- Home

- News and articles

- Thought Leadership

- Trade Credit UK Metal Sector Report H2 2023

Trade Credit UK Metal Sector Report H2 2023

Summary

- High price increases for metal and steel led to increased profits for producers in 2021-22 but that boon period is over with producer price inflation in the sector standing at only 2% in October 2023.

- UK car production grew in 2023 (albeit from record low levels in 2022) but industrial production fell in 2022 and the first half of 2023 before returning to modest growth.

- The labour market is cooling down with the number of vacancies falling but despite this, wage growth in the sector is higher than in any other industry in the UK.

- The Purchasing Managers’ Indices in the manufacturing and the construction sectors are in contraction territory, pointing towards a challenging 2024.

- The Government has recently watered down net zero targets in the car sector but is still supporting metal producers, co-financing new, greener production facilities.

- Credit risk in the metals sector is elevated and will continue to rise next year with higher interest rates and weak macroeconomic growth already resulting in a 10.6% year on year increase in sectoral business failures in Q1-Q3 2023.

To view a pdf version, click here.

Key Trends in 2023

There were winners and losers in the UK metal sector throughout 2023. While producers of raw metal and service centres benefitted from very high prices and improved profit margins, end users felt the pain of these price increases.

Metal Producers

The output of the metal producing sector in the UK has declined over the past years. In 2022, the industry still employed 39,000 people (0.1% of total UK employment, down from 320,000 in 1971) in 1,135 companies (0.1% of the UK’s active business universe), and generated £2.4bn, around 0.1% of UK GDP . However, the sector is unevenly distributed across the country with more than half of the employment being centred in Wales (12,300) and Yorkshire & Humber (9,700).

In line with other sectors, the metal sector faced a steep increase in production costs in 2021-22. This was caused by higher raw material costs but also rising energy prices, especially after the outbreak of war in Ukraine. As a consequence, producer price inflation (PPI) in metal production and fabricated metals (except machinery and equipment) has increased enormously. According to data from the Office for National Statistics (ONS), the sectoral PPI rose from 2% at the beginning of 2021 to 16% at the end of 2021. It maintained this upward trajectory until May 2022, peaking at 23% before gradually subsiding again. On the back of base effects, lower energy prices and growing recession risks, sectoral PPI dropped back into single digits again in March 2023 and latest available data from the ONS shows that production prices in the sector are now barely rising again (2% in October 2023).

While the sharp increase in steel prices could be bad news for UK manufacturers, it boosted profit margins of UK steel mills. In fact, Tata Steel (which owns the Port Talbot steelworks) was able to post its first pre-tax profit in 13 years in 2022 . However, with steel prices normalising recently, demand dropping and production levels falling in order to stabilise prices, the heydays in the sector are already at and end.

End Users

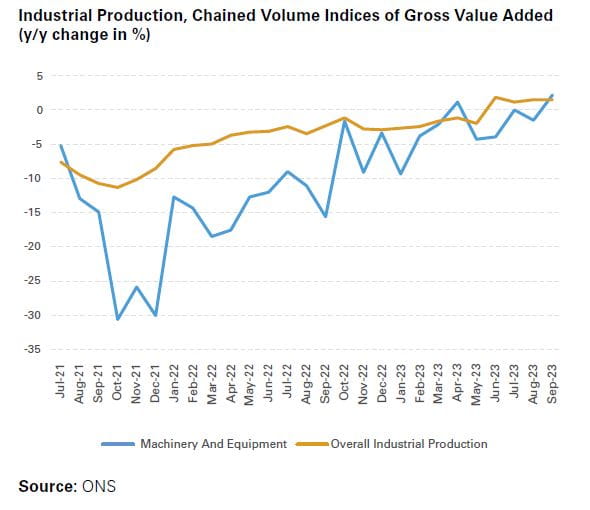

While metal producers enjoyed a period of respite, the elevated price levels for raw materials had adverse effects on the manufacturing sector in the UK. ONS data shows that industrial production in the UK contracted by 3.5% in 2022, in addition to a 3.9% drop in 2021. While output in the machinery and equipment sub-category increased by 2.3% in 202, that was followed by an immense contraction in 2022 (-11.8%) . Worryingly, while industrial production for the UK as a whole has been growing year on year since June 2023, the machinery and equipment sub-index only returned to growth in September.

Car manufacturers in the UK, who employ around 780,000 workers , experienced a particularly difficult 2022. Production dropped to just 775,014 vehicles, the worst reading since 1956 . While global semiconductor shortages, lockdowns in China, strike action and a credit squeeze also played a part, high input costs for steel also suppressed output. More positively, the latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that between Q1 and Q3 this year, car output in the UK is up by almost 15% on last year, providing an added boost to steel demand. Problematically, despite the recent improvements, output is still down considerably from pre-Covid readings of above 1.3 million vehicles per year. According to the CEO of SMMT, it might take until 2028 before the 1 million cars per annum threshold is reached again.

Meanwhile, real GDP data from the ONS also indicates that certain parts of the metal sector are growing while others are lagging somewhat. Overall, real GDP has stagnated quarter on quarter through July to September, indicating that the British economy is running out of steam . In manufacturing, output increased by a meagre 0.1% on Q3 last year, according to the ONS. Out of the 13 sectors surveyed, seven recorded an increase with the already mentioned transport sector being the best performer. Basic metals and metal products (+0.3% q/q) also saw growth in July to September but machinery and equipment output stagnated.

Labour market

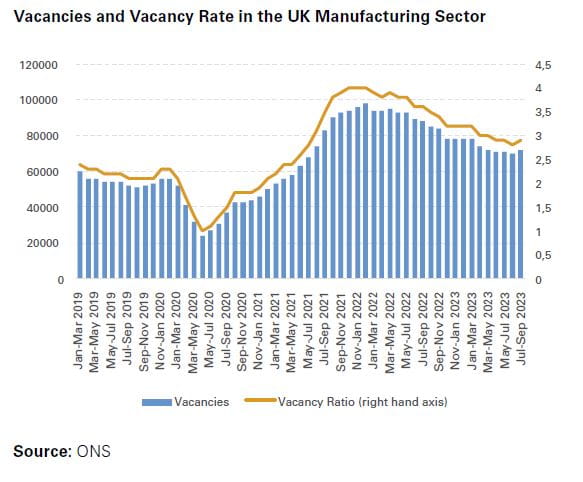

Throughout 2023, labour market conditions in the UK have deteriorated as the unemployment rate has risen somewhat, albeit from ultra-low levels. At the same time, the number of job vacancies has dropped from very high levels. The manufacturing sector followed this general trend with the number of open positions dropping from almost 100,000 in early 2022 to 72,000 in Q3 2023. This reading is still above the pre-Covid record of 53,000 in Q4 2019, highlighting the ongoing labour shortages in the UK economy . The vacancy ratio (which is the share of open positions per 100 employee jobs) in the manufacturing sector has also improved over time. Having peaked at 4.0 in late 2021 and early 2022, the ratio has dropped to 2.9 in Q3 2023 which is roughly in line with the UK average of 3.1 vacancies per 100 jobs.

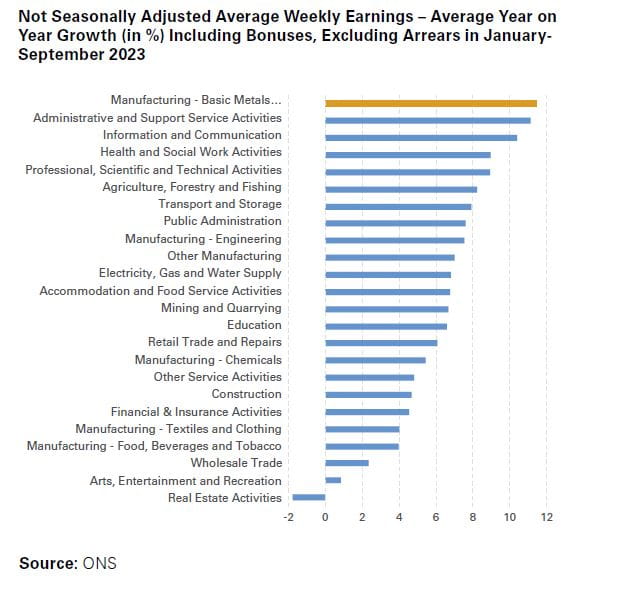

Although job vacancies are falling and the labour market is showing signs of a general slowdown, wages are still rising at a robust pace. In July to September, nominal wages excluding bonuses were up by 7.7% on last year, one of the highest rates of expansion since the launch of the ONS data series in 2001 . Once inflation is factored in, the increase is less impressive (+1.3%) but it still highlights the rising cost base for UK employers.

In a sectoral comparison, basic metals and metal products manufacturing shows the highest wage increase amongst all 24 sectors for which ONS data exists. In comparison to last year, weekly earnings (including bonuses) grew by an average of 11.5%, compared with 6.8% in accommodation and an even lower 4.7% in construction.

2024 Outlook

The sectoral outlook for next year is a mixed bag. Macroeconomic trends point towards a disappointing 2024 with credit risk remaining elevated. At the same time however, there is room for optimism as the car and the aerospace sectors are on improving trajectories with input price inflation moderating considerably. Politics will be an additional factor to watch with the country approaching its next parliamentary election which could result in a change to Government, the first since 2010.

Macroeconomics

The UK metals sector is likely to see little to no tailwind from UK real GDP growth. Although the country is currently forecasted to expand by a marginal rate next year, downward revisions cannot be ruled out. The Bank of England believes there is a 50% risk of the UK economy falling into a recession by mid-2024.

Problematically, confidence indicators in metal-consuming sectors are in contraction territory. The Purchasing Managers’ Index (PMI, compiled by S&P) in the UK construction sector stood at 45.6 points in October, way below the neutral 50-point threshold that divides expansion in sectoral activity from contraction . In continental Europe, the situation is even worse with the Eurozone construction sector PMI coming in at an even lower 42.7 points.

In the manufacturing sector, the outlook is equally bleak as European purchasing managers are rather pessimistic about the year ahead. In the UK, the corresponding PMI came in at 44.8 points in October, with new orders, output and employment sub-indices all deteriorating . Business optimism has now dropped to the lowest reading in ten months, indicating that demand for metal products will remain subdued. In the Eurozone, the picture is even worse: the PMI has dropped to 43.1 points in October and new order inflow dropped by one of the highest rates ever recorded.

Despite these tailwinds, the controlled reduction in European production capacity (and some UK production issues) and the need for restocking, indicates that prices may well improve slightly providing a welcome boost to traders and service centres at the start of a new year. In addition, supply restrictions are again overcoming the persistent lack of demand.

Positively, recent car production data is up year on year (see above) and Nissan’s decision to invest heavily in electric vehicles (EV) production in its factory in Sunderland over the next few years highlights the UK’s potential in this field . Simultaneously, recent announcements by the French government indicate that the UK and EU leadership might be able to reach a compromise on the new rules-of-origins which will come into force in January 2024 . Industry bodies in both the EU and the UK are pressing hard for a delay to implementation out to 2027 as the costs of trading EVs across the Channel would increase by around £3,500 per unit . The introduction of such a sizable tariff would be a severe burden for the UK car industry as, despite Brexit, 58% of its exports still go to the EU.

Simultaneously, conditions in the aerospace sector are also gradually improving. As normality has returned to the airline industry post-Covid, order inflow is sound, and production has started to increase. After a slow start in the first quarter, Airbus reported a robust 2023. The latest available data for October shows that the company has delivered 71 aircrafts, up by 18% on last year . Aircraft engine manufacturer Rolls Royce’s financial results for the first half of 2023 mirror Airbus’ experience with operating profits increasing from £125m in H1 2022 to £673m just one year later. Its operating margin improved from 3.4% to 12.4% , the highest in at least 15 years.

Politics

It’s not just market forces affecting the sector - politics will continue to have a significant impact. The incumbent Government under Conservative Prime Minister Rishi Sunak recently watered down some of its net zero targets and changed the timetable for banning new internal combustion engine cars in the UK. The policy will now be introduced in 2035, five years later than initially planned. While this allows car manufacturers to use current technology five years longer than initially planned, many producers (including Toyota, Ford, BMW and JLR) have criticised the move as it removes certainty and complicates long-term business planning.

Furthermore, steel producers continue to struggle with high energy prices and increasingly stringent environmental protection regulations. Electricity prices for steel makers in the UK stood at around £113 per MWh in November, according to industry body Eurometal. This compares with a price of only £61 pounds in Germany and France, making the UK a very costly location for steel production, even by European standards . Both Tata Steel and British Steel intend to revamp their production methods, replacing older blast furnace-basic oxygen furnaces with electric-arc furnaces in order to reduce costs and become more environmentally friendly. Problematically, the switch requires sizable capital expenditure. In September, Tata Steel announced the investment of £700m in its UK facilities but only after the UK Government had signed off subsidies worth £500m. In addition, despite the additional investment and the Government support, the transition to the new technology could result in up to 3,000 jobs losses in the sector.

As a general election must be held by January 2025 at the latest, industrial policy will also be an area to watch. The Labour Party might return to power having been on the opposition benches since 2010. This complicates the outlook as any new administration might change the incumbent Government’s priorities. The recent cancellation of parts of the High Speed 2 railway project might also be under revision again, with resultant changes to public infrastructure budgets.

Business failures

Worryingly, credit risk in the sector is likely to rise further in the coming quarters due to a combination of weak growth, widespread pessimism and elevated interest rates. Although the BoE has stopped its monetary tightening cycle and the key policy rate has remained unchanged since August 2023, it is now on the highest level since the global financial crisis. This makes taking out new or rolling over existing debt much more expensive. Coupled with the requirement to repay Government support received during the pandemic, this has already led to an increase in business failures in the UK. Across all sectors, England and Wales (which account for around 95% of all business failures in the UK) have seen a 13.7% year on year increase in bankruptcy declarations in Q1-Q3 2023.

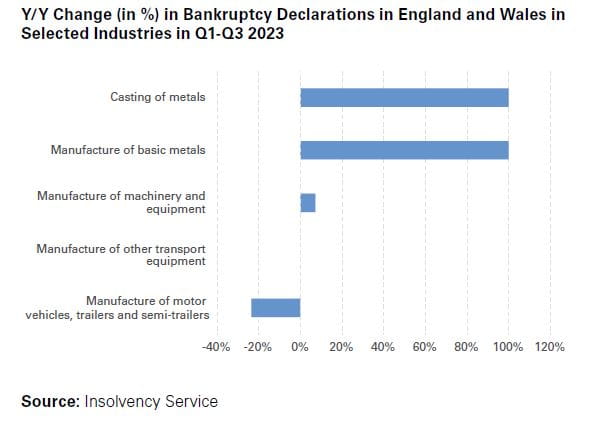

In the metals sector, most industries have followed this troubling trend. Casting of metals and manufacture of basic metals both saw high 100% year on year increases for January-September 2023. Manufacture of machinery and equipment also recorded more business failures (+7%) while manufacture of other transport equipment did not experience any change. More positively, manufacture of motor vehicles went against the tide (-24%) and the overall insolvency risk in the sector remains low as all five sectors combined only accounted for 136 business failures in the first nine months of 2023. This is equal to 0.7% of all business failures in England and Wales in Q1-Q3 2023. Even within manufacturing (which saw 1,473 bankruptcies), the metal sector represents a very small proportion of all insolvencies.

Click here to visit our Whole Turnover Credit page for more information

https://researchbriefings.files.parliament.uk/documents/CDP-2023-0016/CDP-2023-0016.pdf

https://www.theguardian.com/business/2022/jul/20/port-talbot-steelworks-owner-tata-steel-first-pre-tax-profit-in-13-years

https://www.ons.gov.uk/economy/economicoutputandproductivity/output/datasets/outputoftheproductionindustries

https://www.smmt.co.uk/industry-topics/uk-automotive/

https://www.fleetnews.co.uk/news/manufacturer-news/2023/01/26/uk-car-production-at-its-lowest-for-more-than-half-a-century

https://www.reuters.com/business/autos-transportation/uk-car-production-could-take-five-years-return-1-million-units-says-industry-2023-07-26/

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/julytoseptember2023#output

https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/november2023

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

https://www.theguardian.com/business/2023/nov/02/bank-of-england-leaves-interest-rates-unchanged-inflation-slowdown

https://www.pmi.spglobal.com/Public/Home/PressRelease/f3386a51b4b04628a7675e301195ace7

https://www.pmi.spglobal.com/Public/Home/PressRelease/2f529457ca984002aec4948d42ea169e

https://www.pmi.spglobal.com/Public/Home/PressRelease/293f3917029b44008d093c37e51c8eb9

https://www.pmi.spglobal.com/Public/Home/PressRelease/1e1d572fb99e4adb9421a245b97bc0c7

https://www.theguardian.com/business/2023/nov/24/nissan-to-build-three-new-electric-car-models-at-sunderland-plant

https://www.ft.com/content/1fd3590f-6471-41aa-88bc-981cfa171bc9

https://www.smmt.co.uk/2023/10/agreement-with-europe-needed-to-avoid-3400-electric-vehicle-tax-hike/

https://www.smmt.co.uk/wp-content/uploads/sites/2/SMMT-Automotive-Trade-Report-2023.pdf

https://www.reuters.com/business/aerospace-defense/airbus-edges-towards-2023-delivery-goal-after-18-increase-oct-2023-11-07/

https://www.airport-technology.com/news/rolls-royce-h1-results-reveal-soaring-profits-led-by-civil-aerospace/?cf-view&cf-closed

https://www.reuters.com/business/aerospace-defense/rolls-royce-reports-jump-first-half-profit-led-by-civil-aerospace-2023-08-03/

https://www.forbes.com/sites/neilwinton/2023/09/21/britain-reverses-new-ice-car-ban-to-2035-amid-protests-and-praise/

https://eurometal.net/green-transition-of-uk-steelmaking-requires-government-subsidies-for-energy-bills/

https://www.bbc.com/news/uk-wales-66819458

https://www.bbc.com/news/uk-politics-67016873

https://www.gov.uk/government/statistics/company-insolvency-statistics-july-to-september-2023/commentary-company-insolvency-statistics-july-to-september-2023