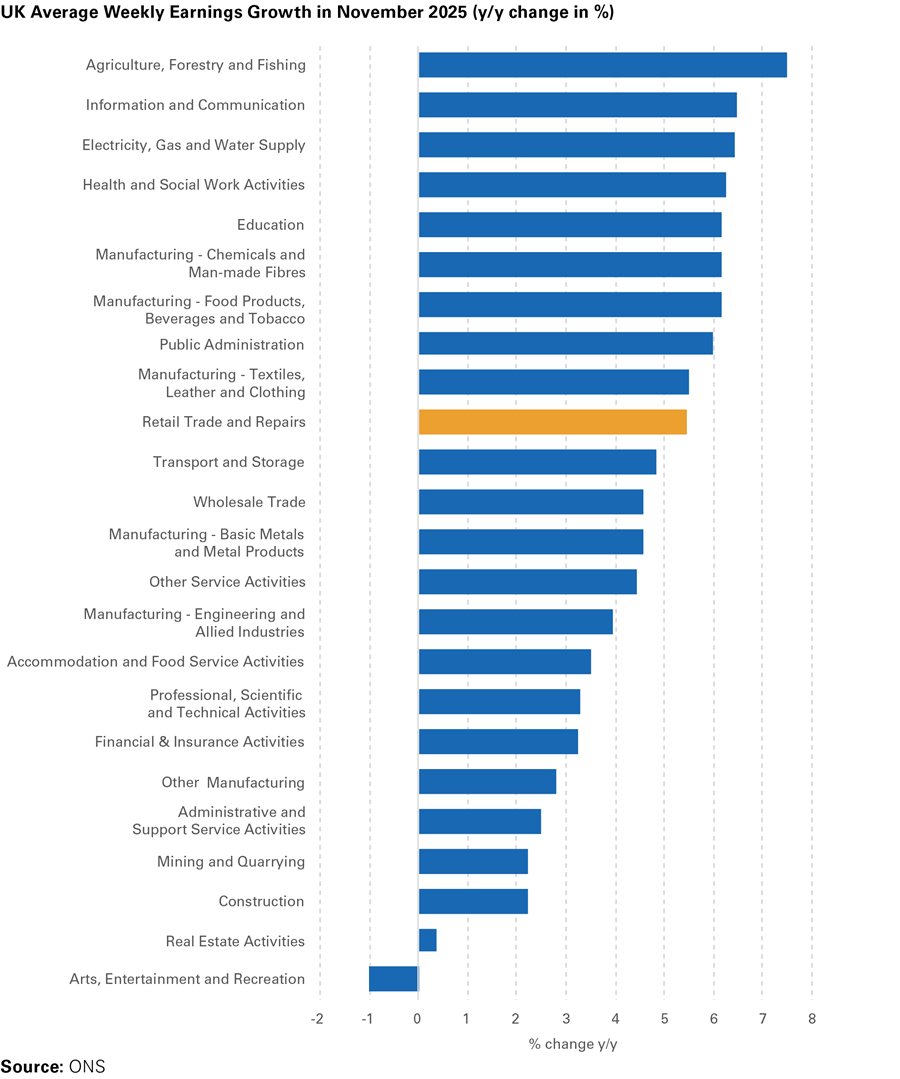

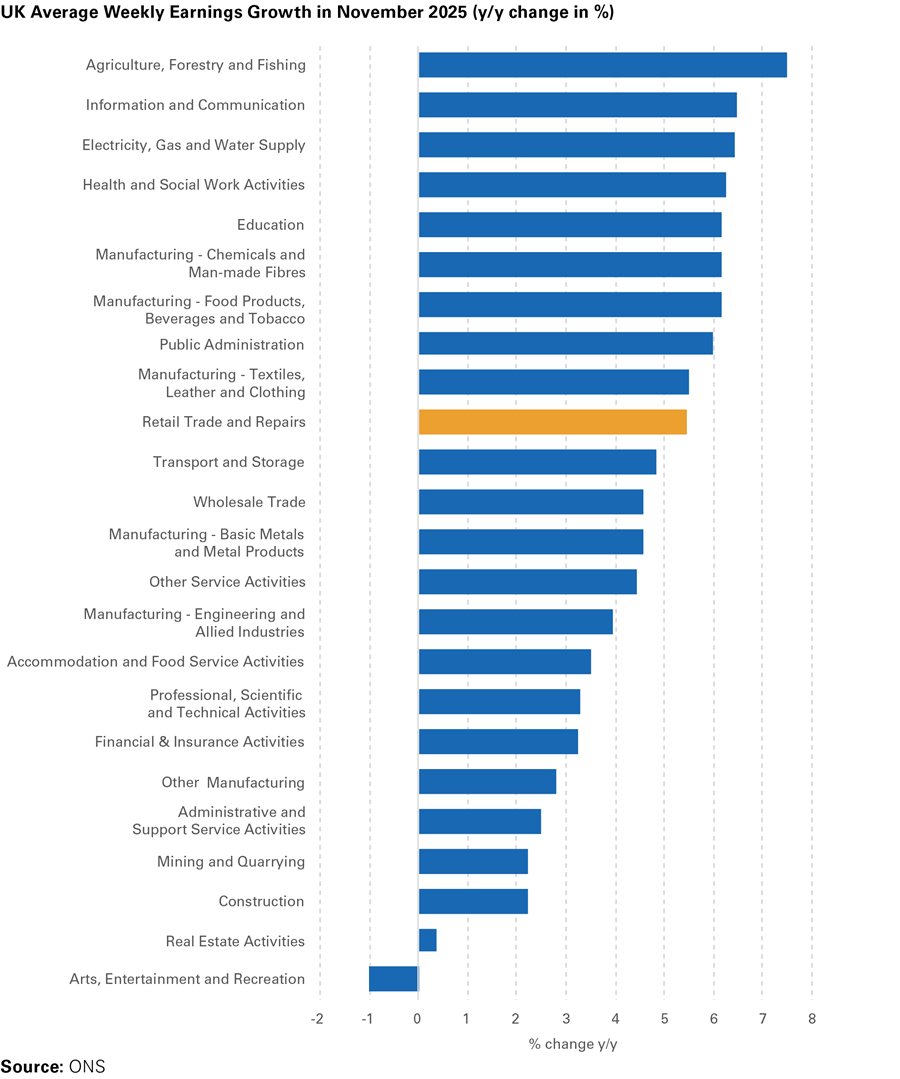

Recent ONS data towards the end of 2025 shows average

annual growth in regular pay of around 4.7-4.8%, with total

earnings growth only marginally lower, indicating that pay rises

have persisted even as demand for labour has softened. The

retail sector, in particular, has continued to face higher wage

costs following increases in the National Living Wage and other

statutory labour cost changes – in November rising 5.5% y/y.

Given that the retail workforce traditionally includes a high share

of younger and part-time workers – a group disproportionately

affected by minimum wage uplifts – these structural cost

pressures remain a drag on profitability and hiring appetite.

Youth and entry-level employment conditions have been

particularly challenged. Broad ONS labour market indicators

show that the number of claimants and unemployed individuals

in younger age cohorts rose through 2025, while the overall

unemployment rate climbed19. Combined with weaker demand

for seasonal staff in the latter part of the year, this suggests

opportunities for younger workers – a key constituent of the

retail labour pool – have not recovered strongly and remain

constrained20.

Overall, labour market conditions entering early 2026 reflect a

softening in hiring demand, persistent cost pressures and rising

unemployment, particularly among entry-level workers. For

UK retail, this translates into constrained recruitment, limited

expansion of workforce levels and continued emphasis on staffing

flexibility and cost control rather than broad employment growth.

With macroeconomic forecasts pointing to further labour market

cooling through 2026, retailers are likely to remain cautious on

hiring amid ongoing uncertainty in consumer spending and cost

trends.

Outlook for 2026

Looking ahead, the factors that weighed on UK retail performance in 2024-25 show little

sign of dissipating in the near term. The macroeconomic backdrop remains subdued,

consumer confidence is stabilised but still muted by historical standards, and household

savings rates remain strong, continuing to constrain discretionary spending. While real

incomes have improved for some households, selective purchasing behaviour and ongoing

pressure from essential costs suggest that consumer demand is unlikely to recover

decisively in 2026.

Against this backdrop, operating conditions across the sector

remain challenging. Retail insolvencies are expected to stay

elevated, particularly among operators with weak balance sheets,

limited differentiation or high exposure to discretionary categories.

At the same time, fiscal constraints and the fragile state of public

finances limit the scope for policy support and raise the risk of

further cost or tax pressures for businesses.

Longer-term structural forces continue to shape the sector’s

trajectory. Investment requirements linked to digitalisation, data

analytics, AI adoption and ESG compliance remain significant,

weighing on near-term margins but also offering opportunities

for retailers able to deploy capital effectively. As a result, 2026

is likely to be characterised less by recovery than by continued

adjustment, with cost discipline and targeted strategic investment

determining relative performance in an increasingly polarise retail

landscape.

Macroeconomics

The UK economy entered 2026 in a state of slow and uneven

expansion, with both domestic and external headwinds

constraining growth. Real GDP growth in 2026 is expected to

be modest at best – likely around 1.0%, reflecting sustained

weakness in consumption and investment21. Business investment

growth is forecast to remain subdued or contract modestly,

further limiting the scope for a cyclical upswing.

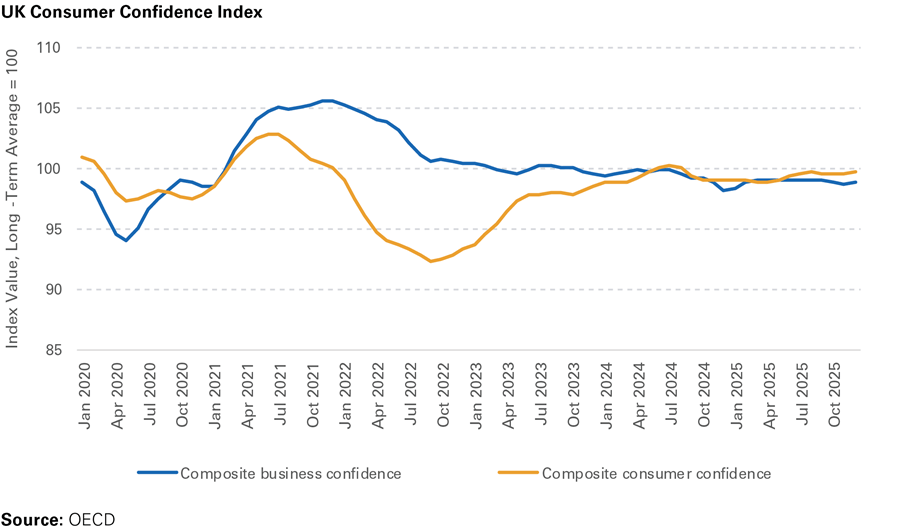

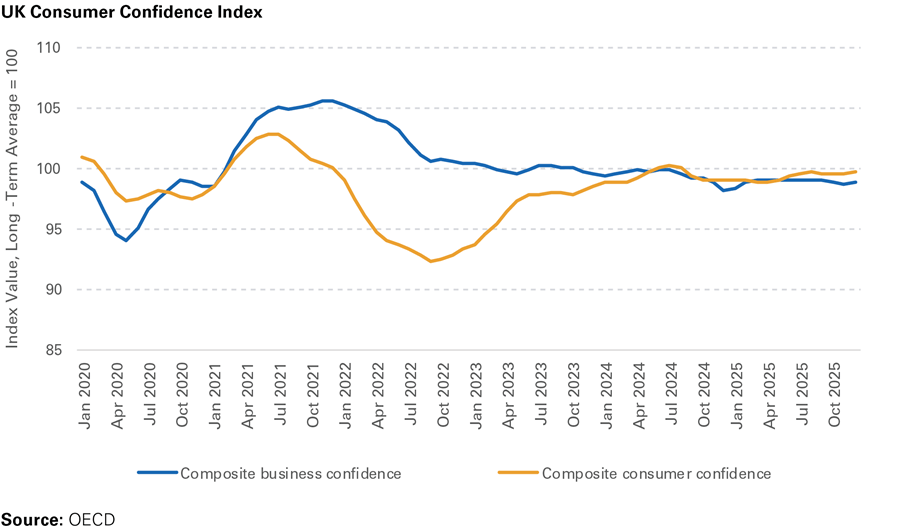

Domestic demand continues to be constrained by ongoing

weakness in household spending. Consumer confidence

indicators remain weak by historical standards, reflecting the

lingering impact of high prices. The OECD indicator of consumer

confidence has recovered steadily to around trend levels,

indicating stabilisation rather than renewed optimism. Although

headline inflation has eased from its mid-2025 peaks, prices

are still above the Bank of England’s 2% target, particularly in

services. This has kept monetary policy cautious: the BoE held

the Bank Rate at 3.75% in early 2026, with markets expecting

only gradual adjustment later in the year as inflation trends

gradually align with target.

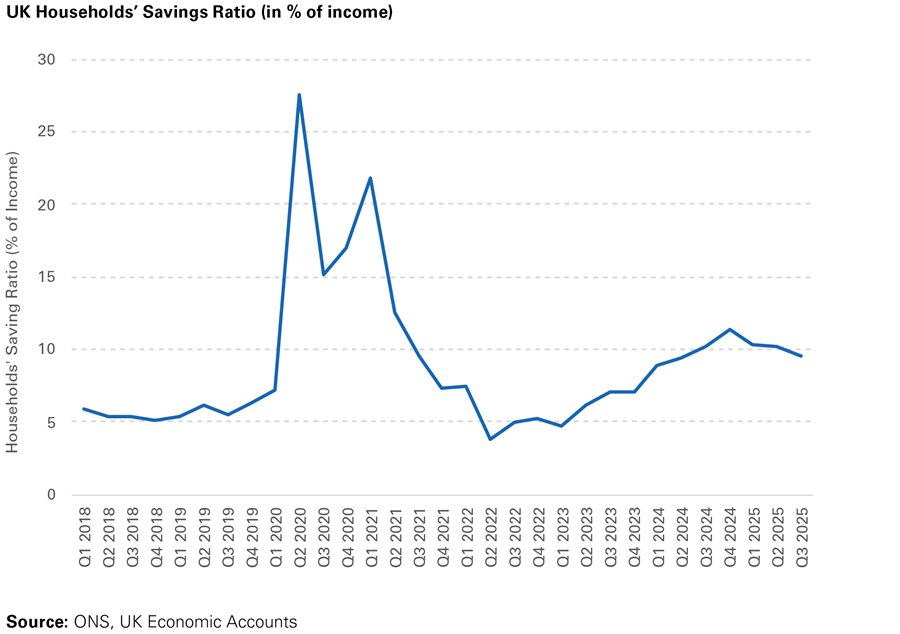

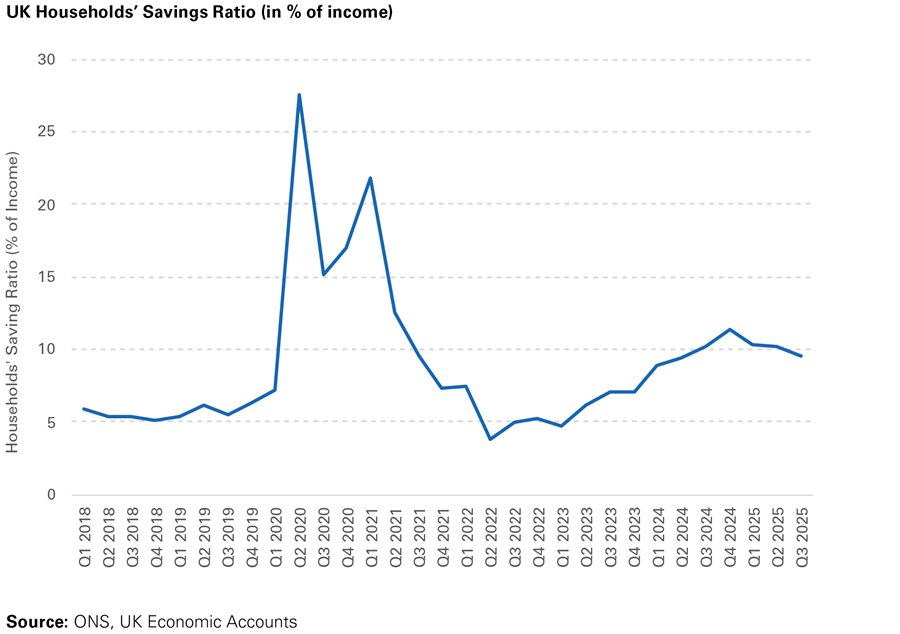

Household saving behaviour remains strong and is dampening consumption growth. Recent economic projections show that the UK

household savings ratio – the share of income saved rather than spent – remains around 9-10%, significantly above pre-pandemic norms

but looking to have moved past a recent plateau. Elevated savings reflect lingering uncertainty about the macroeconomic outlook and a

preference among consumers to retain buffers in the face of slow wage growth and fiscal drag. This higher saving propensity, combined

with relatively muted real income growth, constrains discretionary spending and retail demand, particularly in non-essential categories.

Labour market conditions also point to softening domestic

momentum. Unemployment is projected to rise further in 2026,

with some forecasts expecting the rate to reach around 5.2-5.3%,

its highest in several years, as hiring demand weakens alongside

slowing output growth. Wage growth is expected to moderate

toward 3% by mid-2026, in line with broader inflation easing and

subdued labour market tightness, further tempering household

spending power.

On the external side, global trade uncertainty and protectionist

pressures remain material headwinds for UK growth. Although

a trade agreement with the US has reduced some barriers, UK

goods exports to the US are now effectively subject to average

tariff rates around 11%, as manufacturers faced minimum 10%

tariffs across many product lines and higher 25% tariffs on key

sectors such as automotive and steel – directly impacting around

£60bn of UK exports, equivalent to roughly 2% of UK GDP22.

Trade frictions more broadly are likely a driver of subdued growth:

net trade is expected to remain a modest drag on GDP in 2026,

with export growth constrained relative to imports and global

demand still slowing amid protectionist uncertainty.

Taken together, these domestic and external dynamics point to a

subdued macroeconomic environment in 2026, characterised by

slow GDP growth, weak consumption momentum, high savings

and lingering external headwinds. For the UK retail sector, this

backdrop implies continued constraints on discretionary demand,

with consumer spending likely to remain selective and value-

oriented. Scaling operations, managing costs and navigating

volatile trade conditions – including tariff-related supply chain

impacts – are likely to remain defining strategic challenges for

businesses in the year ahead.

Politics and Supply Chain Risk

Political risk for the UK retail sector remains elevated in early 2026, reflecting ongoing fiscal consolidation, rising regulatory burdens and continued policy intervention under the Labour government. Following its 2024 electoral victory, the administration has prioritised deficit reduction and structural reform, and in the November 2025 Autumn Budget the Chancellor confirmed a package of tax measures expected to raise roughly £26bn over the parliamentary term23. While VAT increases and headline income tax rises have again been ruled out, the burden of fiscal adjustment continues to fall disproportionately on labour- intensive sectors, including retail.

A central source of political risk for retailers remains labour- related taxation and regulation. The increase in employer national insurance contributions from 13.8% to 15.0%, combined with a lower earnings threshold, has materially raised wage costs at a time when retailers are still absorbing post-pandemic salary inflation. This has been compounded by further increases in the National Living Wage, reinforcing a policy trajectory that places deficit reduction ahead of business cost containment. Industry bodies such as the British Retail Consortium continue to warn that the sector’s limited pricing power and weak consumer demand leave little scope to offset further policy-driven cost increases without impairing margins.

Labour market changes have been a central feature of the evolving political environment. The Employment Rights Act24 received Royal Assent in December 2025, transforming the long-planned reforms into law and introducing a modernised framework of workplace protections. Key measures coming into force from April 2026 include statutory sick pay payable from the first day of sickness absence with no minimum earnings threshold, and new day-one rights to paternity and unpaid parental leave. Given the retail sector’s heavy reliance on part- time and flexible labour, these changes will require substantial adjustments to staffing models, payroll systems and scheduling practices. Government estimates suggest economy-wide compliance and transition costs of up to £5bn per year, with retail expected to be among the most exposed sectors due to its workforce composition.

Business rates remain another key area of political risk for the retail sector. While pandemic-era relief has now been replaced by targeted structural adjustments, including lower multipliers for eligible retail properties from April 2026, the system remains subject to ongoing political discretion and fiscal sensitivity. The government’s planned scrapping of the broader business rate relief scheme, combined with reforms to rateable value calculations, will create a mixed impact but large-format and high- street retailers with significant square footage or property value are likely to face substantial cost increases. Previous government concessions, such as those granted to pubs, raise questions about whether similar interventions could mitigate the impact for retailers. As in previous years, business rates remain a readily adjustable revenue lever for the Treasury.

The broader fiscal backdrop reinforces these risks. Government borrowing continues to exceed official projections, and public debt remains close to 100% of GDP. Gilt yields, while off their mid-2025 peaks, remain raised by historical standards, keeping debt servicing costs high. As a result, further revenue-raising measures over the parliamentary term cannot be ruled out.

On the supply chain front, conditions have been more favourable than during the pandemic and early post-Covid period, but risks persist. Global container freight rates remain well below their 2024 highs, easing cost pressures for import-dependent retailers and supporting margin stabilisation. However, renewed volatility in shipping markets linked to geopolitical tensions in key maritime corridors, has increased uncertainty around lead times and inventory planning. Retailers with complex global sourcing networks remain exposed to sudden logistical dislocations and higher working capital requirements.

Cybersecurity and digital resilience represent an additional and growing source of operational and political risk25 - as evidenced by the damaging security breach of M&S in early November 2025. Retailers’ increasing reliance on ecommerce, omnichannel fulfilment and customer data platforms has heightened exposure to cyber incidents, as illustrated by recent high-profile ransomware attacks in the sector that resulted in service disruption, data compromise and material remediation costs. Against this backdrop, the government is progressing legislation such as the proposed Cyber Security and Resilience Bill26, which aims to strengthen protections for digital infrastructure and critical services. While these measures may improve long-term system resilience, they are also likely to impose additional compliance, reporting and investment requirements on large retailers and their supply chains.

Taken together, the political and supply chain environment for UK retailers in 2026 is characterised by sustained cost pressures, tighter regulation and persistent operational uncertainty. Higher labour costs, expanding compliance obligations and fiscal headwinds are coinciding with only partial normalisation in supply chain conditions, leaving the sector vulnerable to further policy shocks or external disruptions at a time of still-fragile consumer demand.

Credit Risk

Corporate insolvency levels remained high in 2025 and into early 2026, reflecting persistent stress across UK businesses despite

some stabilisation in headline figures. According to the UK Government’s Insolvency Service, there were 23,938 registered company

insolvencies in England and Scotland in 2025, roughly similar to 2024, but around 5% below the peak in 2023 (the highest annual count

since 1993).

Breakdowns by procedure show that CVLs accounted for 77%

of cases, with 18,525 company closures, while compulsory

liquidations rose to 3,730 – the highest level since 2012.

Administrations and CVAs declined relative to the prior year, down

6% and 8% respectively27.

Sectoral patterns of distress remain consistent with broader UK

economic pressures. Construction accounted for the largest share

of failures (17%), followed closely by wholesale and retail trade

(16%) and accommodation and food services (14%), underscoring

continued strain in consumer-facing and margin-sensitive sectors.

Smaller firms disproportionately account for insolvencies, with

sectors such as retail, hospitality, and business services among

the hardest hit.

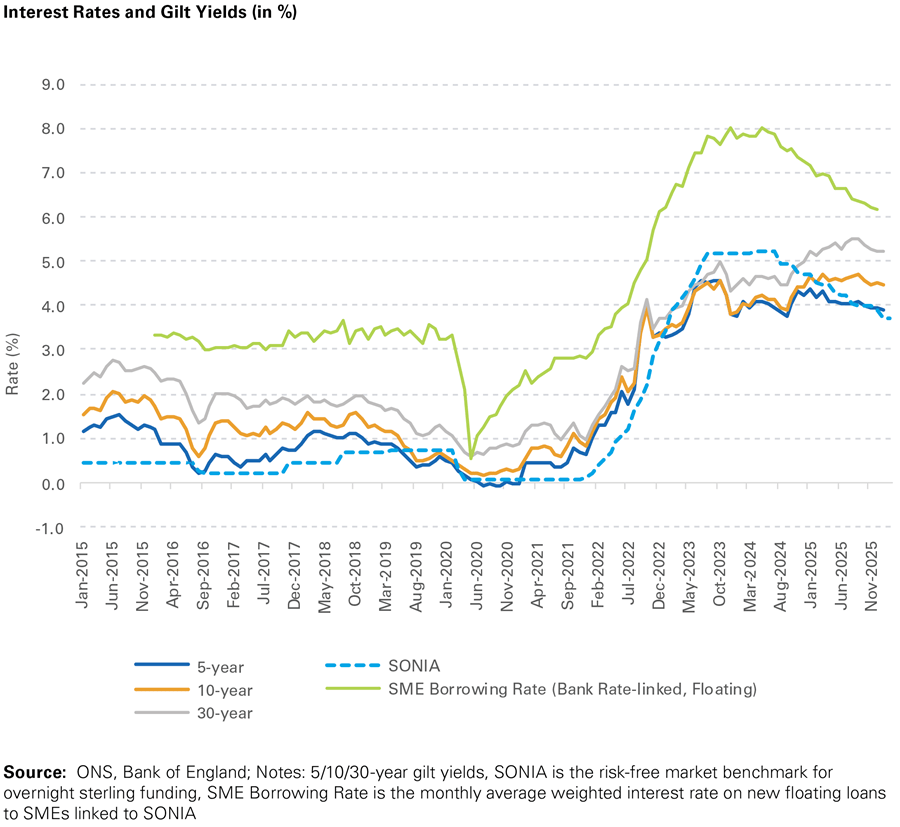

Credit and refinancing conditions continue to influence credit

risk outcomes. Bank of England Agents’ reports for late-2025

and early 2026 indicate that credit availability remained relatively

steady for larger firms but tight for smaller businesses, with many

SMEs continuing to face constrained access to new borrowing

and pressure from lenders to reduce leverage28.

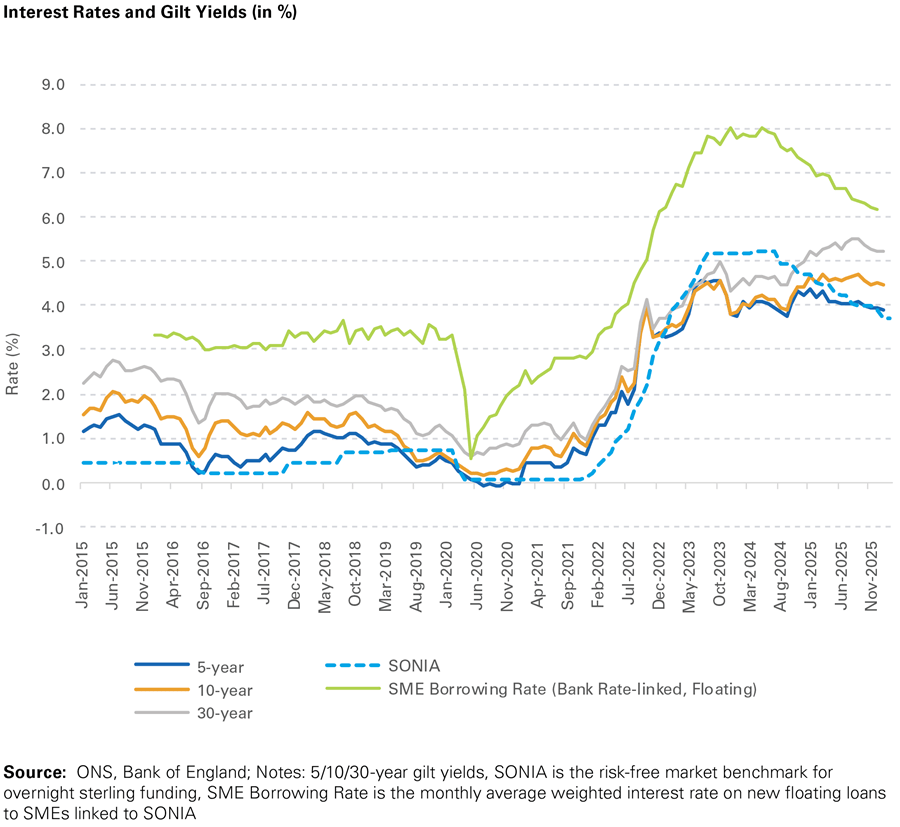

Monetary policy developments over 2025 and into early 2026

also shaped refinancing dynamics. After a period of sustained

tightening in 2022-24, the BoE’s base rate was held at 3.75% in

February 2026 following several cuts through 2024-25, though

inflation remains above target and policymakers have signalled

only gradual future reductions. Market forecasts point to further

rate declines through 2026 but with interest rates likely to remain

elevated relative to pre-pandemic averages for some time29- the

median response of participants expect the Bank Rate to end

2026 at 3.25%.

This trend is reflected in market interest rates (see chart), where

SME borrowing rates remain significantly above pre-pandemic

levels despite recent Bank of England rate cuts. While SONIA and

long-term government bond yields have declined from their 2023

peaks, the persistently higher floating rates for SMEs underscore

continued refinancing pressure and raised credit costs for smaller

firms. The divergence between market rates and policy signals

highlights ongoing risk aversion among lenders, reinforcing

constraints on credit availability for retail SMEs and sustaining

elevated credit risk.

Refinancing conditions remain a drag on corporate credit risk, especially for SMEs. Even with lower base rates than the 2024 peaks,

borrowing costs and lender risk aversion have kept credit expensive and relatively scarce for weaker firms. Risk-averse behaviour by

banks combined with subdued credit demand has meant many businesses prioritise debt reduction over new investment, dampening

growth prospects.

Given persistent structural pressures – including weak consumer demand, input cost inflation, cost-push tax and regulatory burdens,

and constrained credit access for smaller enterprises – credit risk in the UK retail sector is expected to remain high through 2026.

While headline insolvency figures may not materially exceed 2025 levels, underlying financial stress and contingent liquidity constraints

suggest ongoing risk of elevated failure rates, particularly among retail.

Long-term Trends

Looking ahead, the UK retail sector will continue to face structural

pressure on operating models, even beyond the current cyclical

slowdown. Investment requirements remain raised as retailers

accelerate spending on artificial intelligence, data analytics and

digital infrastructure. AI is increasingly used in pricing and demand

forecasting, merchandising, inventory management and customer

engagement. Combined with augmented reality and generative

AI, these investments are expected to enhance personalisation

and conversion rates. However, these investments are capital-

intensive and are likely to weigh on profitability in the short to

medium term, particularly for mid-sized operators with limited

balance-sheet flexibility. Robust ethical frameworks for AI use are

increasingly important as consumer trust becomes a competitive

factor.

Omnichannel execution is now a baseline requirement rather than

a differentiator. Consumers demand seamless experiences across

stores, mobile apps and online platforms, with flexible fulfilment

and returns. Retailers that leverage stores as experiential and

fulfilment hubs are better positioned to defend market share.

Physical retail remains important where it complements digital

journeys, offering convenience, service or experience.

Sustainability and operational resilience are increasingly

embedded in strategy. Energy costs, while lower than peak crisis

levels, remain above pre-2021 averages, and regulatory scrutiny

around packaging, emissions, and supply-chain transparency

is intensifying. Ethical sourcing and labour standards are no

longer niche concerns; they influence consumer choice, investor

expectations and regulatory compliance costs.

Consumer behaviour continues to shift. The second-hand and

resale market is expanding, supported by digital platforms,

reinforcing value-driven and sustainability-conscious purchasing.

Spending preferences, particularly among younger consumers,

continue to favour experiences such as travel, leisure and

entertainment rather than physical goods. This trend, combined

with elevated household savings rates and still-high essential

living costs, is contributing to below-inflation growth in retail

volumes.

Structural adjustments are ongoing. Several established UK

retailers entered insolvency or announced contraction plans in

early 2026, including the entry into administration of The Original

Factory Shop and continued closures at River Island as part of

restructuring efforts. At the start of January, Primark recorded

its first UK store closure in a decade due to unviable repair costs,

reflecting how even resilient formats face physical footprint

rationalisation. These developments highlight the rationalisation

of physical networks in response to shifting footfall and cost

pressures.

Retail real estate dynamics are nuanced. Prime locations and

food stores have attracted investment, with some high streets

showing lower vacancy rates and rental growth. Differentiated

formats that combine experience, convenience and community

utility attract capital even amid sector-wide pressures.

Luxury and big-ticket categories remain under pressure from

weaker inbound tourism, subdued overseas demand, and

consumer prioritisation of essential and experiential spending.

Pockets of resilience persist in affordable premium and

experience-led formats, but long-term trends indicate structurally

lower volume growth, higher capital intensity and greater

execution risk. Retailers that combine disciplined cost control with

targeted investment in technology, experience and sustainability

are best positioned to navigate this environment in the coming

years.

[1] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/december2025

[2] https://www.retailgazette.co.uk/blog/2026/01/retail-footfall-fell-during-disappointing-december/

[3] https://www.bbc.co.uk/news/articles/cre27x179zpo

[4] https://www.retailgazette.co.uk/blog/2026/01/currys-lifts-profit-outlook-after-strong-christmas-trading/

[5] https://www.thisismoney.co.uk/money/markets/article-15483411/JD-Sports-sees-UK-sales-fall-crucial-Christmas-period.html

[6] https://www.express.co.uk/news/uk/2165738/game-high-street-shop-240

[7] https://www.bbc.co.uk/news/articles/czdq1z73pv9o

[8] https://www.retailgazette.co.uk/blog/2026/01/river-island-store-closures/

[9] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/december2025#online-retail-values

[10] https://www.icaew.com/insights/viewpoints-on-the-news/2025/nov-2025/chart-of-the-week-retail-sales-in-great-britain

[11] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/december2025#online-retail-values

[12] https://ecommercenews.uk/story/mobile-ai-power-record-uk-online-christmas-sales

[13] https://www.reuters.com/business/retail-consumer/uk-black-friday-weekend-online-sales-hit-5-billion-adobe-analytics-says-2025-12-02/

[14] https://www.theguardian.com/technology/2025/dec/24/uk-small-businesses-sign-up-to-tiktok-shop

[15] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/december2025

[16] https://www.gov.uk/government/news/lpc-recommendations-take-the-national-living-wage-to-1271#:~:text=The%20 Government%20has%20today%20announced,per%20cent%20to%20%C2%A312.71.

[17] https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

[18] https://commonslibrary.parliament.uk/research-briefings/sn02797/

[19] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/january2026

[20] https://www.cbi.org.uk/articles/cbipertemps-labour-market-update-january-2026/

[21] https://www.imf.org/en/countries/gbr

[22] https://commonslibrary.parliament.uk/research-briefings/cbp-10240/

[23] https://commonslibrary.parliament.uk/research-briefings/cbp-10405/

[24] https://bills.parliament.uk/bills/3737

[25] https://www.bbc.co.uk/news/articles/c93x16zkl9do

[26] https://bills.parliament.uk/bills/4035

[27] https://www.thegazette.co.uk/all-notices/content/104431

[28] https://www.bankofengland.co.uk/agents-summary/2026/february-2026

[29] https://www.bankofengland.co.uk/markets/market-intelligence/survey-results/2025/market-participants-survey-results-december-2025